| |

|

McFadden/Holmes Report

of the Ad Hoc Group on Numbering and Addressing

(8 March 2001) |

The following report was prepared by Mark

McFadden and Tony Holmes of the Ad

Hoc Group on Numbering and Addressing. Under a 13

March 2001 resolution of the ICANN Board, it has been referred

to the Address Council of the Address Supporting Organization

for further consideration and development of recommendations.

February 2001

Version 1

1. Purpose and motivation

This document is put forward as a final

report of the ICANN Ad Hoc Group on Numbering. It reviews the

background to the formation of this group and the efforts and

progress that have been made since its formation. It also includes

other relevant inputs which have been updated since their initial

submission to the ad hoc process. It recognises the difficulties

which have been experienced as part of a factual record, in what

is an area that will continue to change as the convergence between

the traditional different worlds of fixed and mobile communications,

data networking, and computers merge in a multimedia environment.

2. Background to

the formation of the Ad Hoc Group

In the early months of 1999 proposals were

being put forward regarding the creation of the Address Supporting

Organisation (ASO) in accordance with ICANN's bylaws, which called

for its creation as one of three advisory bodies reflecting community

consensus.

One of the major goals then, and now, was

to stimulate a wider public debate on IP address policies and

to promote broad substantive participation in the policy making

process. Accepting that IP addresses are a fundamental Internet

resource without which the IP community cannot function this

was clearly a key requirement. The anticipated explosion of Internet

applications and network devices, the acceptance that 3rd Generation

mobile networks would only serve to accelerate that demand even

more, and firm plans by traditional circuit switched telecommunications

networks to provision both new and existing services over IP

based backbones added additional weight.

The MoU that formed the basis for ICANN

to form the ASO in 1999 (see

http://www.aso.icann.org/docs/aso-mou.html)

was considered unacceptable by some organisations on the basis

that it effectively limited the ability of a number of parties

to contribute, other than from afar. Whilst it was recognised

that the Regional Internet Registries 'bottom up' approach to

policy formation offered one way, some parties argued that future

demands, particularly those of a global nature, required a fresh

approach with wider, more open participation in the ASO.

Against this background and active lobbying

by a number of parties who considered they had been effectively

excluded, a number of decisions were taken by ICANN. Following

the formal ratification of the ASO MoU by ICANN a Resolution

was passed at the ICANN meeting in Santiago to establish an Ad

Hoc group, charged with the task of identifying key technology,

commercial and economic drivers that would affect addressing

and numbering in the Internet. This group was ask to identify

issues problems, risks and opportunities, although it wasn't

expected to propose, much less adopt technical solutions to them.

Current trends in services, network convergence and globalisation

was specifically referred to in the Resolution. The full text

of the Resolution can be found at:

http://www.icann.org/committees/adhoc/

3. Some difficulties

experienced

The resolution also set out the working

methods that were to be adopted. A small editorial team would

be formed to co-ordinate a dedicated web-based ICANN public comment

board. A list of those people selected by ICANN for the editorial

team and the initial timetable specified, can also be found within

the Resolution.

The make-up of the editorial team was carefully

chosen with the intention of providing a balance from parties

who held widely conflicting views at that time. Against such

a background, kick-starting the work proved very difficult. An

initial private exchange of views between the people involved

highlighted this, with one side proposing a wide ranging study

and the other claiming that most of this was 'out of scope'.

This clearly underlined the fact that there could be no co-ordinated

effort from the editorial team. The public comment forum was

then opened, requiring those wishing to post a message to register

first. The public comment forum can be found at: http://forum.icann.org/adhoc/

It soon became clear that this site was

going to be used by many people as a place where they could air

their grievances on a wide variety of topics, totally unrelated

to the focus of the Ad Hoc Group. Things quickly degenerated

to such a degree that the ICANN staff were forced to take executive

action and set up an 'Off Topic Forum', which can now be found

at http://forum.icann.org/offtopic/

4. Relevant inputs

to the process

4.1 Input Documentation

to the ad hoc web site

Two major contributions to advance the

work were submitted to the public comment forum. The first was

a Bibliography (submitted by Mark McFadden see:

http://forum.icann.org/cgi-bin/rpgmessage.cgi?adhoc;391C7F8E0000003B).

The second an input on Future Trends (submitted by Tony Holmes

see: http://www.cix.org/adhoc1.html).

Both documents called for comment and have now been updated.

The revised versions are provided in the following sections as

part of this report.

4.1.1 Current Bibliography

on Addressing Trends, Standards and Drivers

Attached as appendix

A is a bibliography on addressing trends, standards and drivers.

The bibliography was last updated in February of 2001.

4.1.2 Future trends

and driving forces - What is going on in the world?

(i) Key areas of

growth and new drivers

We are now in an environment where seamless

multimedia and information transport to all business and home

users is becoming a part of our everyday

communications requirements. Figures indicating predicted growth

appear to be updated daily and always make staggering reading.

Looking at a variety of sources the following facts are put forward

as a broad indication of the way things are moving.

- Traffic from the traditional telecommunications

world to Internet Service Providers (ISPs) is growing at a very

fast rate (in excess of 30% p.a. in many countries) and is still

increasing.

- Over 5 million US consumers used the Internet

for the first time in the first quarter, 2000.

- Almost 50% of the US population now have

Internet access.

- Overall Internet and IP based traffic

is growing at 400% a year world-wide whilst Internet revenues

have been growing at more than 100% a year compared with core

telecommunications businesses growth of 5% per annum.

- Data has been growing at more than 20%

per year compared with 8% for voice.

- Demand for Internet access is increasing

at the staggering rate of 1000% a year

- Before end of year 2000, half of all the

bandwidth in the world will be Internet traffic

There is a generally accepted concept that

the Internet world works on a different timescale to the rest

of the telecommunications world, some say that 1 Internet year

is equivalent to 10 telecommunications years. Whether this figure

is valid isn't really the issue, what is true is that in terms

of technological change the pace will be rapid.

Fixed Internet traffic stemming from services

offered by telecommunications operators and Internet Service

Providers (ISPs) will experience exponential growth. In Europe

alone the fixed Internet market has been forecast to exceed more

than EURO 60 billion by 2005.

