II.2.3 Marketing Overview for .biz (RFP Section D13.2.3)

The global business community wants and needs a new business specific domain space. JVTeam’s research confirms that businesses will be very attracted by the opportunity to distinguish their online business with a more memorable, function-rich domain name. JVTeam will not only capitalize on this demand, it will execute on a sound marketing plan based on a marketing strategy which will stimulate demand and ensure the commercial success of the new, business TLD. JVTeam’s understanding of the domain name market place and its experience in channel management will ensure that a .biz domain name will become a standard for doing business online.

The information presented in this section addresses the historical background to the TLD market, a brief situation review of the past, present and future global marketplace for a new business TLD as well as current and projected market definitions including size, demand and accessibility.

Background

In order to understand the domain name market place, it is essential to understand the environment and history of top level domain names including their interdependence with Internet usage. As the cost of personal computing has continued to decline, as innovations in telecommunications technology continue to improve the flexibility, versatility and speed at which services are delivered, the number of regular Internet users has continued to grow exponentially. In the first fifteen years of the domain name industry, the Internet has experienced unbridled growth, but even now it is still in its infancy. CommerceNet, the association representing e-commerce worldwide, found that there were approximately 242 million Internet users worldwide in January 2000. CommerceNet is projecting 490 million Internet users by the end of 2002 and 765 million by the end of 2005.

Although the U.S. still leads the way in Internet use by individuals and businesses, Europe, developed Asia, and Latin America represent substantial areas of growth. In fact, the combined total of the online population from these regions now outnumbers U.S. users, a trend that is likely to continue in view of their population and economic growth rates. Today, slightly less than 400 million people worldwide use the Internet regularly and the purchase rate of domain names has grown in direct correlation. As of the end of August 2000, the total number of domains registered worldwide was more than 27.6 million names, a leap of more than 800% over the 3.3 million domain names that were registered as of the end of July 1998. This represents a 38,300% increase over January 1995, when the Internet Software Consortium counted some 71,000 domain names.

Who Is Buying all the Domain Names?

The three most significant groups of domain name purchasers are (1) small businesses (especially those with 4 employees or less), (2) speculators and (3) personal portals. Our research shows that small businesses purchase domain names to identify their websites and for customized email. Speculators facilitate resale of domain names to the highest bidder while personal portals use domains to acquire and retain members of their community.

The market has seen increased purchasing activity from

speculators and personal portals in the past 12 to 18 months, in particular,

since one-year registrations became available.

The predominant number of these purchases are in the .com TLD.

The Growth of .com

Despite the fact that Internet use has exploded and the demographic of the typical user has diversified dramatically, the selection of TLDs available to consumers has not varied from .com, .net and .org. This has had the effect of diluting the .com domain space’s utility as a tool for finding information on the Internet. Of particular concern is the rapidly depleting availability of meaningful and useful .com domain names, a supply problem that could slow and impede the growth of the DNS environment, global communications and e-commerce.

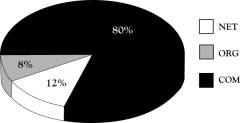

Because of a lack of attractive and appropriate choices, the .com domain space has become the default domain space for anyone wishing to have an Internet address leading to a dilution of its “intended” purpose for commercial entities. Overall, .com is the single most widely purchased, used, recognized and branded domain name representing some 80% of all registered gTLDs. The following chart illustrates the break down of registrations across .com, .net and .org.

The dominant selection of .com over other TLDs is due, we believe, to the historical perceptions of the purposes and meanings of .com, .net and .org. A survey commissioned by JVTeam shows a widespread and generic interpretation of .com, but a larger portion of people who believe that .net denotes a network services provider and that .org denotes a non-profit organization. In practice, these perceptions have tended to become self-fulfilling as more and more network services companies have registered in .net, and more and more non-profit organizations have registered in .org. Conversely, .com is seen as a “melting pot” TLD where all and every intended use is registered.

One accompanying byproduct of the success of .com sales is the dearth of available generic words in the .com TLD. This is particularly true in the English language where, according to the Wall Street Journal, some 98% of all the words listed in the Webster’s English Dictionary have been registered as domain names. This phenomenon is already substantial and increasing in other languages.

Why .com?

The .com extension has taken on a connotation far beyond the original intent of this three-letter TLD. In the common lexicon, the term “dot com” now stands for a new breed of private and publicly traded e-commerce businesses. “Dot com” represents a positive, can-do, innovative energy which has fed the western world’s obsession with dot com companies.

