SECTION

D – PARTS 1 AND II – GENERAL INFORMATION

AND

BUSINESS CAPABILITIES AND PLAN

D5 URL of

Registry operator’s principle world wide web site

D6 Dun and

Bradstreet D-U-N-S number (if any) of registry operator

D8 Registry

operator’s total revenue (in US dollars) in the last fiscal year.

D9 Details of

Registry operators owner, managers

D10 Contact for

information - CONFIDENTIAL

II. BUSINESS CAPABILITIES AND PLAN

D12 Instructions

for Business Capabilities and plan

D13.1 Registry

Operator’s Capabilities

D13.1.2 Current Business Operations

D13.1.3 Past Business Operations

and Entity History

D13.1.5 The Mission Of The Global

Name Registry

D13.1.8 Commercial General

Liability Insurance

D13.2.1 Services To Be Provided

D13.2.5 Estimated Demand For

Registry Services In The New Tld

D13.2.7 Plans For Acquiring

Necessary Systems And Facilities

D13.2.8 Staff Size/Expansion

Capability

D13.2.14 Business Opportunities and

Risks

D13.2.15 Registry Failure

Provisions

D13.3 Pro-Forma

Financial Projections

D13.4 Supporting

Documentation

D13.4.1 Registry Operator's

Organizational Documents

[INSTRUCTION: A Registry Operator's Proposal is to be submitted as part of every new TLD application. In the case of applications for unsponsored TLDs, the registry operator will be the applicant and should prepare and submit the proposal as part of the application. In the case of applications for sponsored TLDs, the sponsoring organization (or, where the sponsoring organization has not yet been formed, organization(s) or person(s) proposing to form the sponsoring organization) will be the applicant. The sponsoring organization should select the proposed registry operator, have it prepare the Registry Operator's Proposal, and submit it as part of the application.

Please place the legend "CONFIDENTIAL" on any part of your description that you have listed in item F3.1 of your Statement of Requested Confidential Treatment of Materials Submitted.

The Registry Operator's Proposal should be separately bound (if more than one volume, please sequentially number them) and labeled: "Registry Operator's Proposal." and must cover all topics described below. This page, signed on behalf of the registry operator, should be included at the front of the Registry Operator's Proposal.]

D1 Introduction

The first section of the registry operator's proposal (after the signed copy of this page) should be a listing of the following information about the registry operator. Please key your responses to the designators (D1, D2, D3, etc.) below.

D2 Registry operator details

The full legal name, principal address, telephone and fax numbers, and e-mail address of the registry operator.

The Global Name Registry, Limited

10 Fenchurch Avenue,

LONDON

EC3M 5BN

UK

Tel: +47 (0)20 7663 5600

Fax: +47 (0)20 7663 5700

Email: Icann@theglobalname.org

D3 Other business locations

The addresses and telephone and fax numbers of all other business locations of the registry operator.

The registry operator does not have any other business location than listed under D2.

D4 Type of business entity

The registry operator's type of business entity (e.g., corporation, partnership, etc.) And law (e.g., Denmark) under which it is organized.

The Global Name Registry, Ltd. is a limited liability company, incorporated under the laws of England and Wales with the company number 04076112 at the UK Companies House.

D5 URL of Registry operator’s principle world wide web site

The Global Name Registry Ltd, URL is www.theglobalname.org.

D6 Dun and Bradstreet D-U-N-S number (if any) of registry operator

The Global Name Registry, Ltd. does not have a Dun & Bradstreet D-U-N-S number.

D7 Number of employees

The Global Name Registry, Ltd. does not yet have any employees. However senior managers from Nameplanet.com have been seconded to The Global Name Registry, both for the preparation of this plan, and for permanent placement into GNR on successful delegation. The number currently seconded is equal to 3.

D8 Registry operator’s total revenue (in US dollars) in the last fiscal year.

The company will be set up for the purpose of running the TLD, so no operations currently exist.

D9 Details of Registry operators owner, managers

Full names and positions of (i) all directors, (ii) all officers, (iii) all relevant managers, and (iv) any persons or entities owning five percent or more of registry operator.

Hakon Haugnes and Lars Odin Mellemseter are the initial directors of The Global Name Registry, Ltd. The latter director is CEO in Nameplanet.com, Ltd. The former director is Vice President in the same company.

The Global Name Registry as yet is not operational, although, it is proposed that the following senior managers from Nameplanet.com are permanently transferred as Officers: Hakon Haughes (VP Business Development), Geir Rasmussen (Chief Technical Officer), & Dominic Chambers (Sales & Marketing VP). The non-executive directors will be Michael Dillon and Julie Meyers.

The Global Name Registry, Ltd. does not yet have any managers.

The registry operator is fully owned (100 %) by Nameplanet.com, Ltd., a limited liability company, registered in England and Wales with the company number 03895286 and with 10 Fenchurch Avenue, LONDON, EC3M 5BN, as the registered business address

D10 Contact for information

Name, telephone and fax number, and e-mail address of person to contact for additional information regarding this proposal. If there are multiple people, please list all their names, telephone and fax numbers, and email addresses and describe the areas as to which each should be contacted.

The contact point for all requests for additional information regarding this proposal from ICANN should be directed to Hakon Haugnes, as per his contact details below:

Email: Hakon.Haugnes@theglobalname.org

The contact point for all requests for additional information regarding this proposal should be directed in the first instance to questions@theglobalname.org

D11 Subcontractors details

The full legal name, principal address, telephone and fax numbers, email address, and Dun & Bradstreet D-U-N-S number (if any) of all subcontractors identified in item D15.3 below.

IBM United Kingdom limited

PO Box 41, North Harbour

Portsmouth

Hampshire, PO6 3AU

Tel.: +44 02392 561000

Fax: +44 02392 388914

Email: david_white@uk.ibm.com. Tel.: +44(0)-7710-031042.

DUNS: Dunn & Bradstreet No.: 210151718

SourceFile

2201 Broadway, Suite 703,

Oakland, California 94612,

Tel: +1 510-419-3888

Fax: +1 510-419-3875

National tax number:943294304

Email: escrow@sourcefile.com

D12 Instructions for Business Capabilities and plan

D13.1 Registry Operator’s Capabilities

Detailed description of the registry operator's capabilities. This should describe general capabilities and activities. This description also offers the registry operator an opportunity to demonstrate the extent of its business and managerial expertise in activities relevant to the operation of the proposed registry. The following items should, at a bare minimum, be covered:

D13.1.1 Company Information

Date of formation, legal status, primary location, size of staff, formal alliances, references, corporate or other structure, ownership structure

The Global Name Registry is being established as the

operational company to apply and run a new TLD, .NAME. This company is a wholly

owned subsidiary of Nameplanet.com Ltd. The following sections, to D13.1.4

refer to the parent company Nameplanet.com Ltd:

NamePlanet.com Ltd was formed in December 1999, and is a private limited company registered both in Norway & the United Kingdom. The Head Office is in London; Norway acts as a branch office. Nameplanet.com also has representive offices in Germany (Frankfurt) & Sweden (Stockholm). The primary location is London, although the servers are located in Oslo.

The company currently has 35 employees, 26 in London, 9

in Oslo

The company has a close technical relationship with IBM

and UUNET, which provide hardware and hosting facilities

Nameplanet.com Ltd is a privately owned company, with

the shares almost evenly between investors and founders or employees. The

actual split is shown below:

WITHDRAWN BY APPLICANT

D13.1.2 Current Business Operations

Core capabilities, services offered, products offered, duration of provision of services and products.

NamePlanet.com became fully operational in February 2000, and since then has experienced exceptional growth, with over 650,000 users now registered to the service around the World.

The Nameplanet.com vision is to enable as many people as possible with the same last to share a domain name. Nameplanet.com effectively buys 'cyber real estate' in the form of domain names and then build virtual skyscrapers renting out the floors to individuals in cyberspace. Nameplanet.com aims to build a web-based personal communications service built around a community of individuals with the unique benefit of having their own name as their Internet address.

Nameplanet.com is a "full service" company with capabilities in the following key areas:

Marketing

Although Nameplanet.com commenced operations in Norway, it has since relocated to London and developed an international marketing capability. Marketing is currently focused on the four key markets: Norway, Sweden, UK and Germany. PR is the primary channel being used to generate awareness and consumer understanding of what Nameplanet.com offers, PR via an experienced PR manager is managed through one the world's largest consultancies, Burson Marsteller.

In addition to PR, Nameplanet.com has made extensive use of affiliate programmes in the USA and Europe to cost effectively attract new users to the site. Nameplanet.com currently has total base of 500 affiliates delivering 25,000 new users per month.