Investment in cable technologies and DSL

will open up a new and dynamic market to businesses both small

and large, and ordinary consumers. Despite the fact that implementation

is likely to vary between countries due to early teething troubles

Local Loop Unbundling for instance), all predictions indicate

rapid growth. Web hosting facilities and the introduction of

large server farms will also fuel the rapid build out of broadband

networks with huge bandwidths. According to some analysts the

world-wide Web hosting market will rise from the current figure

of $3 billion (E2.9 billion) to $23 billion (E22.3 billion) by

2002. Networks with a capacity measured in petabytes, (which

is 1,000 terabytes) are already planned. It has been estimated

that before long we may very well end up with 30Mbit/s or more

per person, and the people that really need high-speed access

could get bandwidths an order of magnitude higher. High initial

prices for broadband will not hold back demand for long, the

trend is already upwards. As an example, take-up is expected

to exceed 100,00 Million in Europe by 2005.

There are a number of issues that could

have an impact on the speed and direction of change (certainly

in the near term), related to some specific service offerings,

such as VoIP. Customers with dedicated access to the Internet

have benefited accordingly, even though 'always on' doesn't necessarily

mean 'always works'. TCP/IP is a best-efforts protocol and depends

upon the network paths available. Providing the equivalent QoS

that customers are use to on the public switched network is still

an issue. Some hold the view that this can only be resolved by

routeing traffic over Intranets that guarantee performance and

keep unwanted traffic off their facilities. This has seen a rise

in the number of carriers looking to provide service to large

corporate clients who require this. Such considerations also

impact back on the types of IP addresses required (public or

private address space). The possible widespread deployment of

RSVP (Resource Reservation Protocol) and MPLS ( Multi Protocol

Label Switching) could help change this in the future.

There are also many new and potential applications

that have yet to make their mark in a big way, although it can

only be a matter of time. The e-commerce and entertainment sectors

are already viewed as key markets, but there are also opportunities

for business and industrial applications (such as remote learning

and electronic publishing) telematics and infomatics and of course

the home, where a variety household gadgets will also be controlled

across 'the net'.

The introduction of 'Bluetooth' technology

will enable digital devices such as mobile phones and desktop

and notebook computers to achieve instant connectivity without

using any cable connections by incorporating tiny radio receivers.

Thereby facilitating transmission of both voice and data. Software

controls and identity coding built into each microchip ensures

that only those units pre-set by their owners can communicate.

By 2002 Bluetooth functionality will be built into thousands

of different devices, supporting both point to point and multipoint

connections.

(ii) Voice over

IP

Voice over IP or IP telephony is a particular

technology for transporting and setting up voice calls over an

IP infrastructure. It is now the focus of attention in the international

standards arena (ETSI Project TIPHON being just one example)

and is already being deployed in a number of countries. The realisation

of this service owes much to technology developments, much of

which was outside of the telecommunications industry. These include

voice compression technology, processor power, and IP network

equipment. Call control functionality will no longer be embedded

within localised telephony switches, instead this functionality

can be provided by network based servers which can have global

significance, thanks to the adoption of internationally based

standards.

The growth of IP telephony is likely to

follow the trend of Internet access growth as the incremental

to provide this application on a PC is minimal. Breakout from/to

the PSTN will also occur (either near- end or far-end) so for

the foreseeable future both IP addresses and E.164 numbers (traditional

PSTN/ISDN) will also be required for voice telephony. Ultimately

current economics indicate voice telephony will migrate from

traditional PSTN networks towards international broadband multi-service

(IP based) networks. Given that multiple service providers will

be supporting IP based telephony, it is essential that current

efforts to set in place address resolution mechanisms are completed.

Carrying voice traffic over corporate IP based networks means

that only one network is required. Voice over IP will continue

to grow as ADSL based 'always on' connectivity is rolled out.

(iii) The Mobile

sector

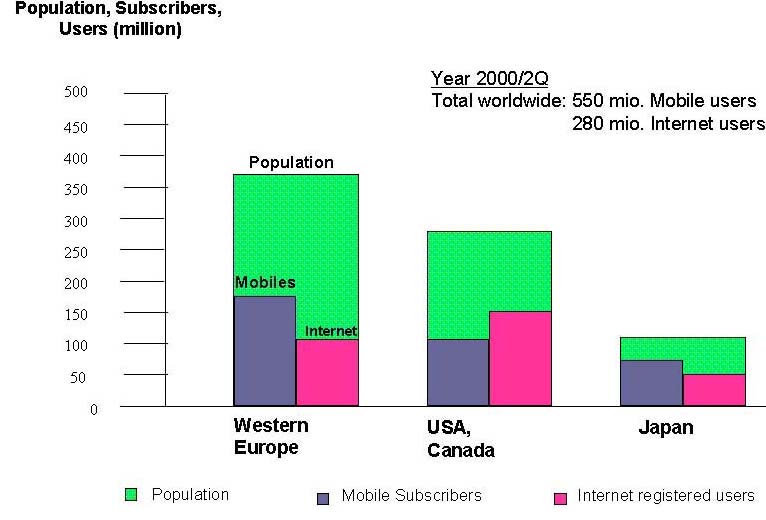

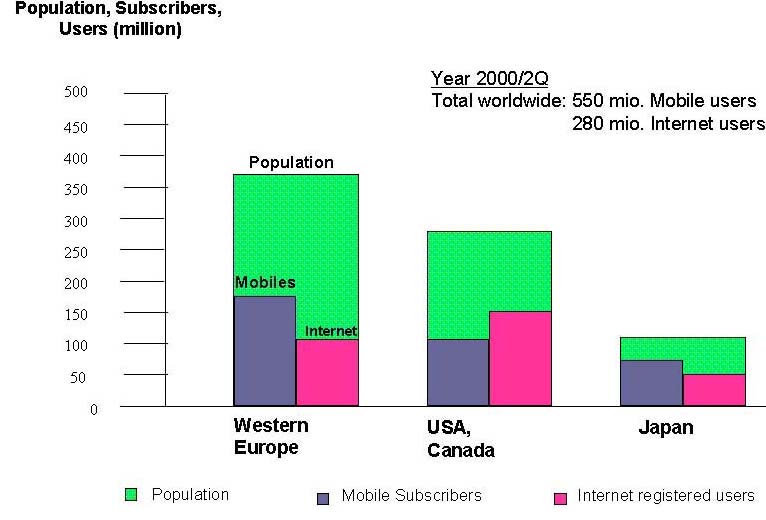

We are already experiencing huge growth

in the mobile sector.