We also believe that the branding of “dot com,” and the

4:1 ratio of registered .com domain names to .net and .org, is a reflection of

significantly stronger perceptions that a .com domain name is more

valuable than all others currently available.

This perception is attributable in part to the early adoption of .com

and the associated wave of advertising by .com companies. However it is also

evident that .com’s popularity has been driven in large part by a lack of any

comparable choice.

Why Not .net?

Granting the original intent for the current gTLDs, there is no law or rule preventing a commercial entity from using .net or .org. Therefore, if John Doe Inc. wants to register a domain name for a commercial web site and branded email address, he might reasonably want johndoeinc.com. If that name is already owned, he could choose johndoeinc.net or johndoeinc.org. But that is not what is happening. It is more likely that The John Doe Company will opt for some other, second choice derivative of its name in .com. The question is, “Why?” Is this decision motivated by the originally intended meanings of .com, .org and .net? Is it because of the broad recognition of .com, or is it simply that the John Doe company has not been given a more appropriate and desirable choice? To find answers to these questions and to understand the broader motivators in the domain name marketplace, JVTeam undertook a research project and following is a summary of our findings.

Primary Research

To ensure that the right TLD is introduced in the right way, it is not sufficient to speculate on what motivates the market. It is imperative that empirical and reliable data be the driver for the selection of the new TLD string. Accordingly, JVTeam commissioned a primary research study of consumers and business people. The research which follows provides an instructional snapshot of the domain name market and has provided the impetus for JVTeam’s selection of .biz as its proposal for a new top level domain space.

The specific objectives of this market research project were:

·

To assess the behavior and perceptions associated with

current domain names and extensions

·

To quantify the various ways that domain names are

perceived and used by the market

·

To assess the way domain extensions are categorized and

selected

·

To solicit feedback on potential domain extensions

among an international sampling of Internet savvy respondents

·

To assess the branding potential for each extension

· To quantify acceptability, preference and consideration associated with the various options

·

To determine which proposed extensions have the

greatest target audience preference

·

To understand ways to differentiate and build

preference for new domain extensions vs. current extension options

· To obtain preliminary pricing feedback.

|

Overview of JVTeam domain name market research project |

|

|

Methodology |

A 10-minute online survey consisting of closed-end questions only |

|

|

A sample size of 500 |

|

|

Invitations were emailed to the respondent panel |

|

|

Cash drawing included as incentive to boost participation rate |

|

|

The three business oriented TLD strings tested were .ebiz, .biz and .ecom |

|

Research participants |

Sample composition of 250 consumer panelists and 250 business panelists from a broad international base |

|

|

Respondent composition of 210 consumer panelists and 290 business panelists |

|

|

All respondents had either registered a domain name in the past, plan to register in future, or are online intermediates/experts |

|

|

Seven in 10 consumer panelists work full or part time, and their answers often reflect both a business and personal perspective. |

|

|

The business panel consisted mostly of business owners, top executives and middle managers; the consumer panel included technicians, professionals and administrative workers. |

|

Target audience |

The sample was drawn from an existing online panel |

|

|

Split sample of consumers and business people who have used the Internet with some frequency |

|

|

A broad international base, not favoring any single country or region |

|

|

Respondents were screened for familiarity/understanding of domain extensions |

|

|

Screener identified but did not terminate decision makers in the category with the intention of finding a sufficient sample size |

|

Summary of Results And Conclusions |

|

|

Past and planned domain name registration activities |

More than half the business panelists have registered a domain name in the past, and nearly three quarters say they will in the next three years |

|

|

Respondents who’ve already registered a domain name are also much more likely than others to plan future registration |

|

|

Just over 7 in 10 of both consumer and business panelists who’ve already registered a name did so for business purposes; about 6 in 10 of those planning a registration have a business use in mind |

|

|

Reasons for having registered a domain name vary widely, and most often relate to an existing business, while the reasons behind registration intent are more disbursed |

|

|

Business panelists who plan to register a name most often say they want to reserve a name for future use, use it for a business they already own, start a home-based business or simply prevent someone else from getting the name |

|

|

Respondents who currently have no plans to register a domain name would be most motivated to do so if they decided to start a home business |

|

Attitudes about existing TLD options |

.net and .org lag substantially in past usage and favor (with less than 10% past usage and little greater future intent) |