The targeted use of banner campaigns has been used to raise awareness, improve image, and recruit users. These campaigns are constantly monitored, and have been used in most European countries.

Nameplanet.com has a clear identity that uses an iconic "thumb print" device that is intended to communicate that Nameplanet.com will allow consumers to have their personal ID on the web. Nameplanet.com has used both qualitative and quantitative research surveys to improve consumer insight within the company, in order to develop services that match the needs of our consumers. In addition we have a very active support service that handles incoming suggestions from users.

In summary the marketing efforts of Nameplanet.com have in a very short space of time developed a brand that is the 3rd best known web mail provider in Norway (Source: Nettavisen). It has also managed to attract 650,000 users with a relatively small marketing budget, by creative use of PR and a valuable viral effect that drives forward the recruitment of new users.

Sales

Nameplanet.com uses both a direct sales force, two banner networks, and a dynamic opt-in email partner to maximise revenues from some 18 million page impressions a month.

The direct sales force of 6 is based out of Oslo, managed by a highly experienced sales manger (from the Norwegian telecom operator, Telenor). The company is currently developing direct sales in the 3 Scandinavian markets, and relying on banner networks for the rest of the world.

Content including Product & Service provision

Nameplanet.com has a very active product development department that is following a programme of continually improving the Nameplanet.com offer.

Existing Products and Services

Web Mail (introduced February 2000)

The primary offering is a web-mail service. This offers consumers a comprehensive free email service that can be accessed anywhere in the world from the WWW. The service includes address book, 5mb disk space, folders, sender block option and other features.

Personal Web Address (introduced September 2000)

Nameplanet.com is offering the world’s first free personal web address service, this allows users to convert their current Nameplanet.com email address (e.g. David@Wellings.com) to a web address www.David.Wellings.com. An opportunity is also given for users to click to partner sites where web home pages can be created and hosted.

WAP Service (introduced May 2000)

Users can access their web mail by using their WAP mobile phone. This allows users to send as well as receive messages, and is free to users, (although normal phone charges apply).

E Cards (introduced September 2000)

Users can also send e cards, this allows them to send humorous or occasion based cards to friends and family from their Nameplanet.com email.

Future Services (October-November 2000)

Nameplanet.com intends to introduce a number of new features in the near futures, including, POP 3 access and additional storage (paid for), voice mail, and free IP calls to North America, instant messaging and chat.

Finance & Administration

Nameplanet.com has a full service financial and accounting department, providing financial and management accounts for both operational territories (Norway & UK). There is also an arrangement in place with Worldpay.com to accept consumer payment via credit cards for premium services. In addition Nameplanet.com have a legal counsel providing in-house advice, and executing commercial contracts with suppliers, partners, and customers.

Domains

Nameplanet.com has an unrivalled knowledge and capability with domain management and use.

The company has the world’s largest number of personal domains and has developed a bespoke database management system to ensure it has sufficient coverage of names amongst the population.

Technical

Nameplanet.com:

Has successfully acquired 700,000 users after 8 months of operations, who are all using a personal domain name to solve a web-mail and web-page solution which has fully developed and operated in-house;

Is currently operating a 2.3 Terabyte ESS backend system, and a high availability active-active failover front-end system designed to scale to millions of users;

Encrypts private information in real-time;

Operates currently a system handling more than 90 transactions per second;

Has extensive experience with backup, which is taken daily and transported offsite;

Has extensive experience with running DNS, since the company is handling the full DNS service for the personal domains of all 700,000 users;

Has entered into a strategic partnership with IBM and minimised variations in equipment used;

Has ensured 99.85% uptime since the service was launched February 1.

D13.1.3 Past Business Operations and Entity History

History, date of formation, legal status, type of entity, initial services, duration of provision of services and products.

As stated in D13.1.2 Nameplanet.com was established in December 1999 as a new venture providing personal domain web mail. No previous business operations existed.

D13.1.4 Registry, Database, Internet Related Experience And Activities

Registry and DNS experience

Nameplanet.com has, as its core proposition to end users, the free usage of a domain name that corresponds to the user's personal name for email and web page purposes. To be able to offer this service, Nameplanet.com has acquired extensive statistics about the most common last names in the world, for each of the countries in which the service is launched. A large number of domain names identical to the most common last names have then been purchased on different TLDs to be shared among different users, each using it for free. The result is that domain names are being shared among people with equal interests, i.e. Ken Williams and Sven Williams can both use the domain name Williams for their personal purpose, instead of it being held by one user only.

To keep track of domain names covering the last names of over 210 million people in the US alone, and the DNS functionality of hundreds of thousands of domain names, Nameplanet.com has developed a custom database for administering the DNS servers, renewals, MX records etc. This database makes Nameplanet.com confident that all possible actions are taken to ensure a stable operation of the domain names that the end users rely on. Large efforts have been deployed to ensure that all DNS updates, maintenance and transfers of data to DNS servers are done securely and without loss of function.

Nameplanet.com has through the operations in the DNS space secured knowledge and contacts within the arena, both through commercial relationships with several registrars, ccTLD managers, and ICANN-ccTLD relationships. Participation in the ICANN Board meetings have also given insight into the policies and operations of the DNS community.

Internet experience, database operations, IP rights and data protection

The users of Nameplanet.com register on-line and immediately get assigned an address of the type firstname@lastname.com and a web page www.firstname.lastname.com, or other TLDs where the .COM version has not been available. Nameplanet.com has developed fully in-house a custom object-oriented database for the web mail users, and has ensured 99.9% uptime since launch in February 2000. This custom database currently runs with more than 70 transactions per second, and can do tens of thousands of email account and web page account registrations per day. The high-performance web-servers and storage solutions scale to millions of users, and is able to handle increasing data volumes.

By currently operating a web mail solution for 700,000 people, Nameplanet.com has taken extreme precautions in ensuring user privacy, both technically and legally, in terms of storage, encryption, backup, protection and IP rights in various jurisdictions.

Nameplanet.com has recent experience of managing intellectual property rights with regards to domain names, dealing with conflicts that have arisen between people and businesses with the same last name domain name. This expertise applies to the UDRP as well as national IP law of the US and EU countries.

D13.1.5 The Mission Of The Global Name Registry

VIsion

The need for a global personal naming solution transcends the barriers of nation and language. Our enduring commitment to promote individuality and the right to self-expression will create the opportunity for all people in the digital society to own their own names independent of commercial connotations.

What This Means

For some hundreds of millions of people access to computers and the Internet has brought a previously unimaginable enlargement of perspective. In these countries the number online will inexorably grow, certainly passing the 350 million mark before the end of the 2000, and likely to reach 750 million by 2003.

As the people of world come on line - so the demand for domain names will also grow-from 28 million today to over 300 million by the end of 2003 (Source: Network Solutions Predictions - www.dotcom.com).

But the Global Name Registry is about more than allowing an individual his or her own digital identity. It is ultimately about what, with that identity, an individual can achieve.

We believe that individuals everywhere should have the opportunity to participate in the digital society and that a prerequisite to digital citizenship is a fair personal naming solution that puts the individual in control of how he or she is represented and contacted.

Our approach to achieving these ambitious goals is inherently rooted in another aspect of the culture of cyberland: its essentially decentralized spirit. Taking the evolution of the Net and the Web as models, the Global Name Registry sees its role as catalysing the development of a web of initiatives. We imagine that most of these will be local initiatives, though some will be global; many will be grassroots actions, though some may be actions by governments or international organizations.

Functions

What the Global Name Registry can do to help will be even more varied. Our primary objectives will be in three key areas:

To provide a top level domain that is reserved for the exclusive use of individuals not commercial organisations;

To allow only the 3rd level domain to be registered, so allowing a much better control and space allocation of the domain space;

To provide services to ICAAN and the registrars which enable them to sell .NAME;

To encourage competition amongst registrars and resellers to drive acceptance of .NAME in their marketplace.

On a less material level, the Global Name Registry will serve to distribute ideas, to facilitate the creation of networks and, will act intellectually as a spearhead of new ideas honed to protect and promote the creative use of Personal Domain Space.

D13.1.6 Management

Qualifications and experience of financial and business officers and other relevant employees. Please address/include past experience, resumes, references, biographies.

The Global Names Registry (GNR) currently has three employees seconded to it: Hakon Haugnes, Georg Panzer, and Dominic Chambers. In addition two further employees: Ken Trotter and Geir Rasmussen have been identified as the initial officers of GNR.

The recruitment plan in section D13.2.8 describes how additional human resources will be acquired through recruiting. GNR will, from the moment of delegation, extract key competences from the mother company. In addition it will recruit new employees and management and give them proper training to ensure safe and stable operations of the Registry.