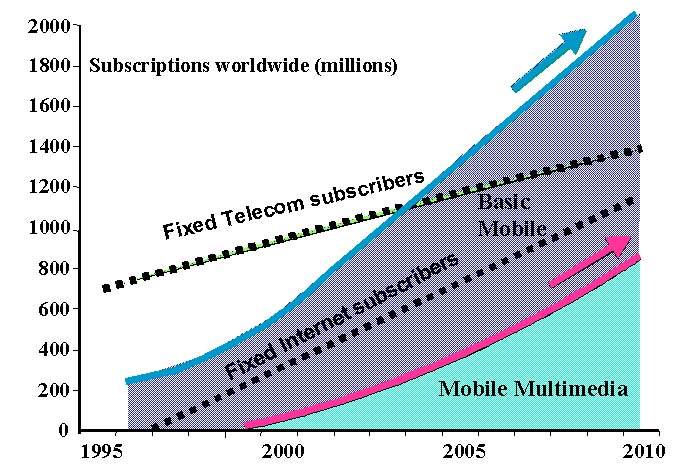

The current market size is shown in the

figure below.

(Source UMTS Forum 2000 report)

It is estimated that in excess of 78% of

Internet users also use mobile communications and that this trend

will only increases with 3rd Generation Mobile handsets that

will bring IP to the handset.

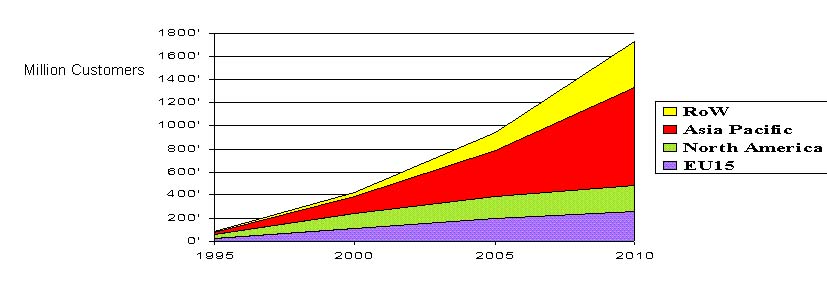

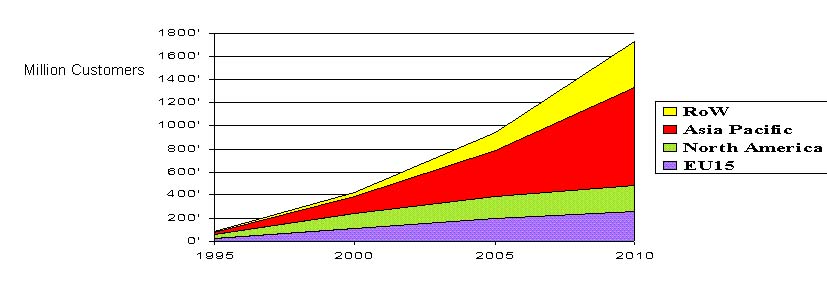

The predicted growth of the mobile market

is shown below.

When you consider that in some areas of

the world current penetration is currently very low, such as

less than 5% in the Asia Pacific region, then even these predictions

could be surpassed. The ratio of mobile to fixed is changing

rapidly and they are no longer viewed as a supplement to the

fixed networks. Many developing countries are building mobile

networks as a less expensive means of providing access, for example

Cambodia. As mobile operators amortise the build out cost of

their new networks and new licensees generate increase competition

mobile call prices are expected to fall. As voice has been the

prime service to date this will be particularly noticeable in

that market sector.

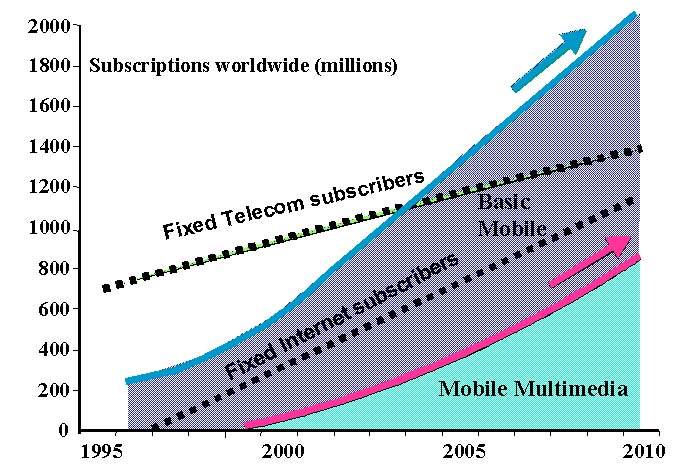

Much of the focus now is on 3rd Generation

Mobile (or UMTS). Mobile multimedia combines real-time voice,

image and textual information.

Mobile growth and Internet access

capability

Source: UMTS Forum

At the time this report was compiled the

latest survey predicted that 535 million cellular telephones

will be sold in 2001, an increase of 33 per cent over sales in

2000.

Bluetooth technology will also offer new

ways of using mobile devices both for professional and personal

use. As well as being able to access e-mail, web browsing, video

conferencing and a range of other varied services will be possible.

Users will come to expect access from their mobile terminals

to a similar range of multimedia applications that can be reached

from traditional fixed network connections. There will also be

additional benefits for the mobile user such as access to time

critical information related to stockmarket prices and on line

share dealing, traffic information, etc. Work is already underway

to provide tailored applications so that consumers will not feel

they are trying to browse the web whilst looking through a keyhole

because of the smaller screens on mobile devices. Applications

will remain a key enabler but with consumer applications likely

to grow very quickly with the introduction of WAP (Wireless Application

Protocol), coupled with existing demands for telemetry applications

such as meter readings, alarm and stock control, this area will

advance rapidly.

The provision of 'always-on' capabilities

for users will add yet another dimension along with the development

of the new services and e-commerce applications.