|

|

Current/planned TLD choice is based on the perceived appropriateness of the TLD for the use or the notion that the TLD is the “standard” that everyone uses; an easy to remember TLD is also seen as important |

|

|

Most respondents have mentally assigned categories of use to existing TLDs |

|

|

.com is seen as most universal, with at least three quarters of respondents believing it can be used by any offline or online private business or by any individual – there are no boundaries and it is subsequently a less desirable ‘strictly-business’ space |

|

|

Nine in 10 respondents think .org is appropriate for a non-profit or charitable organization, while less than a third think it works for anyone else (most often an educational organization); fewer than 2 in 10 think private businesses or individuals can use .org |

|

|

More than 8 in 10 think .net is only for use by a network or alliance, while just under half think individuals or private business can use it |

|

Interest in new TLD options |

There is strong interest in the availability of new TLDs |

|

|

Nearly 6 in 10 respondents have a favorable reaction to the idea (another 3 in 10 are neutral) |

|

|

Respondents who plan to register a domain name are even more favorably impressed with the idea of new TLDs than the average respondent |

|

|

More than half the respondents would choose a new TLD like .biz right now instead of .com, .net or .org |

|

|

Nearly 2 in 10 respondents (especially the business panelists) say they’d purchase more domain names in the future if a new business specific TLD like .biz became available |

|

|

About a quarter of those who’ve already registered or plan to do so say new TLDs would increase the number of planned purchases |

|

|

Interest in new TLDs is fueled by the notions that more desirable names would be available and that new TLDs could better describe and differentiate a website |

|

|

Respondents also respond very favorably to the idea that the cost of registering a domain name might be less expensive if more TLDs were available |

|

|

Preference for one of the seven TLD options tested was most often driven by perceptions that it was the easiest to remember |

|

Preferred

string |

.biz was the favored business TLD; it’s seen as easy to remember, business-like and descriptive |

|

|

.biz was best received by business panelists, with 11% of them choosing it among the full field of TLD options and 18% preferring it among the test choices |

|

|

Nearly half the business panelists would choose .biz over .ecom (favored by 3 in 10) or .ebiz (chosen by 2 in 10) |

|

|

More than a third of the business panelists and likely registrants would consider a .biz TLD |

Research Conclusions

The results from the survey demonstrated that tremendous natural demand exists for the .biz TLD, and this demand will grow significantly with market and brand awareness. It is clear that the market recognizes the need for a domain space which is differentiated from the .com melting pot and provides a dedicated space exclusively for businesses. It is also clear that the most favored, most business-distinct string is .biz. Hence JVTeam has chosen .biz as the domain space which will facilitate a new, competitive and clearly defined business community. This will assist businesses to market their brands, products and services and with the benefit of enhanced indexing functionality, will make it easier for consumers to find the business they are looking for.

Market Definition

The Current Domain Name Marketplace

Like many other products, domain name registrations are highly concentrated in major urban markets, particularly those with high Internet usage. By focusing a branding campaign on the top 20 urban centers with high Internet usage, JVTeam will be able to target a large portion of .biz buyers.

Consumer Market Size, Present and Future

More and more consumers are using the Internet to meet lifestyle needs, to shop for services and to research product information such as comparing insurance policies. However, many still have yet to create their own commercial identity on the Web. A recent survey of some 15,000 consumers found that two-thirds plan to register a domain name in the coming year. This is a significant indication of pent-up, consumer-side market demand and of the opportunity for increased sales volume for domain names.

The research also found that, based on the decision to purchase timeframe, prospects for new domain name purchases fell into three categories: Early Adopters, Followers and Laggers.

Early Adopters—These are identified as the consumers planning to register a domain name within the next year, a group representing the largest segment of this consumer marketplace. They are 17 to 40 year olds who are very Internet savvy. In the past, price resistance has been the main reason they have not registered a domain name. But, as more affordable product and service offerings become available, these consumers are more attracted to registering a domain name.

According to the research, this group is poised to purchase. More than 75% have considered registering a domain name in the past and most are reported to have very specific plans for those names when purchased. Communicating with friends and family is one key driver but with advances in delivery and types of Internet services it has become increasingly possible to provide products and services from home. As a result, many consumers have left the corporate world to start their own home-based business. The majority of this consumer group stated the commitment to start an online business with their domain name.