The management that is already for the initial phase is:

GNR management CV’s

Dominic Chambers |

|

VP Sales and Marketing |

Born

|

1965 |

London |

Work |

2000 |

Nameplanet.com, Global Head of Sales & Marketing |

|

|

1999-2000 |

Warner Home Video (UK & Ireland), Marketing Director reporting to Managing Director |

|

|

1988-1998 |

Seagram: Marketing Director. Overall responsibility for Seagram's malt portfolio with particular focus in North America |

Education |

1993 |

Kingston University, MBA (Part One) |

|

|

1984-1988 |

University of Lancaster, BSc (Hons) 2:1 in Management Science |

|

Languages |

|

English |

Geir Rasmussen |

|

CTO |

|

Geir Rasmussen is one of the co-founders of Nameplanet.com and has been CTO for Nameplanet.com since launch of its services. Geir has successfully managed the in-house development of the system which today serves 700,000 users and has had 99.86% uptime since it was first opened for traffic, including external backbone downtime. Being overall responsible for the design, stability and security of the system, Geir has ensured that Nameplanet.com now has a system that both in hardware and software is scalable to millions of users. Geir will be dedicated to the task of ensuring a fully stable and secure system for registrations and will recruit the appropriate people to develop and maintain the necessary environment and operational conditions for the system. |

||

Ken Trotter |

|

Financial Controller |

Born

|

1957 |

Britain |

Work |

2000 |

Nameplanet.Com Limited, Financial Controller |

|

|

1999 -00 |

Nexpress Solutions Limited, Business Director |

|

|

1999 - 00 |

Alfred McAlpine Plant Limited, Finance Manager |

|

|

1993 - 97 |

Virgin Aerostations / Virgin Airship & Balloon Co |

|

|

1990 - 93 |

The Charndown Company Limited, Finance Director |

|

|

1986 - 90 |

GEC Traffic Automation Limited, Finance Director |

|

|

1982 - 85 |

Cyfas Systems Limited, Financial Controller |

|

|

1978 - 82 |

DOW Chemical Company Limited, UK Management Accountant |

|

|

1973 - 77 |

TI Churchill Limited, Trainee Accountant |

|

Qualifications |

|

ACMA |

Hakon Haugnes |

|

VP Business Development |

Born

|

1975 |

Norway |

Work |

1999-2000 |

Cofounder of Nameplanet.com, successfully built the

whole domain name infrastructure on which Nameplanet.com is operating,

including commercial relationships, financing and technical system

design. Project Manager for the new

TLD .name ICANN application. |

|

|

1999 |

The Norwegian Defence HQ, re-evaluating the

Norwegian defence IT-project portfolio and reworking the IT-strategy in

Project "Focus". |

|

|

1998 |

Alcatel Telecom Norway, Business developement on

WAP, Screenphone and mobile Internet.

Wrote a final thesis in Engineering studies on the porting of CTI

services and Internet synergies on to mobile terminals. Obtained top ranking

A. |

Education |

1996-1998 |

3rd to 5th year of Institute for Cybernetics,

Norwegian Institute of Technology (NTNU). Specialisation in technology

management and technology business administration. Graduated with top

ranking, average 1.7/1. |

|

|

1994-1996 |

Classes Préparatoires at INSA, France. This was a preparation course. Graduated among top 2%. |

|

Languages |

|

French (fluent), English (fluent), Norwegian

(fluent), German (reading skills), Spanish (conversational skills) |

Georg Panzer |

|

Legal Counsel |

Born

|

1970 |

Norway |

Work |

2000 |

General counsel, Nameplanet.com Ltd., London |

|

|

1997-2000 |

Attorney

at Advokatfirmaet Steenstrup Stordrange DA, Oslo. Lead counsel in several Norwegian litigations, involving

ISP and competition Law. |

Education |

1997 |

Law degree from the University of Oslo. Cand.jur (1st

class). Stays at the Universities of

Amsterdam, Cambridge, and Vienna |

|

|

1999 |

Lecturer in law at the Norwegian Bar Association and the Norwegian Patent and Trademark Office and other institutions. |

|

Languages |

|

German

(fluent), English (fluent), Norwegian (fluent) |

Michael Dillon |

|

Non-Executive Director |

|

Internet user since 1991 and a participant in the Internet Service Provider industry since 1994, Michael Dillon’s knowledge of Internet infrastructure, operations and Internet networking technology including security is unusually comprehensive. For two years, from mid-1997 through mid 1999, he was Senior Contributing Columnist for Internet world magazine writing a weekly column as their Internet infrastructure expert. He has also written for Boardwatch and other publications. In the recent years he has worked with many companies including Global Telesystems Ltd, ISP Ltd, Prince Rupert Citytel Internet, Priori Networks Inc, and Okanagan Internet Junction. |

||

Julie Meyer |

|

Non-Executive Director |

|

Julie Meyers is Chief Marketing Officer and Head of International Affairs at FirstTuesday.Com. Julie launched First Tuesday in 17 cities on September 7th 1999, and has managed the growth to 80+ cities worldwide with a UK staff of 40. She was an Assistant Director at NewMedia Investors (1998/9), where she assisted lastminute.com, WGSN.com and ARCCores in raising expansion and development capital. She is still on the Advisory Board of NewMedia Investors and additionally, Lago Partners, BrightStation, Holtron, iWorldGroup and Global Start-up. Previously, Meyer worked with Andy Cunningham, Cunningham.com where she managed the Motorola PC Marketing Communication program in 1995 and 1996. Julie consulted to Hewlett Packard, 3Com, the OECD and other technology companies in Paris from 1998 to 1993. She has an INSEAD MBA (Dec'97) and a BA and Honors degree from Valparaiso University (1988): Ernst & Young London Entrepreneur of the Year Award - June 2000. Received "Supporter of Entrepreneurship" in recognition of her ingenuity in bringing internet entrepreneurs and investors together through a series of networking events. Management Today - April 2000. Britain's Most Powerful Women. Julie Meyer, straight into the list for at No.17. "US-born INSEAD graduate Meyer has become a leading voice of e-business in Britain since founding First Tuesday, bringing investors and e-trepreneurs together." Silicon.com Agenda Setters 2000 - Voted number 30 in a list of Top 50 Industry Agenda setters Forbes magazine - 30 Dec'99. Highlighted as one of eight people in the technology industry to watch as a trailblazer in 2000. Julie Meyer, "The co-founder of First Tuesday is bringing the spirit of American venture capitalism to Europe's new breed of Internet startups." |

||

D13.1.7 Staff

Current staff size, demonstrated ability to expand employee base, hiring policy, employee training, space for additional staff.

(This section is also elaborated upon in point D13.2.8)

The Global Name Registry LTD was established for the purpose of operating a potential new top-level domain as delegated by ICANN. GNR will be fully supported in the initial period by the parent company Nameplanet.com Ltd. Due to being a new company entirely dedicated to its purpose, the Registry can become independent of other entities and optimally operate the new top-level domain and ensure a competitive regime for registrations.

The Global Name Registry currently has three seconded employees from Nameplanet.com Ltd in-place, with others identified should the application go forward.(See D13.1.6.)

The parent company, Nameplanet.com, has in 8 months successfully expanded to 35 employees and has divided into two offices in two countries. At the same time, the company has ensured a stable and secure service for its userbase, which has been growing at 5% a week, reaching 700,000 after eight months of operation. Throughout this growth, the company has successfully managed to secure and recruit key personnel in technical, marketing, finance and management areas.

Employees and management not taken from Nameplanet.com will be recruited by recruitment agencies. The hiring policy and recruitment is described in detail in D13.2.8.

The company will set aside 2% of turnover for staff training and will comply with the most recent employment legislation in the E.U.

Space for additional staff

Provision has been made within the Nameplanet.com offices to accommodate all the initial staff of GNR. The office space, in central London, is an attractive location for new employees. The office space available to GNR will be scalable and allow expansion for both companies.

Hiring Policy

GNR will have a comprehensive HR policy, in step with the most recent EU legislation.

GNR will make use of professional recruitment agencies. The agencies will receive a written brief, and a set procedure will be set up in-house to ensure that there is consistency in evaluation;

GNR will operate an equal opportunities hiring policy in line with current US and EU legislation;

All new employees will be offered share options in the new organization.

Employee training

The company will have a progressive policy towards staff training. It will dedicate 2% of revenue for the purpose of individual and team training;

A senior employee in Sales and Marketing will be designated as a champion for staff training.