Merill Lynch estimates that growth in mobile

data is expected to be 70% p.a. in the next 5 years. Data traffic

will eclipse voice traffic on wireless networks by 2004. There

is also a view that multimedia data will account for up to 60%

of total mobile traffic in 2005 with more people accessing the

Internet from mobile devices as opposed to desktop by that date.

What is clear is that UMTS will facilitate

the integration of traditional mobile communications capabilities

with data information capabilities and access to the Internet

and Intranets which will fuel demand. Initiatives like 'Bluetooth'

and the rapid introduction of WAP technology, coupled with new

types of terminals and digital assistants will serve to increase

the demands on the world of IP naming and addressing.

GPRS

This trend has already started with the

introduction of GPRS (General Packet Radio Service). This is

an enhancement to the existing digital GSM voice based network.

It conveys data across the mobile network using IP packet based

switching. With its 'Always on' functionality its considered

to provide a more efficient use of network resources. It provides

higher data rates, up to 40kb/s initially although this should

more than double with time, but even the initial offering is

far higher than the existing GSM circuit switched technology

which provides 9.6 kb/s. GPRS is a stepping stone towards high

bandwidth 3rd Generation mobile networks (3G/UMTS). With its

focus on data networking and new opportunities for e-commerce

on the move, GPRS has also had to build in a range of access

control and data security measures. This is yet another area

that will demand constant attention as the new mobile market

grows.

The first GPRS Network was launched by

BT Cellnet in June 2000 enabling corporate users to access corporate

intranets. Deutsche Telekom's mobile operator T-Mobil later announced

they would be providing GPRS services in Germany by September

2000.

GPRS will evolve through several phases

Initially GPRS will provide a core network overlay of IP to the

circuit switched phase 2 GSM. This can facilitates IP access

from mobile terminals to an ISP or corporate network using tunnels.

The radio interface used ensures compatibility between mobile

networks whether they are GPRS compliant or not. With the introduction

of UMTS Release 5 (3 phases later) we will see the core migrate

to a single IP network and the addition of multimedia services

based on IP. Initial releases allow a choice of IP version 4

or IP version 6 in the PS (packet switched) domain, although

UMTS Release 5 (forecast implementation 2003/4), will specify

that IPv6 is used for the IM (IP multimedia) domain. The IM domain

can be considered as a standalone area of the network. Currently

all GPRS networks use IPv4. Basically the three factors that

could drive UMTS migration towards IPv6 are exactly the same

as those for other types of networks; additional benefits from

v6 capabilities, v4 address exhaustion or equipment standards.

3rd Generation Mobile

3G Mobile embraces a wide family of networks,

including those that are referred to as UMTS and IMT2000. As

well as providing voice these networks will facilitate high speed

data access, up to 20 times faster than current technology. On

demand bandwidth and wide multimedia functionality. Video conferencing,

video imaging, video on demand and downloading information using

3G terminals will be everyday occurrences. The greatest growth

is expected to be in the areas of content provision, terminal

manufacture and service provisioning. Areas that were traditionally

the focus of mainly ISP operators, such as those related to Internet

naming and addressing, will increasingly become a major focus

for mobile network operators and those concerned with service

provisioning. The number of players in this market place is expected

to mushroom over the next few years.

Auctions for 3G licences will remain a

focal point over the next few years as administrations identify

their preferred way of handling a heavy potential demand from

both existing and new entrants in to the mobile market. Whilst

Finland awarded licences in a 'beauty contest' the UK chose to

use the auction process, raising in excess of $35 Billion in

the process. Licence costs are now proving unpredictable in spectrum

auctions across Western Europe with prices ranging between 100

EURs and 150 EURs per capita in the early rounds. Whether regulatory

authorities choose to allocate through auctions, beauty contests

or lottery it will not stifle the race to open up this new market

sector, neither will the cost. If companies are forced to pay

large sums of money to obtain licences they will need to achieve

payback as soon as possible. This could well lead to innovative

marketing and widespread arrangements with 3rd party service

providers and other mobile networks.

Implementation of 3rd Generation Mobile

seems certain to occur first in Western Europe, North America

and Asia. Understandably the most developed countries will lead

the way. Europeans being particularly aggressive with the push

towards licence assignment. The importance with which this is

viewed is underlined by the fact that virtually all existing

operators have competed vigorously, and it most cases successfully,

for a licence in order to safeguard their ambitions for the future.

In the US it was originally thought that existing PCS networks

would evolve towards 3rd Generation technology, but this has

seen them start to fall behind the pace of change occurring elsewhere.

The table below provides some indication

of the world-wide focus on 3G licensing.

|

Country |

Licence procedure defined |

Timetable established for bids |

Licences awarded |

| Australia |

X |

X |

X |

| Austria |

X |

X |

X |

| Belgium |

X |

X |

|

| Canada |

X |

X |

|

| Denmark |

X |

X |

|

| Finland |

X |

X |

X |

| France |

X |

X |

|

| Germany |

X |

X |

X |

| Greece |

X |

X |

|

| Holland |

X |

X |

|

| Hong Kong |

X |

X |

|

| Ireland |

X |

X |

|

| Italy |

X |

X |

X |

| Japan |

X |

X |

X |

| Luxembourg |

X |

X |

|

| Netherlands |

X |

X |

X |

| New Zealand |

X |

X |

X |

| Norway |

X |

X |

|

| Portugal |

X |

X |

|

| Spain |

X |

X |

X |

| Sweden |

X |

X |

X |

| Switzerland |

X |

X |

|

| UK |

X |

X |

X |

The introduction of new players in the

guise of Mobile Virtual Network Operators (MVNOs) should also

increase growth in this sector. This concept enables new players

to enter the market without the burden of having to obtain licences

or spectrum or the additional costs this incurs. New interconnect

arrangements will enable them to negotiate for a variety of resources

which will then result in them bringing to the market place a

variety of services, without providing much of the infrastructure

required. They can adopt a business model and operate in manner

which can be sustained by the maturity of the market they choose

to operate in. They may take different roles, such as service

integrators, bundling airtime, Internet access and a variety

of different applications. Its generally considered that this

will fuel the market and generate growth in an area where start-up

costs could otherwise jeopardise benefits gained through competition.