Followers—According to the research, these business people express great interest in registering a domain name (some 70% have considered doing so), but have no immediate plans or needs to buy now. While the majority is online daily, their use of the Internet is mostly personal.

Followers also are considered Internet savvy, and largely fall into the 25 to 45 year-old group. They are so named because they tend to “follow” trends rather than create them, so their timing for making decisions tends to lag behind the Early Adopters by as much as two years. Like Early Adopters, Followers know they want a domain name but aren't quite as certain about what they will do with them.

Reasons for failure to register a domain name vary for Followers. Some noted that they simply had no reason and/or no time to do so. Others expressed uncertainty about how to set one up. Followers who knew for sure that they wanted to set up a web site wanted to do so for the same reasons: starting an online business or creating a family-related web site. To stimulate this market segment, the product positioning and benefits must be abundantly clear. Followers will be attracted by the enhanced indexing functionality of .biz

Laggers—Laggers like to wait and see. They have no immediate, driving wants or needs to set up a web site, and have no real focus on what they would do with one. Representing 16% of the market, this group won’t register a domain name for two years or longer, and 90% largely use the Internet for personal reasons.

The big difference between Laggers and other segments is that they have never considered registering a domain name. Laggers are overwhelmingly family and not business oriented. So, when they do register a domain name, it is usually to create a family-oriented web site. Laggers tend not to have the ready resources to use the Internet as a fulfilling medium for connecting with family and friends. Time, not money, is the crucial factor in bringing these consumers online. Therefore, simplicity and usability are critical to engage this segment of the market

The marketplace for domain names is expanding and opportunities also abound for repeat sales of .biz domain names to existing customers. The average number of Web addresses registered per customer is projected to increase to four by First Quarter 2003 (includes businesses and consumers). This fact bodes well for registrars both in terms of being able to move more product overall and of achieving marketing economies, since it costs dramatically less to sell to an existing customer than it does to “cast a wide marketing net” to find new ones.

The Business Community

As noted earlier, businesses across a broad spectrum of descriptions represent some 80% of all domain name registrations. Forecasts are for business to continue registering the greatest number of any market segment in the foreseeable future. The chart below shows the top 20 business types that registered web addresses in the past three years:

|

Top 20 Business Markets: Y2000 |

Top 20 Business Markets: Y1999 |

Top 20 Business Markets: Y1998 |

|

Internet Services Attorneys Computer Software Real Estate Business Management Consultants Advertising Agencies and Counselors Insurance System Designers and Consultants Computer and Equipment Dealers Physicians and Surgeons Billings Services Restaurants Churches Marketing Consultants Graphic Designers Real Estate Loans Automobile Dealers: New Cars Dentists Accountants Web Site Design Services |

Attorneys Internet Services Real Estate Computer Software Insurance Advertising Agencies and Counselors System Designers and Consultants Business Management Consultants Physicians and Surgeons Computer and Equipment Dealers Churches Real Estate Loans Freight-Forwarding Restaurants Accountants Automobile Dealers: New Cars Travel Agencies and Bureaus Graphic Designers General Contractors Printers |

Internet Services Attorneys Real Estate Computer Software System Designers and Consultants Computer and Equipment Dealers Advertising Agencies and Counselors Insurance Churches Physicians and Surgeons Business Management Consultants Restaurants Travel Agencies and Bureaus Automobile Dealers: New Cars Accountants Real Estate Loans Associations Newspapers (Publishers) Financial Advisory Services Human Services Organizations |

Small businesses lead the way. While large companies continue to increase their presence on and investments in the Internet, it’s the small office/home office (SOHO) segment that is joining the Internet and the online economy in a big way.

Notwithstanding the number of businesses owning domain names, the business presence online is far from developed. For example, many categories among even the biggest bricks-and-mortar businesses do not yet have a web presence and many of those have no e-commerce capability online.

|

Industry |

Percent of Brick and Mortar Companies with Domain Names |

|

Manufacturing |

28% |

|

Wholesale Trade |

17% |

|

Finance, Insurance and Real Estate |

14% |

|

Transportation, Communication and Utilities |

12% |

|

Services |

11% |

|

Mining |

10% |

|

Retail Trade |

9% |

|

Construction |

7% |

|

Agriculture, Forestry and Fishing |

5% |

|

Public Administration |

2% |

In establishing an

online presence, “manufacturing” has the highest penetration percentage across

all vertical markets. The “manufacturing” vertical market involves brick and

mortar companies (electrical, industrial, furniture, rubber, and paper).