D13.1.8 Commercial General Liability Insurance

Address/include amount of insurance policy, provider of policy, plans for obtaining additional insurance.

Insurance will be taken out covering the following:

Negligence or breach of contractual duty to use reasonable care and skill;

Negligent misstatement or misrepresentation;

Breach of copyright or intellectual property rights;

Defamation;

Breach of confidentiality;

Dishonesty and malice of partners, directors or employees;

The costs and expenses of investigating, settling and defending a claim;

Web site damages;

Damage to computer network ;

Director and officer liability against personal liability.

We have a quote on the above from AIG Europe (UK) Ltd and Hiscox Insurance Company Ltd through our insurance broker:

Lark Insurance Group

Wigham House

Wakering Road, Barking

Essex, IG11 8PJ

UK

D13.2 Business Plan

Business plan for the proposed registry operations. This section should present a comprehensive business plan for the proposed registry operations. In addition to providing basic information concerning the viability of the proposed operations, this section offers the registry operator an opportunity to demonstrate that it has carefully analysed the financial and operations aspects of the proposal.

D13.2.1 Services To Be Provided

(See E9 for Policies in respect to Services to be Provided)

New registrations

The Registry will enter new domain names into the database on request from any Registrar. The registrations will be on a first-come, first-served basis, and will in case of high, simultaneous demand be served in a round-robin order, with queuing allowed for each Registrar.

The Registrar will hold a prepaid account with the Registry that will be debited monthly with applicable fees for processed registrations. The application software and database management systems will not accept registrations from a Registrar for whom pre-paid amounts have been exceeded. The system is designed to avoid unpaid registrations and cancellations, which would make the DNS unstable and create the potential for unsatisfied users.

Registrations will be on third level only. Any combination of more than one (1) letter, with the exception of the prohibited list (see E5.2) will be accepted as valid. The destination DNS server will be selected by the Registrant.

Registrars will hold all personal information as it relates to the Registrant. The end-user information that will be held is described in E4.1.7. The Registry does not demand such information for the registration process.

New registrations will be inserted into the DNS continuously after which the propagation time will determine when the domain becomes active.

Transfers between Registrars

A registrant is free to change Registrar at any time. The policy in respect to transfers is described in E4.1.8

Accreditation of non-ICANN accredited Registrars

Only ICANN accredited Registrars will be eligible as GNR Registrars.

Registry interface client software

Registrars will be free to use the current Registry-Registrar software as implemented by Network Solutions and the alterations to interface with GNR system will be minimal.

Further, an enhanced software for connection to the GNR Registry will be made available to Registrars free of charge, along with a password, Registrar ID, protocol implementation and API. It is encouraged that the Registrar also uses a Virtual Private Network (VPN) interface encryption card to ensure secure communication between the Registrar and the Registry. There also will be an automated string notification system and a registry search (see E1.4.7 WHOIS).

DNS services

The second level DNS will be operated and controlled by the Registry.

Third level DNS records will point to DNS servers as set by the Registrant.

WHOIS service

The WHOIS service is described in D15.2.8 and in E1.4.7.

Renewals

Initial registration will record an expiration date and time in the database. It is the Registrar's responsibility to notify users of expiration, although reports can be generated by the Registrars at any time to determine expiration dates for any given domain.

Registrars are able to renew a domain in the same mechanism in which they were able to register the name. Renewals will be allowed up to the maximum term as described in E4.

Accounting information

The Registrars will have access to a special page where information about their domains can be extracted. Reports are generated and content is updated daily from the Registry database. The information given is typically number of registrations, listings of registrations, nameservers, billing and account information (remaining credit, billing information to Registrar, contact information, etc.), expiration dates and modification dates of domains.

Registry web

The Registry will have web pages with public, common access. The pages will describe the Registry, give our public statistics, contact information, WHOIS information, etc.

The web page for GNR is www.theglobalname.org

Registry-Registrar interface set-up assistance, if needed

The Registry can assist new, ICANN accredited registrars to set up the Registry interface through consultancy support, installation of software, web integration and testing.

Dispute Resolution

The Registry policy for handling disputes is described in E6.

D13.2.2 Revenue Model

A full description of the revenue model, including rates to be charged for various services.

The revenue model is based on several primary sources:

New registration

Renewal registrations

There are other ancillary revenue sources, which are incidental to the total revenue for the Registry:

Domain transfer fees

Registration fees

Registrar renewal fees

Registry interface set-up assistance

Registry interface client software

Descriptions of the revenue model for each of the services and the rates charged are included in the sections below. For a detailed description of the revenue associated with each of the above items refer to D13.2.12.

D13.2.2.1 NEW REGISTRATION FEES

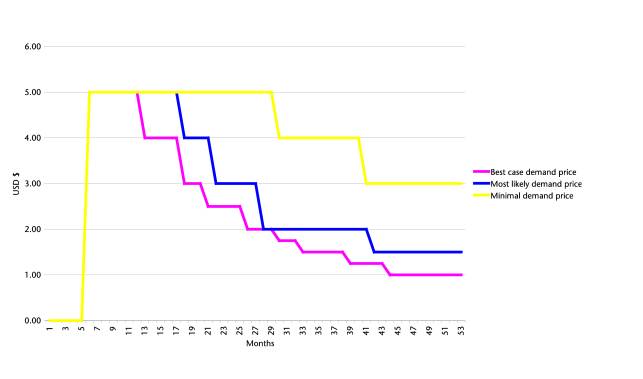

For each new registration, a fee is charged to the registrant, via the Registrar. The fee for each registration is based on the pricing assumption shown in the chart below. All registration fees are payable annually in advance at the time of registration or renewal. The price varies over time based on the assumed demand for new registrations as detailed in D13.2.5. The prices specified above, are for a one year registration.

These price changes are driven by the rate of new registrations in combination with the rate at which existing registrations are renewed to determine the total number of active registrations held on the Registry. For further details on the assumptions of the rate at which registered domains are renewed, please refer to D13.2.12.2. The price charged to the Registrar can be reduced over time as the cost of operating the Registry is relatively insensitive to the total number of registrations on the Registry. The greater the number of new registrations and subsequent renewals, the lower the price can be driven due to the cost of the Registry being spread over a larger number of registrations. For further details on the costs of the Registry, refer to D13.2.11.

D13.2.2.2 REGISTRATION RENEWAL FEES

At the end of the initial registration period, assumed to be one year, the Registrant will need to renew their registration to continue their right to the domain. It is possible that some Registrars may offer alternative (longer) initial registration periods, although for the purposes of the revenue model, all registrations are assumed to be for one year, as this would provide a more conservative maximum cash requirement assumption.

The renewal price will be the price then prevailing as published by the

Registry, assumed to be based on the pricing structure shown below, subject to

the assumptions on demand and registration renewals. The renewal fee is payable annually in advance of the original

registration.

The pricing forecast

D13.2.2.3 DOMAIN TRANSFER CHARGES

The need to provide a service for registrants to transfer their registration from one Registrar to another, or from themselves as owner to another owner is a service that any Registry would be required to provide. A fixed fee of USD $5 is made for this service to update the Registry database, which is charged to the Registrar. For details of the revenue this generates, refer to D13.2.12.

D13.2.2.4 REGISTRAR REGISTRATION FEE

The primary channel to market is through the Registrar. Therefore, it is crucial that they are able to become a Registrar for the Registry with the minimum of barriers (on the assumption that they do meet the necessary assessment criteria for approval).

To meet this objective, for ICANN approved Registrars, no fee will be charged by the Registry. This also assumes that they will not require any support to implement the Registry-Registrar interface, nor elect to implement the revised communication protocol being developed by GNR.

If Registrars are subject to registration fees, the cost of accessing a number of TLD's would quickly become prohibitive for many.

D13.2.2.5 REGISTRAR RENEWAL FEE

For the purposes of determining the operational effectiveness of GNR, it has been assumed that no revenue would be generated from the Registrars for the total term of the financial projections. This includes both initial registration charges and subsequent renewal fees.

D13.2.2.6 ANCILLARY FEES

For the purposes of financial projections, GNR has assumed nil revenue from ancillary fees. However, it is recognised that some Registrars will require support in establishing their Registry-Registrar interface systems, and that it would be inappropriate for GNR to subsidise these Registrars at the expense of others. Therefore a fee will be charged at cost, but it is not anticipated that this would in any way either contribute to earnings or revenue to any significant level.

Likewise, those Registrars wishing to implement GNR's interface software would be expected to make a contribution to the cost of providing the software, probably in the region of USD $5,000 per annum. However, as this is also never intended to represent anything more than a cost recovery process, this has been assumed for financial planning purposes to have nil contribution.