The IMT2000 terrestrial and radio interface

specifications will further optimise performance in a wide range

of operating environments using satellites within the LEO, MEO

and GEO orbits.

(iv) e-Commerce

E-Commerce is set to revolutionise the

way we do business. Its facilitator again being the new communications

technology. All aspects of trading will be influenced, from the

ordering stage, through the supply chain and of course even the

actual transfer of money between involved parties. As technology

becomes more pervasive organisations will adapt and collaborate

within a fast emerging global e-commerce market. Existing Internet

sites such as Yahoo and Excite are merely early examples. Whilst

specialist communications tools such as EDI (Electronic Data

Interchange) has facilitated e-Commerce for many years this has

mainly provided links between large companies with established

trading relationships. The rapid introduction of highly intelligent

devices at low cost now brings this capability within reach of

all consumers with the Internet being the key as the ubiquitous

common trading mechanism. Entry costs are low and no one on the

web is more than a click away. Some research organisations estimate

that business transactions over the Internet will be in excess

of $300bn this year. World-wide acceptance of non cash trading

methods such as credit cards coupled with a readily available

global, always open, market pace (the web) will also fuel e-Commerce.

Currently growth figures for on-line purchasing

vary between regions, but much of this is dictated by PC ownership

and the take up of Internet access. On-line sales also vary greatly

between products, fast moving and convenient consumer goods (travel,

books, CDs, stocks) being at the top end. Compared to the US.

Europe and Asia still have a long way to go before credit card

penetration is comparable, but the pace of change is already

increasing. Recent surveys have indicated that e-commerce revenues

for European SMEs will soar by 800 percent, from just over EUR400

million last year to over EUR3 billion by 2003. Much of this

due to on-line selling.

Concerns over security also have to be

overcome Consumers must be confident that deals are not visible

to third parties and that authentication between communicating

parties is secure. Rapid advance in encryption techniques and

the use of cryptograph and asymmetric key systems should do much

to elevate such fears. Public key schemes provide confidentiality

by encrypting documents so that they can only be read by the

owner of a corresponding key, whilst digital signatures can facilitate

authentication and transaction integrity. Major industry players

including Mastercard and Visa are also working to develop SET

(Secure Electronic Transactions) which should provide a secure

method of paying by credit card over the Internet.

The introduction of smart cards will provide

a convenient way of providing key storage and the generation

of digital signatures, as opposed to storage on hard disks. Smart

cards have the potential to bring together a wide range of applications

in e-Commerce. Future generations enabling financial service

companies to offer a single card combining traditional credit

and debit card facilities alongside strong authentication and

an electronic purse capability. It has been estimated that up

to seven billion smart cards will be in circulation by 2004.

As well as the technical developments taking

place the other significant barriers to growth which need to

be tackled are the legal and regulatory aspects. Currently the

world of e-commerce is still getting to grips with the demands

stemming from the administrative and legislative sectors. New

frameworks are still the focus of much attention by International

trade organisations and other external bodies such as the European

Commission. Industry codes of practice are also likely to play

an ever increasing role. Already a number of governments have

announced their intention to introduce legislation making digital

signatures legally binding.

The addition of speech recognition software

in to palmtops and mobile handsets will also assist in growing

the market place. Prototypes already exist and commercially available

products will follow shortly. Intelligent content management

will also be very important, to enable consumers to navigate

through a huge amount of information and choice.

Against this background the power of the

Internet has been widely recognised. Information fuels free markets.

Consumers have already identified the ability to exploit price

disparities between countries, which will ultimately result in

price levelling, bringing clear benefits. The inevitable tide

of e-commerce will mean that today's dominant player who fails

to keep pace will be bypassed. With existing geographic constraints

being removed it is essential that the resultant growth of the

Internet, which will be spectacular, is always considered on

a global basis.

(v) Global Networks,

Intranets and VPNs

Within the telecommunications environment

a number of international carriers and ISPs are looking to serve

the need of large multi-national companies. Global alliances

and strategic partnerships are also bringing a new dimension

to the market place as a rapid build out of large global networks

takes place to meet future telecommunications needs in a ubiquitous

manner. The provision of sophisticated value add data services

being key in order to meet the demands of the e-commerce driven

market. Much of the required bandwidth will now be provided over

IP based infrastructure. Out sourcing arrangements will also

require these global companies to meet new and emerging requirements

in a consistent way, no matter what part of the globe they are

operating in. Managed global IP based VPN's will become the norm,

providing guaranteed bandwidth and performance levels. Intranets

will greatly enhance business communications, both internally

and with key business partners, providing a much more effective

way of gaining and distributing information.

(vi) Home Networking

Home networking is also viewed as a future

key growth area. Entertainment and information appliances are

rapidly increasing in the home. 'Networked' devices will increase

in places such as the kitchen, the garage and in other areas

for security and control functions. We will also see the introduction

of devices as diverse as refrigerators and TVs becoming part

of the network through residential gateways. Many devices will

share resources between them and also with the outside world,

some via high speed data connections. Today the main appliances

tend to be PC's, set top boxes, games machines and modems The

interfaces are many, but a few tend to be more ubiquitous such

as UBD (Universal Serial Bus) Ethernet and possibly IEEE1394.

Virtually all new consumer PC's and peripherals are equipped

with a USB interface, and many leading brands are providing IEEE1394

interfaces. Ethernet has been around for a long time and many

business ADSL and set top boxes have these interfaces built in.