While the

“services” vertical market (attorneys, Internet services, computer systems

designers and consultants, ad agencies and consultants and business management

consultants) is number one in web address registration, it has only penetrated

11% of its available market.

Only the biggest

of the big, the Fortune 1000 Companies (F1000), appear to be fully

“self-actualizing” on the Internet.

Since the earliest days of the New Economy, these leading companies have

been the trendsetters in developing a strong online presence; many registered

their first domain names in the early 1990’s and they continue to register more

to promote new products or divisions, or otherwise enhance their current web

sites. Within the past 14 years, F1000

companies have secured an average of 23 web addresses each. Some of the largest have registered hundreds

of domain names. Last year alone, the

number of domain names purchased by F1000 companies increased by 312%.

Successful sales

of new domain names will come from delivering impact, benefits-laden marketing

messages to specifically targeted and specifically opportunistic, vertical

business categories. These correlate to

those business categories with significant growth projections, cross-referenced

to those showing a proclivity to establish an online presence. The following table shows growth rates for

all ten vertical markets that established a web presence between 1995 and 1999.

|

SIC |

Description |

Growth % 1996 |

Growth % 1997 |

Growth % 1998 |

Growth % 1999 |

|

01 to 09 |

Agriculture, Forestry and Fishing |

485% |

253% |

222% |

238% |

|

10 to 14 |

Mining |

228% |

165% |

134% |

178% |

|

15 to 17 |

Construction |

522% |

213% |

199% |

211% |

|

20 to 39 |

Manufacturing |

244% |

124% |

118% |

159% |

|

40 to 49 |

Transportation, Communication and Utilities |

227% |

143% |

144% |

185% |

|

50 to 51 |

Wholesale Trade |

377% |

146% |

142% |

171% |

|

52 to 59 |

Retail Trade |

254% |

154% |

165% |

202% |

|

60 to 67 |

Finance, Insurance and Real Estate |

321% |

156% |

158% |

213% |

|

70 to 89 |

Services |

211% |

150% |

151% |

194% |

|

91 to 97 |

Public Administration |

338% |

184% |

183% |

199% |

Clearly, there is a significant domain name marketing opportunity within these and other vertical categories, as the world becomes increasingly aware of and is habituated to use of the Internet as a core medium for making and encouraging commerce. The new .biz domain space will be integral to the growth of this segment of the market.

Market Accessibility

As a result of the diminished availability of desirable .com names and with an eye toward the accelerated global expansion of Internet use, it makes sense to introduce a wider choice of top level domain names. To deliver real benefit to customers and to stimulate healthy, productive competition in the global marketplace, these new domain names must:

· Deliver real utility

· Have international significance and recognition

· Be memorable and meaningful

· Enable a wider opportunity to purchase a name that reflects their intended use.

In order for the .biz domain extension to take hold and grow three things must occur.

First, a new competitive registry must establish consumer confidence in the stability, security and additional functionality of a new TLD. To achieve this, the registry must be capable of providing and managing the necessary infrastructure. JVTeam is proposing a comprehensive technical solution, as outlined in this proposal, to introduce the next generation domain name registry and facilitate increased security and functionality.

Second, the new TLD must have an effective marketing and distribution network and the means to stimulate demand through those channels. In addition, the type and number of registrars must expand considerably if the domain name distribution channels are to grow beyond the current bias towards Internet Service Providers so that the domain name system may penetrate new segments and new markets. JVTeam’s eXtensible Registry Protocol and fat registry design will reduce risk and complexity at the registrar level thereby increasing the number and diversity of accredited registrars. We believe this fat registry concept and the nature of the .biz domain space will present a very attractive and simple proposition for large community portals to seek accreditation as registrars.

Third, the benefits and differentiators of the new TLD must be communicated effectively to the market place. JVTeam will develop a worldwide branding campaign and provide focused public relations and advertising programs to create public awareness for .biz. In addition JVTeam will work closely with registrars to take advantage of the existing public demand that is reflected in the primary research we have completed for this response.

These efforts will not only take future market share from the overextended .com TLD, they will deliver to the market domain names that are simpler, more memorable and more closely aligned with the branding and activities of online business. A .biz domain name supported by enhanced functionality and a clearly differentiated web space will ensure that customers can more easily and readily find the business they want.