D13.2.3 Market Definitions

D13.2.3.1 MARKET OVERVIEW

The Internet domains market has seen an extraordinary rise over the last two years, growing at 64% a quarter on average (Source: Network Solutions). To many consumers the words "dot com" are seen as the definitive Internet tagline, with aspirational connotations to the boom years at the turn of the 21st Century in the United States.

As the Internet continues to grow and consumer experience increases, understanding of domains, the online real estate, will improve. In the USA, with over 50% (source: NUA) of the population online, only about 1% (source: Network Solutions) of people have a personal domain, and even fewer have a personal or family home page. Domestic Internet usage is set torapidly increase over the coming months. This phenomenon is driven both by a better commercial provision of domain names since the end of Network Solutions' monopoly as a registrar, and consumers wanting to have an identity on the web. The widespread use of individual home pages has the potential to enhance communication by providing a platform for a vast range of consumer applications.

It is considered that the introduction of a global personal TLD will provide many ISPs with a global brand to which consumer services can be attached. Furthermore, there will be more space to provide users with a good quality and memorable address. These factors will catalyse the rate at which domestic consumers register personal domain names.

For the purpose of this document, "the market" is considered to be the total number of domain names sold for personal use. This section will analyse the competitive scenario in that market; then it will investigate the geographical, demographic and behavioural dimensions of Internet usage; finally, a segmentation hypothesis will be made on the most attractive target consumers wishing to buy a personal domain.

D13.2.3.2 COMPETITIVE ENVIRONMENT

Between TLDs

The

Division of registrations between the gTLDs (Source:InterNIC)

At present, nearly 60% of all domain names registered are on .COM. Country-specific TLDs are popular in those areas, outside North America, where online populations are large. However, Network Solutions estimate that by the end of 2002 more than half of all new domain name registrations will take place outside the USA. It is assumed that registration on .NAME will follow this trend of internationalisation.

By increasing the number of global TLDs, ICANN is giving consumers a greater opportunity to register a personal domain name.

Between Business and Personal use

It is becoming easier for consumers to register a domain name because:

The distribution has become much wider due to the increase in the number of registrars and subsequent growth in the number of affiliate sites;

The cost to the consumer of domain names continues to fall;

The service proposition being offered to consumers is more sophisticated as packages are bundled together which allow almost effortless registration, design and management of personal websites;

Consumer knowledge about the opportunities and advantages of having a personal domain are increasing.

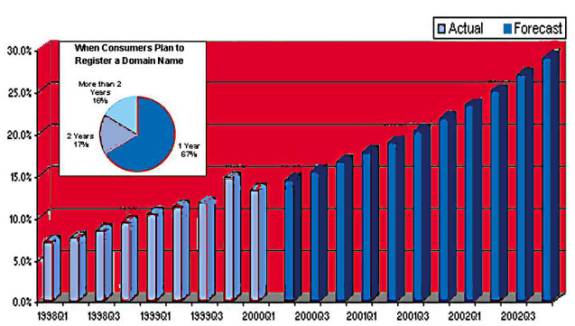

Network Solutions predict a significant growth in the proportion of personal registrations as a percentage of total registrations. This is substantiated by market research which indicates that 67% (Source: Network Solutions) of people surveyed plan to register a personal address in the coming year.

Proportion of personal domains registered on the Internet. (Source: Network Solutions.)

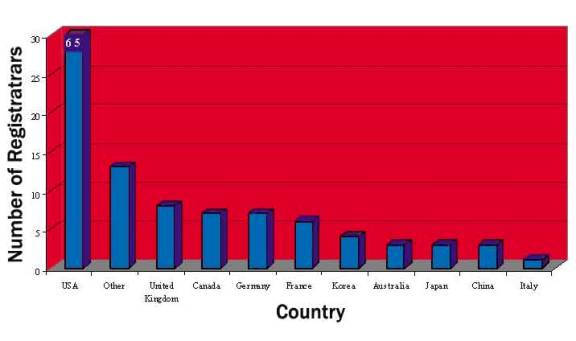

Between Registrars

The number of registrars has grown quickly from 1 in 1999 to 119 in 2000, as the market has evolved. We believe this number will grow as the demand for domains in countries such as Italy, Japan and France increases.

The Global Name Registry believes that a wide number of registrars with expertise in the local markets in where they are active will lead to competition that will be healthy for the domain name industry. Competition will ensure that the newest services and applications are brought to consumers at the best price, which will encourage a rapid adoption of personal domain names.

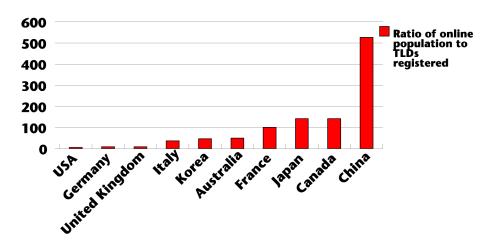

The distribution of Registrars across the ten largest Internet populations. (Source: ICANN)

Between communication and naming platforms (e.g. telephone numbers or postcodes)

As more and more personal business is transacted online, it seems likely that an individual's personal "address" and identity on the web will become increasingly important. Already personal banking and insurance services are widely managed over the web, and as the sophistication of these services develops, people will need a more advanced interaction platform than a simple e-mail address. It is not inconceivable that personal business in the future might be completely transacted through the medium of an individual's website. Furthermore, the address of this site will be an important personal identifier; just as someone's telephone number is today.

Secondly, the convergence of communications media to IP channels suggests that using an individual's web address might be the most convenient way to get in touch or to leave a message in the future.

D13.2.3.3 MARKET OPPORTUNITIES AND SEGMENTATION

Geographical and Linguistic opportunities

There are nearly more people online in the United States than in the rest of the world put together, but rapid Internet adoption since the millennium in populous countries such as China, Japan and Germany suggests that this will not be the case for very much longer.

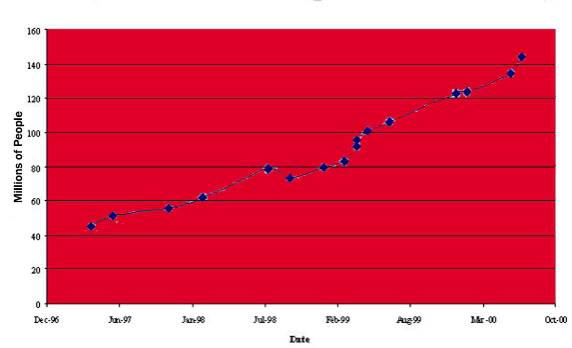

The rate at which people have come on line in the USA (Source: NUA)

Online penetration is an indicator of the level of development of Internet usage in the ten largest online markets. It is clear that there is still a lot of catching up to be done in Western Europe and East Asia to reach the level of Internet sophistication that can be seen in North America and Australia.

Percentage of total population online (Source: NUA )

Whilst it is dangerous to make assumptions about national culture, the fact that nearly 70% of all .COM registrations have been made in the United States suggests that other countries have been less able or inclined to register international TLDs.

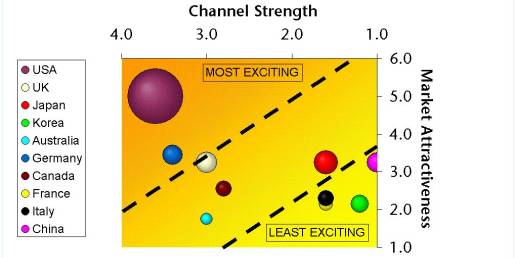

Using the data presented, a prioritisation model was used to demonstrate which markets would be most attractive for the new TLD at launch. The prioritisation matrix maps channel strength (which is a function of the number of resellers, the linguistic logic to the particular market, and the cultural impact of .NAME) against market attractiveness (which is dependent on market size, market growth, Internet sophistication and the degree of regulation).

Market prioritisation matrix (Source: The Venture Practice)

Analysing the ten countries with the most people online at the moment, the

matrix shows that USA, UK and Germany are the most promising markets. Moderately exciting markets are Japan,

Canada and China and less exciting ones are France, Italy, Korea and Australia.

Channel Opportunities

In countries where there are a large number of registrars operating, The Global Name Registry will evaluate the channels so that internal resources can be focused at the best opportunities. This is initially likely to represent 10 or so in the USA and 2-3 in each of the other markets.

Our most attractive channel partners will be categorised as follows:

1. Declared interest, 'they get it' and are enthusiastic

2. They have made a strong verbal commitment to support and promote .NAME

3. Large installed base of Personal Domain Names already

4. Already successful - particularly in the customer acquisition

5. Operates in one of the top 10 markets.

Consumer Opportunities

What types of people are registering web sites at the moment?