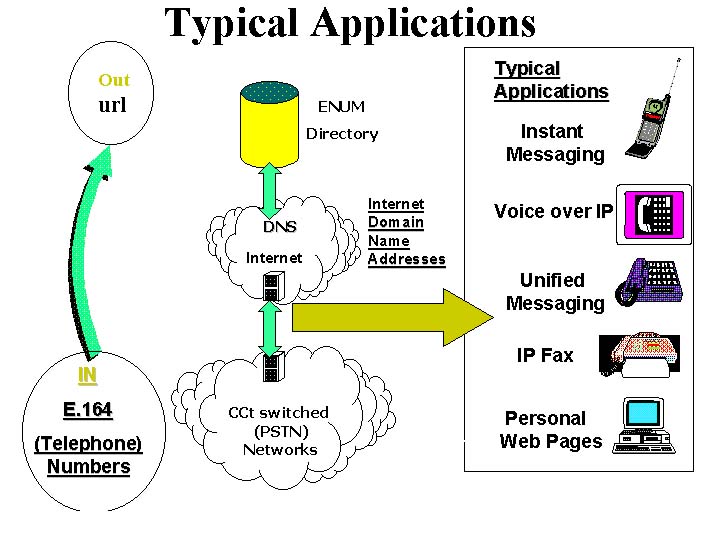

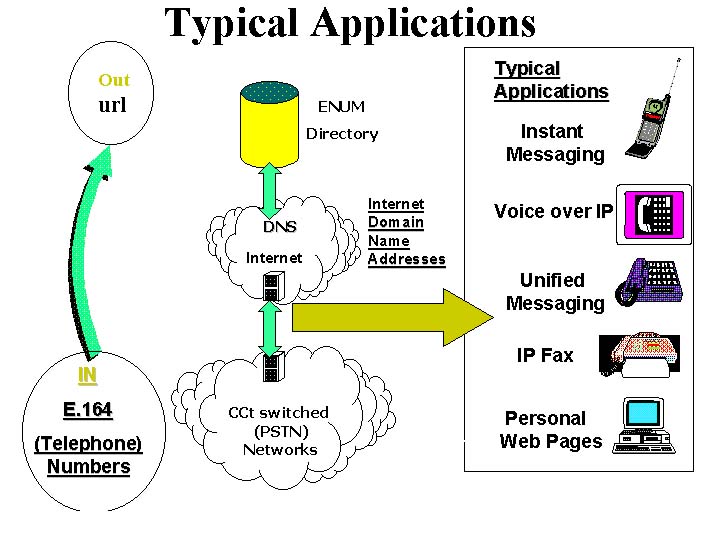

(vii) ENUM

Within the telecommunications world much

attention is currently focusing on an initiative which will enable

E.164 numbers (public telephone numbers) to be mapped into the

Internet's Domain Name System (DNS). Through this mechanism,

telephone numbers can be employed by users to look up a variety

of addresses, including those used for phone, fax and email,

by which the target user can be contacted. This also enables

end users to tailor the manner in which they be contacted through

a single E.164 number. This additional contact information can

also be easily added to or amended without changing the number

used for access. It will enable the provision of a variety of

new and emerging applications to be accessed from circuit switched

networks through the use of normal telephone numbers.

'ENUM' is the acronym that has been adopted

to describe this capability, it is also the name given to the

Internet Engineering Task Force (IETF) Working Group that defined

the protocol.

This initiative will facilitate both-way interworking between

the PSTN and Internet Protocol (IP) based networks; e.g., by

using ENUM to translate a number into a domain name and then

using this to look up a corresponding IP address to complete

the connection. It therefore provides a method of interconnection

between the traditional circuit switched world (PSTN) and the

new world of IP based networks which could help to increase the

pace of change and the move towards using IP infrastructure for

traditional telephony focused applications.

(viii) TIPHON

The European Telecommunications Standards

Institute, ETSI established TIPHON (Telecommunications and Internet

Protocol Harmonization Over Networks), to support the market

for voice communication and related voiceband communication between

users. It also aims to ensure that users connected to IP based

networks can communicate with users in Switched Circuit Networks

such as PSTN, ISDN and GSM based networks, and vice versa Given

the universal nature of IP networks, the prime goal is to produce

global standards. It is working on schemes to permit network

operators to implement guaranteed Quality of Service levels,

and new billing models. Work is also carried out to define security,

call set up and signalling standards relate to both the H.323

protocol and SIP. Networks based on TIPHON developed specifications

are due to launched in 2001.

5 Some early global

addressing requirements

5.1 GPRS Request for

IP addresses

At RIPE 35 (Amsterdam, 22 - 25 February

2000) a representative of BT Cellnet (on behalf of the GSM Association

gave the first of his presentations on "IP

Addressing for GPRS Data Network Infrastructure and International

Networks" There was considerable debate regarding the

suitability of the use of and the amount registered addresses

required, and the potential use of RFC 1918 addresses. A

number of issues and concerns were raised and it was evident

that a better understanding both the infrastructure and requirements

was required. A small task force was therefore formed. Their

main objective was gain agreement on an approach that could be

used by all GSM operators to use public registered addressing

in the GPRS infrastructure. Thereby enabling GPRS roaming services

to be supported. This met in April 2000 and the report of this

meeting can be found at http://www.ripe.net/ripe/wg/lir/gprs/index.html.

The approach agreed at this meeting was then submitted to the

LIR working group at the RIPE meeting in May 2000 as part of

the process for its approval and steering it through to adoption.

At this meeting it was acknowledged that some operators were

already in the process of configuring their GPRS networks to

support a commercial service by Q2 2000, for which globally unique

addressing was required. In order to meet this demand it was

accepted that initially any public address space already assigned

to operators for use in the GPRS infrastructure could be utilised.

At RIPE 36 (Budapest, 16 - 19 May 2000)

a follow-up

presentation was made. There was agreement

in principle to the use of IPv4 registered address space

to identify nodes in the GPRS network infrastructure. In summary

it has been agreed that

- Public IPv4 address space can be used

in parts of the GPRS network infrastructure.

- Existing IP address allocation policies

and procedures apply.

- Requests from mobile network operators

can be sent directly to the RIPE NCC or their data network backbone

providers

Address requirements for mobile devices

(handsets) are still not been finalised and work continues on

determining the needs of GPRS terminals and third generation

mobile systems. The results of the GPRS Task Force can be found

at: http://www.gsmworld.com/cgi/bounce/www.ripe.net/ripe/wg/lir/gprs/

Having gained agreement with RIPE there

was still a need to consult with the other RIRs, ARIN and APNIC.

For APNIC this happened at the APNIC Meeting

held in Brisbane, Australia (October 2000) Consensus agreement

was achieved

in principal.

The issue was raised at ARIN at their meeting

in Herndon Virginia (October 2000). No final decision was taken

on whether the use of public address space was valid, the issue

being referred to a mailing list for further discussion. Minutes

at http://www.arin.net/minutes/public/arinvi/ARIN_VI_PPM.htm

5.2 Addressing requirements

for UMTS

In December 2000 the UMTS Forum, an association

of telecommunications operators, manufacturers and regulatory

authorities, as well as IT industries and media industries world-wide,

produced a report 'Naming, Addressing & Identification Issues

for UMTS'. This initial study looked at three types of addresses,

IP, Mobile station roaming numbers and routeing prefixes for

E.164. In this document only the IP addressing issues are considered.

The report stated IPv4 address will be needed for the core network

infrastructure because it is the default protocol for UMTS Releases

3 & 4. It was also recognised that a new version of the mobile

operators internal DNS, compatible with IPv4 and IP V6 (e.g.

BIND9.X) will be required when IPv6 is used in the core networks.

The report proposed that the GSM Association should facilitate

the introduction of IPv6 by providing mechanisms for operators

to exchange information about v6 introduction and the transition

tools they will use.

The report set out the need for IP addresses

to be used for end points within the GPRS/UMTS network infrastructure,

for mobile terminals connected across the mobile networks to

ISPs and mobile terminals in multimedia services. In the absence

of any other reason to start earlier, the report states that

UMTS operators will have to start to introduce IPV6 in the IP

Multimedia domain when they start to implement services based

on Release 5 of the UMTS standards, around 2003-2004. The PS

domain for UMTS Release 5 can be either IPv4, IPv6 or dual stack.

6. IPV4 - IPv6 Evolution

IPv6 will be most apt for supporting new

mass-market IP services because of its carrier scale capabilities.

The move from IPv4 to IPv6 is most likely to occur as an evolutionary

path, which is likely to pick up pace as the amount of available

IPv4 address space reduces. Such a transition is not a trivial

exercise. A number of studies have been conducted trying to predict

when IPv4 address exhaustion will occur. Various methods have

been utilised, but there is no single 'correct' method of predicting

such an event when there are so many variables to be taken into

account. The continued growth of the Internet and IP address

usage such as that set out in Section 4 of this document makes

any assessment a moving target. On that basis predictions based

on two separate approaches are put forward for consideration.

6.1 How much IPv4

address space is left?

The starting point for any assessment has

to be an assessment of how much address space is still available.

Data used in this report may be found at the IANA Website at

http://www.isi.edu/in-notes/iana/assignments/ipv4-address-space

The total IPv4 address range is 000/8 through

to 255/8. The current list of non-usable Internet address space

(special use prefixes) given below, is taken from "Documenting

Special Use IPv4 Address Blocks that have been registered with

IANA" - by Bill Manning.

- 0.0.0.0/8

- 10.0.0.0/8

- 127.0.0.0/8

- 169.254.0.0/16

- 172.16.0.0/12

- 192.0.2/24

- 192.168.0.0/16

- all D/E space i.e.224/8 through to 239/8.

The remaining address space is assumed

to be usable.

6.2 IPv4 Address Space

currently allocated to the RIRs

- RIPE has 7 x /8's (62, 193, 194, 195,

212, 213, 217)

- ARIN has13 x /8's ( 63, 64, 65, 66, 199,

200, 204, 205, 206, 207, 208, 209, 216)

- APNIC has 6 x /8's (61, 202, 203, 210,

211, 218)

IANA still has many address blocks reserved

and available for allocation to RIRs, namely:

1, 2, 5, 7, 23, 27, 31, 36, 37, 39, 41,

42, 49, 50, 58, 59, 60, 67-95, 96-126, 197, 201, 219-223, i.e.

84 /8s. In addition to this, the former "Class B" space

is completely free from 173/8 to 191/8, i.e. 19 /8s. This makes

a total of 103 /8s available for allocation to the RIRs.

6.3 Assessment method

1

Method 1 focuses on IP address demand based

on predictions for Cellular IP devices plus DSL lines and cable

modem - it excludes NAT deployment. For best case prediction

it factors in extensive use of WAP proxy servers and DHCP, thus

reducing the demand on registered IP address space. Most likely

case scenario factors in what is considered to be the most likely

realistic deployment of proxy servers and DHCP, whereas worst

case factors in very limited but realistic deployment of proxy

servers and DHCP. DHCP gain from dynamic allocation of addresses

is factored in as 1:1 business user and 5:1 residential user.

It is important to note that both "NAT" and "no-NAT"

solutions are available to the ISPs, the extent to which each

option is deployed will vary from ISP to ISP on a global basis.

It must be appreciated that these figures reflect one just one

set of opinions and should be therefore be treated as subjective.

The H ratio not used in these calculations.

Instead of this an 80% utilisation has been built in to the original

figures i.e. the original figures have been scaled up by 25%

to give the values shown in the Tables in §4.1, §4.2,

§4.3 and §4.4 below.

Reclamation of allocated but unassigned

IPv4 address space is a possible option, but one that is considered

to be quite problematic and is thus not considered in this report,

although it would clearly extend the lifetime of IPv4 address

space.

6.3.1 Global: Cellular

IP (millions) - address demand is based on terminal demand

|

1999/2000 |

2000/2001 |

2001/2002 |

2002/2003 |

2003/2004 |

2004/2005 |

|

284

|

398

|

520

|

640

|

875

|

1,250

|

worst case

|

144

|

200

|

260

|

319

|

438

|

625

|

most likely

|

29

|

40

|

53

|

65

|

88

|

125

|

best case

|

Sources of Data

6.3.2 Global: DSL+

Cable Modems (millions) - address demand is based on line demand

|

1999/2000 |

2000/2001 |

2001/2002 |

2002/2003 |

2003/2004 |

2004/2005 |

|

22.75

|

61.38

|

127.5

|

186.3

|

230.25

|

285.6

|

worst case

|

12.5

|

31.25

|

63.75

|

93.75

|

115.0

|

143.8

|

most likely

|

2.25

|

6.123

|

12.75

|

18.625

|

23.0

|

28.5

|

best case

|

Sources of Data - various sources including

BT Market Intelligence Reports, and other forecasts for DSL +

cable modems. Industry analysts are consistently increasing significantly

their estimates of DSL deployment, as have Carriers (figures

will probably need to be revised upwards).