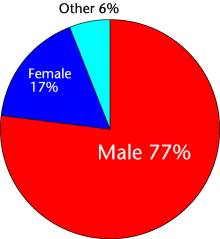

Gender

Data from Network Solutions suggest that whilst the male/female split online is about 50-50, 77% of consumers currently registering web addresses are male. Clearly there is an opportunity to directly target women to register .NAME domains.

Gender divide of domain registration (Source: Network Solutions)

Age

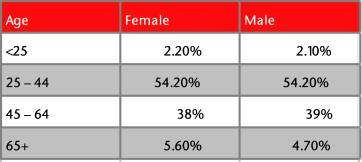

Registrations by age (Source: Network Solutions)

Currently the majority of consumers registering .COM are in the 25 - 44 age group. It is suggested that younger consumers, who perhaps are more accustomed to the Internet, have been put off registering on .COM because of its intimidating commercial feel and high cost. It is suggested that .NAME will be a more inclusive proposition for younger consumers and that increased competition between registrars will reduce the price of registration.

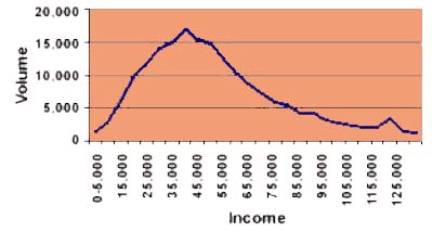

Income

The price of registration should not be a factor preventing people from owning their own names. Network Solutions data about the characteristics of consumers currently registering personal TLDs demonstrates that the majority of registrants have a household income between $20,000 and $60,000 a year. Consequently, it is likely that .NAME will be positioned to target middle income individuals and families.

Income profile of domain registrants. (Source: Network Solutions)

D13.2.3.4 SUMMARY SEGMENTATION

This basic segmentation suggests that the most promising consumer segment for .NAME might be young non-working people, quite possibly female, from middle income families either in USA or Western Europe.

Geographical dispersion of target markets.

Anecdotal description of the segments

Caricatures of target consumers have been created to illustrate the range of applications of the new TLD that could be valuable to different types of people.

Caricature of target consumers to illustrate potential usage.

D13.2.4 Marketing Plan

D13.2.4.1 EXECUTIVE SUMMARY

The marketing plan is divided into six sections:

1. Value propositions:

This demonstrates the consumer need for a new TLD specifically for personal use. It then discusses the value propositions that GNR is making to consumers, the channels of distribution, and the wider Internet community.

2. Pricing strategy:

GNR proposes a sunrise pricing strategy that manages demand and creates a co-marketing fund to be used by registrars.

3. Channel strategy:

Efficient management and development of channels will be critical to the speed of adoption and the long-term success of .NAME. A channel strategy is presented to demonstrate the effective management of this process.

4. Communications strategy:

The communications strategy, focusing on the development of the .NAME brand and channel marketing. The two fundamental objectives of this process are to stimulate market demand by establishing .NAME in users’ minds and to establish an extensive network of fulfilment.

5. Promotional strategy:

This section proposes the development of a co-marketing fund to be directed at consumers via registrars for local marketing activities during operations.

6. Knowledge Management:

The registry is an organisation based on the gathering and management of a large amount of data. The process by which knowledge is captured and drawn out of this data will be outlined in this section.

D13.2.4.2 VALUE PROPOSITIONS

Consumers Needs

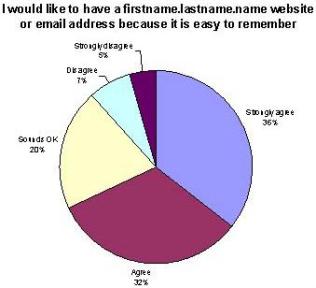

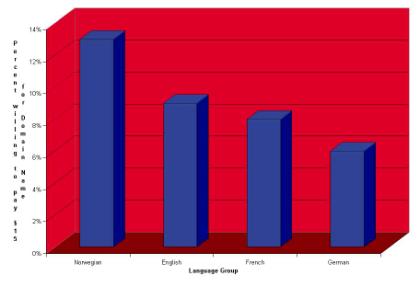

To better understand the value of the new TLD, specifically designed for personal use, a questionnaire was sent out to Nameplanet.comusers across the world. Nameplanet.com has 700,000 users that provide a good sample of global Internet users which give us an indication of consumer sentiment. Nearly twenty thousand responses were completed across four language groups (English, French, German, Norwegian).

The Need for .NAME

49% of those questioned expressed a positive interest in owning a website of the form www.firstname.lastname.NAME. Interestingly, the need for an e-mail address of the type mail@firstname.lastname.NAME was seen as less important with 29% of people expressing a positive interest. The difference between these is numbers is perhaps explained by the scarcity of individual names on website.

62% of respondents agreed or strongly agreed that they would often use their firstname.lastname website and email address

Consumer Value Propositions

The most compelling proposition to consumers, with 68% of those surveyed agreeing or strongly agreeing, is that the firstname.lastname .NAME format is easy to remember

The proposition that consumers rank second is the personal feel, without commercial implications, of .NAME websites and e-mail addresses. (58% of responses are positive)

56% of respondents value .NAME because it is "for life". 43% like the fact that a firstname.lastname.NAME would allow better management of communications as new forms of technology such as mobile phones or televisions go on the web.

Other value propositions that have been identified are that the new TLD is independent of geography, a "people's champion" promoting a fairer allocation of Internet real-estate.

GNR Domain management

In order to maximise available domain space, GNR will only register on the 3rd level not the 2nd level. This will allow for greater control, and greater availability of names for users (e.g. smith.NAME will not be registered, david.smith.NAME will be).

This innovation in domain management will be used to promote .NAME to both end users, and the registrars (who will benefit because of the increased availability).

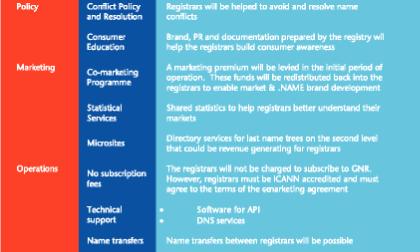

Channel Value Propositions

The Global Name Registry recognises that to make .NAME a success on the Internet, it will be essential to offer a service proposition to the distribution channel, the registrars. It is intended to make it extremely easy for them to propagate the delivery of personal domains to consumers. To do this the registrars must have support in the areas of policy, marketing and operations.

The Internet Community and ICANN

It is possible that the advent of .NAME will provide the focal point for businesses to create new applications and services in the personal communications area. The current DNS has no specific domain dedicated to individuals. The development of .NAME will also provide a global brand easily be identified as being for individual uses.

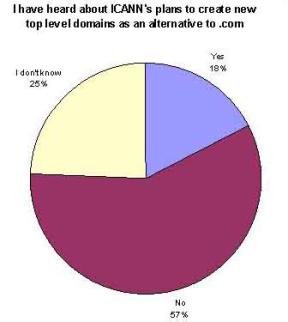

The Nameplanet.com user research indicates that 18% have heard of ICANN's plans

to create some new TLDs. This indicates

that there is good awareness, & some excitement within the online public

about this expansion of the Internet.

D13.2.4.3 PRICING STRATEGY

Background

The Global Name Registry will look to follow the current pricing conventions in the domain market. The new global TLDs to be introduced by ICANN are likely to have far lower levels of consumer awareness than the existing global TLDs, .com, .net and .org. GNR proposes that registrars are charged a development premium to be spent on developing consumer awareness, according to the following guidance:

The management of demand in the Sunrise Period

The launch of new global top-level domains is an unprecedented event in the short life of the Internet. The orderly management of the sunrise period is a key consideration of GNR’s application. In particular, the registry must control the land grab on the most popular names. It is, therefore, proposed that a registrar development premium should be charged on the initial million registrations to manage demand. The initial registrations will be charged at a premium, this will be a sliding scale for the first million registrations, (see detail in promotion strategy) these monies will be used by the registrars to help accelerate the adoption ballistic of .NAME after the Sunrise Period.

Acceleration of adoption

GNR will ensure that there is a publicity and registration adoption campaign prior to launch in order to:

Generate public awareness in .NAME

To ensure a positive and well informed press

Ensure distribution channels are in place

The price of domain name registrations will have to reflect this sunk cost in marketing prior to launch.

Access to an individual's personal name

It is recognized that to achieve GNR's global aspiration of, A .NAME for everyone, pricing in the medium and long-term must be acceptable to the general online population.

Global Name Registry's profit objectives

In order to ensure stable management of the registry, it is considered necessary for GNR to have a fair profit margin of 20% in the latter years.

D13.2.4.4 CHANNEL STRATEGY

The Channel Environment

The expansion of the registrar market since 1999 has created in a very short time a highly competitive market both between domain suffixes and between registrars.

The development of strong and vibrant channels not only promotes healthy competition, but also represents the most effective way for GNR to generate. NAME awareness and market share most effectively.

The number of registrars has grown quickly from 1 in 1999 to 119 as of 2000. We believe the number will certainly grow further as demand for domains in countries such as France and China increase .

As the market matures and competition increases, we are beginning to see segmentation both in their user bases, their business models and their channel strategies. For example, BulkRegister.com is targeting intermediaries with its wholesale strategy while Register.com and Network Solutions are targeting mainly businesses through a network of partners and affiliates.

The balance of power in the channel resides in a few operators based in the US and Europe. Between them Network Solutions, Register.com, and Bulk Register represent over 60% share for all domain registrations in Q2 2000. All three operate large partner and affiliate programmes. Network Solutions registers domain names through 240 companies in over 30 countries in its Premier Program, and over 41,000 companies in its Affiliate Program. And now thanks to its sale to Verisign it has access to 3,500 ISPs and ASPs and 25 international affiliates.

Affiliate and partner networks will become increasingly important for propagating .NAME through the Internet to consumers. As an example, Register.com believe that at a minimum, 15% of their business in the next year will come through affiliate programmes.

Benefits of focusing the marketing via the Registrar channel

The benefits of a channel approach are these:

1. Registrars and affiliates are already aggressively growing the market with large marketing campaigns. For example, Register.com plans to spend $70 million in fiscal 2000.

2. Registrars are already developing compelling offers and services to niche segments which is driving uptake and accessibility e.g. email forwarding, diary management and web page creation.

3. Registrars already have large international networks of partnerships and affiliates though which they run co-marketing programmes

4. It is in the interests of the channel to develop new routes to customers (e.g. The Postal Services) and to seed new platforms (e.g. G3 wireless and Interactive Televisions).

Types of channel

There are different types of channel through which GNR is able to get to market.

1. Existing registrars

Such as Register.com who provide technology, registration services and both branded and unbranded (white label) marketing services to their resellers and end user communities directly. These may be sub-segmented by their Geography and segments they target. Above and beyond registry services GNR would seek to enter into some sort of formal relationships with the 10 largest to ensure that .NAME received adequate share of mind.

2. Resellers and affiliates

who do not have registrar status and use the Registrars to fulfil the demand they generate. These are typically smaller companies or individuals who can deliver 10's or hundreds of referrals per month in exchange for a 'referral fee'. Over time these will generate a large proportion of the sales of .NAME simply because they are closer to the target audience ( in many cases they are the target audience.)

3. Potential registrars

such as large Portals, Infotainment sites, Women's

portals (Women.com, I Village.com), Geographical portals (Sino.com), alliances

between ISPs and Retailers (e.g. Freeserve.com, Buy.com), Corporate's with

innovative employee policies who wish to fully outsource email management (e.g.

Apple).

Potential registrars are likely to have large numbers of consumer constituents

who may or may not be currently on the Internet (e.g. cable companies),

affinity groups (such as the RNIB which has 1.2 million members in the UK and

the AARP, which is one of the largest member organisations in the USA)

4. New platforms

such as Wireless (Phone and PDA) , Bluetooth and Interactive TV which may use GNRs Personal Naming Solution as the protocol upon which to base their communications and addressing (Imagine for a moment using a mobile phone and saying phone@anthony.booth.NAME instead of a telephone number). In this case GNR would work with Registrars to form deals with companies such as Ericsson, Motorola, DoCoMo and the emergent Mobile operators across Europe and Asia.

Channel Objectives

Immediately

1. To identify and actively recruit the minimum number of channel partners necessary to create and satisfy the available demand

2. To incentivise the channel to 'push' .NAME aggressively into the market using sophisticated co-marketing techniques.

Longer term

3. To research and help new registrars in markets where there is large demand and small number of registrars

4. To investigate and help Registrars develop new platforms for the use of .NAME naming solution for their users.

D13.2.4.5 SERVICES DEVELOPMENT STRATEGY

Objectives

GNR will develop a range of services for each of the registrar segments in order to:

1. Make it easier to become a registrar (if they are not already a registrar)

2. Make it attractive for existing registrars to support .NAME and to make it easier for them to go to market. (Please see section D13.2.1)

Methodology

GNR will use a number of Service Development techniques which have been developed by The Channel Practice (WPP Group) which identify the stated needs and values of the respective segments (e.g. new and existing registrars) and match high value services against.

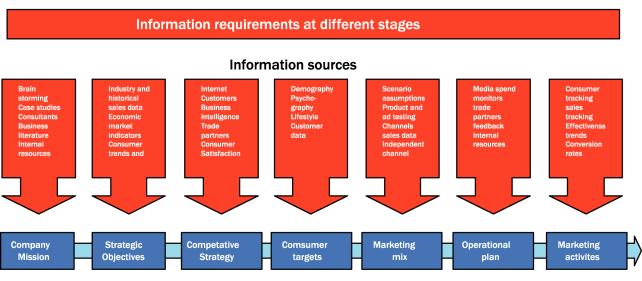

D13.2.4.6 KNOWLEDGE MANAGEMENT

In the Networked Economy, effective knowledge management and decision making processes are what separate organisations such as G.E. from the rest. The speed at which an organisation learns and deploys that learning is heightened by the fact that many organisations are operating, simultaneously, in:

Multiple geographical marketplaces with

Multiple products configured in different ways for

Multiple segments.

Understanding what information is useful and designing the process whereby it is captured, analysed and utilised is as vital as the data itself. Without such a process an organisation stands to suffer from:

Information overload (when there is too much data)

Inappropriate or underused information (when it is the wrong data)

Non-matching information (when the data is badly captured)

Lack of information authority (when it is not possible to be sure of the data provenance)

The benefits of a knowledge led approach are:

Rapid organisational learning

No loss or recreation of learning

Continual focus and alignment of the organisation with the maximum opportunities.

It will be important for GNR to manage knowledge on channels and end-customer behaviour efficiently to continually optimise the relationship between the Registry and registrars.

"In a time of drastic change it is the learners who inherit the future. The learned usually find themselves equipped to live in a world that no longer exists." - Eric Hoffer (1902 - 1983)

D13.2.4.7 COMMUNICATIONS STRATEGY

Communications Objectives

The primary objective is to ensure rapid recognition and understanding of .NAME, and to ensure that .NAME rapidly reaches one million registrations. Once a million registrations have been reached a powerful viral effect will help to sustain future growth.

To raise the spontaneous and prompted awareness of .NAME to significant level amongst Internet users (10% spontaneous, 30% prompted)

To ensure that the press have a full & positive understanding of the need and purpose of .NAME

To create a local "presence" in the target markets

The majority of marketing communications will be undertaken by the Registrars

GNR's relationship with consumers will be via the registrars. They have a direct relationship with users and affiliates. Consequently, they will monitor and react to movements in consumer taste and market demand. The registrars also have an existing database of users that have registered domains in the past, a flow of site traffic amongst users looking to register domains, and a network of affiliate sites. The largest registrars are also developing a significant off-line presence (e.g. Register.com) and are raising awareness amongst the general public not only of their web site, but also of TLDs.

GNR's role is to provide the registrars with a full marketing back-up service. This would include PR support, data transfer, market intelligence, and co-marketing money that should be used to acquire new customers. The registry would also provide .NAME branding & identity materials for online and offline campaigns to develop consumer awareness.

A global approach

The Internet is growing rapidly. The consequent geographic spread calls for a realistic and practical approach to marketing communication.

GNR will not have the resources to do tactical promotion and territory marketing. The majority of the marketing is to be undertaken by the registrars in the 10 focus markets.

Public Relations will form a major part of the plan

GNR will set up two in house PR offices, one in London (GNR HQ) and one outside Europe. It is the intention that after the launch year PR will be directed from a professional in-house team.

In the period leading up to launch and after, GNR will secure the services of a global PR consultancy to ensure that the resources are in place to roll out .NAME effectively over a very large territory.

Ogilvy PR have accepted to be a strategic marketing partner engaged for a five-month period, and to be directed out of London.

Ogilvy PR will be given the following objectives for the launch PR programme:

To co-ordinate activity over the 10 focus markets

To ensure that all relevant local press are provided with materials and news stories that are relevant to their territory

To execute successful launch events in the 10 focus markets, these will be directed primarily at local press, both news and specialist press, but also the local registrars

To provide a full briefing on Internet domains, and the objective of the release of the new TLDs, in particular the introduction of .NAME

To focus on the consumer lifestyle side of the Internet, including personal identity on the web for email,

The use of personal/family home pages, and growing ascendancy of the web over traditional mail service

To design and execute innovative launch events in the focus ten markets. These events will be attended by the senior mangers of GNR

To set up one-to-one interviews with key journalists in the focus markets to ensure quality news coverage

Advertising

Traditional media advertising is not the most effective route, due to the lack of financial resources to achieve an impact in so many international territories. Furthermore, the message is complex and is better suited to PR rather than media advertising.

Creative development process

A well-defined identity and consumer positioning for .NAME, will be essential for a clear message to be generated for the press to communicate to consumers, and for the registrars to communicate to their users and community. GNR will be undertaking the following process:

1. Developing a brief that takes in the diverse back grounds and needs of the top 10 markets;

2. Research the current trends in the domain community, and examine how .NAME is to positioned vis a vis the other new TLDs;

3. Make it clear that that .NAME is exclusively reserved for personal not corporate use and will be domain for all personal communication services on the web;

4. Three integrated design agencies will be briefed and asked to pitch for this work;

5. The successful agency will then work on the project with the following outputs:

Identity for .NAME

Usage of the identity in on and off line media

Clear positioning of .NAME for press usage

A guidelines/branding resources pack for use by the registrar community

Some initial creative work is listed over the next few pages.

Brand structure

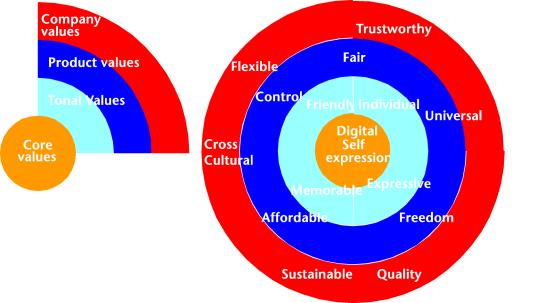

We have devised a desired brand map for GNR communications and the .NAME brand. This comprises:

Company values:

These values represent what our company stands for - emotionally and practically

They provide a reference point internally (for all of us) and externally (for are "members" and partners)

They should embody how our company wishes to be perceived

Product Values

These values are the tangible manifestations of our product/service

They describe the key functionalities and characteristics of the service

These key attributes must be borne in mind as the service is set up and developed

Tonal Values

These values will represent GNR's tone of voice

This is how you would want our members to describe the brand's personality as if it was a human being

They are the words that describe our tone in all our communications, e.g. E-mails, press releases and ads

The tonal values are a fundamental part of the design brief to the website development company, advertising and PR agencies.

Core brand essence

The final piece of the jigsaw and the foundation stone of our brand positioning the core thought that we can own in the minds of our existing customers and prospects

It should be a thought that no current competitor owns

This is the one thing that is inherently true and relevant to what we are and what our service offers

Positioning statement

This is the phrase that should be used as an internal and external statement to position .name in the marketplace and versus the competition.

Tagline

This is the line which will appear on all our external communications - it is the thought we leave all our constituents with.

Company values (for The Global Name Registry):

Trustworthy: we are an honest and reliable company; we respect our community and value their contributions; we will go to great lengths to protect their privacy

Sustainable: we have an experienced management team who are seeking to build a lasting company of value. We have developed a long-term vision and set of goals; we are not short-term or opportunistic

Cross-cultural: we are creating a global company, consisting of like-minded people from a wide range of countries and cultures.

Flexible: we are responsive to the needs of our constituents in particularly the Registrars.

Quality: we will deliver a quality service for Registrars at a fair price.

Product values (for .NAME):

Freedom: a .NAME domain name gives you the freedom to express yourself free from commercial connotations.

Control: a .NAME domain name puts you in control of how you choose to get in touch.

Fair: unlike .COM, .NAME is only for individuals

For life: You can own your own .NAME for as long as you choose.

Affordable: For much less than you would pay to have access to a telephone you can own your own personal digital identity.

Tonal values (for .NAME)

Friendly: .NAMEs are easy, and friendly - in fact they just "are"

Expressive: They express "youness" - your self and your identity

Memorable: A .NAME is the easiest way to be remembered - not like some of the URLs people use !

Individual: Like you , a .NAME is unique.

Core brand essence

"digital

self expression"

Positioning statement

".NAME is my identity on the internet. It allows me to choose how I am represented in a digital world."

Tag line

" A .NAME for everyone"

Brand expression

Promotional strategy

It is the intention for the active promotion, and selling of .NAME to be driven by the registrars. The registrars have the transactional relationship with the user, and they will have the most effective approach to local promotion their local market.

Business development funds (Channel Co-Marketing Programme)

In order to ensure that there is effective promotion and awareness of .NAME, GNR will create and manage a co-operative business development fund. It will have the following objectives:

1. To reduce the time it takes to get 1 million registrations from 18 to 9 months in order to give .NAME the largest possible head start

2. To equitably distribute marketing funds to those companies best placed to spend them most effectively (i.e. the most successful Registrars) to generate demand while not requiring significant upfront capital from GNR

3. To be seen to be rewarding and promoting innovative, successful marketing of the Registrars

4. To incentivise Registrars to focus resources on promoting the .NAME product

5. To drive awareness of the .NAME brand by making a stipulation of receipt of funds that the .NAME brand be prominent (i.e. such as Intel Inside, Oracle etc.)

This will operate in the following manner:

The base price for .NAME will be set at $5 for the initial period.

In order to manage demand, and ensure a substantial promotion budget is generated, GNR proposes the following co-marketing charging framework (see the figure below).

Total co-marketing fund generated $ 4,075,000

This fund will then be spent by the registrars in their territories on advertising and promoting .NAME both on and offline.

The registrars will then be able to claim the marketing cash back based on the number of registrations and compliance with the GNR promotional agreement.

The GNR promotional agreement will clearly state the guidelines as to how the money is to be spent. This will include: using the .NAME identity, spending the funds on off and online media (with proof), and not price reduction.

In terms of how the money is spent, that will be to the discretion of the registrars, who have a knowledge of efficient techniques in local markets.

The Co-Marketing programme

|

Registrations |

Total registrations fee $ |

Co-marketing fund |

|

100,000 |

20 |

$1.5m |

|

200,000 |

15 |

$1m |

|

350,000 |

10 |

$0.75m |

|

500,000 |

8 |

$0.45m |

|

750,000 |

6.5 |

$0.375m |

D13.2.5 Estimated Demand For Registry Services In The New Tld

Projected total demand for registry services in the TLD, effect of projected registration fees, competition. Please provide estimates for at least 10%, 50%, and 90% confidence.

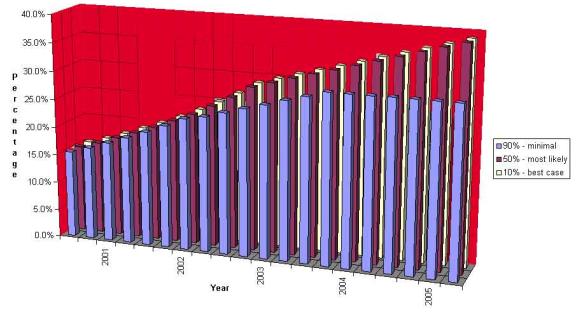

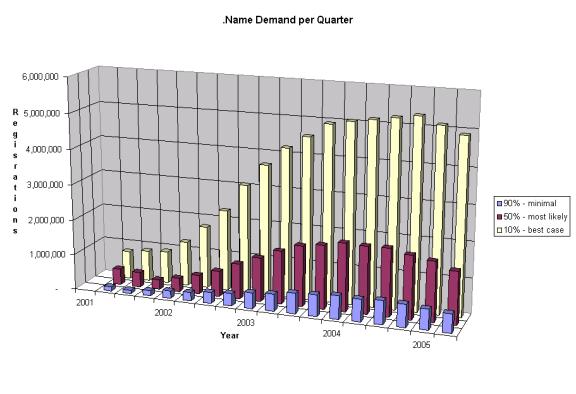

A top-down approach based on existing historical data and personal domain forecasts for .com TLD registrations have been made to estimate the demand for personal domain names up to the end of 2004. It is assumed that a proportion of these future registrations will be made under. Name. Consequently, the demand for .Name TLDs is illustrated.

D13.2.5.1 ASSUPMTIONS

Three models are presented:

A 50% (most likely) model that illustrates demand under the most likely forecast criteria