6.3.3 Global Address

Demand for Cellular IP Plus DSL + cable modem (millions)

|

1999/2000 |

2000/2001 |

2001/2002 |

2002/2003 |

2003/2004 |

2004/2005 |

|

|

306.75 |

459.4 |

647.5 |

826.3 |

1,105 |

1,536 |

worst case

|

|

156.5 |

231.25 |

324.0 |

412.75 |

553 |

769 |

most likely

|

|

31.2 |

5 46.1 |

65.75 |

83.625 |

111 |

154 |

best case

|

This table simply represents the sum of

the two previous tables

6.3.4 Global Address

Demand for Cellular IP plus DSL + cable modem ( /8s)

|

1999/2000 |

2000/2001 |

2001/2002 |

2002/2003 |

2003/2004 |

2004/2005 |

|

|

18.28 |

27.38 |

38.59 |

49.25 |

65.86 |

91.5 |

worst case

|

|

9.33 |

13.7 |

19.31 |

24.6 |

32.96 |

45.84 |

most likely

|

|

1.86 |

2.75 |

3.92 |

4.98 |

6.62 |

9.2 |

best case

|

This table represents the previous table

in units of /8 s - 80% utilisation is built in to these figures

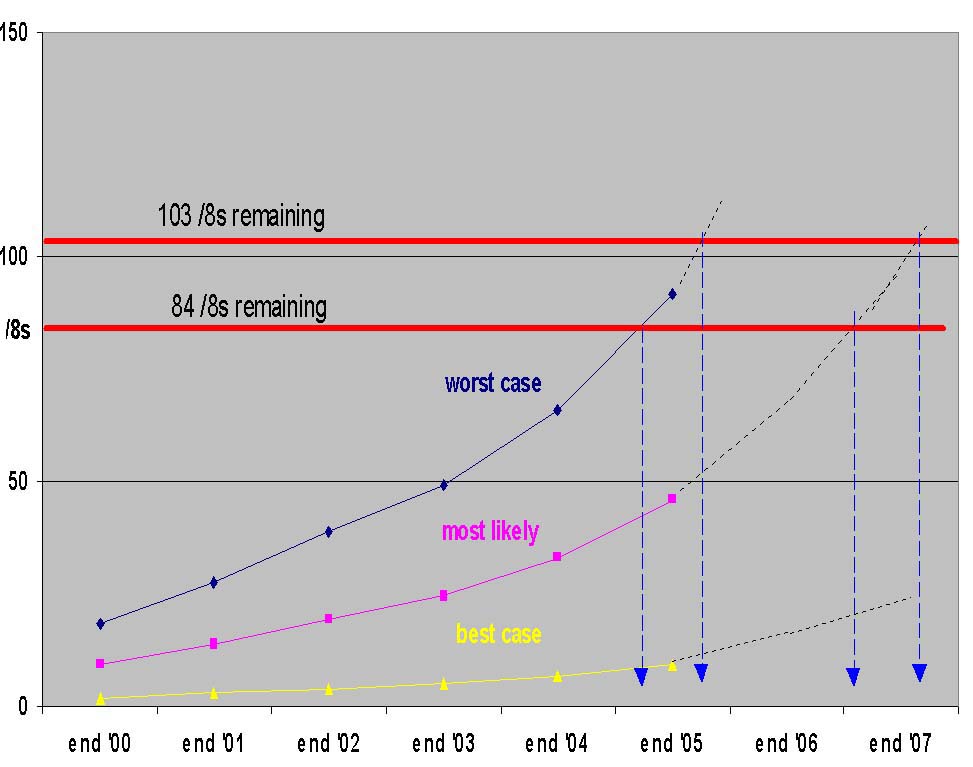

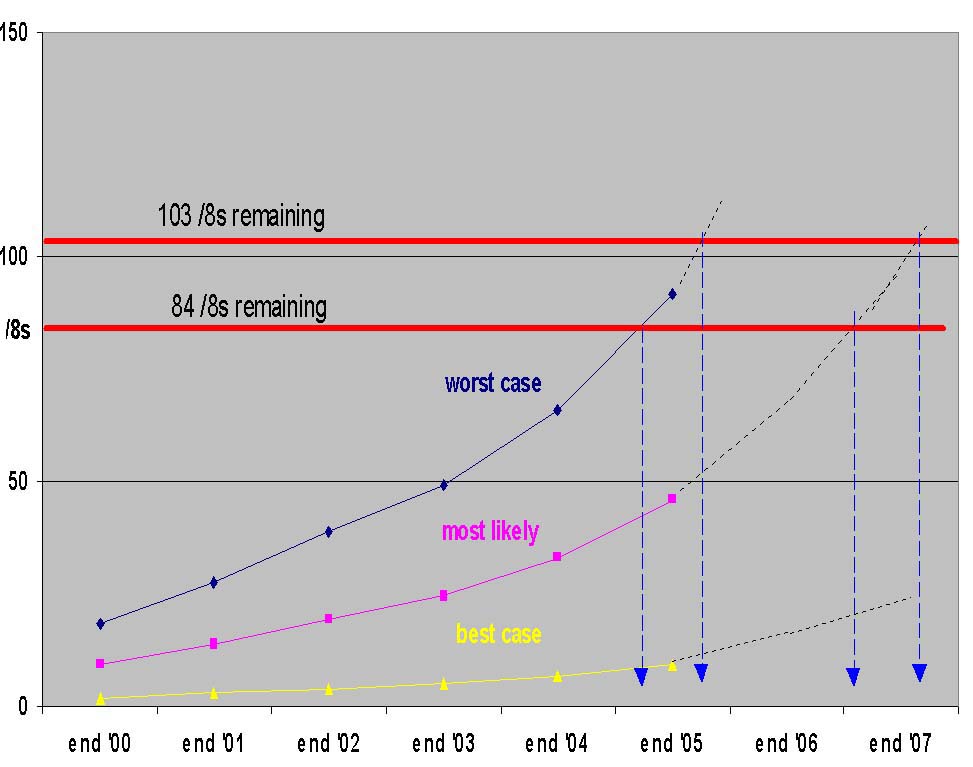

6.4 Method 1 - summary

of exhaustion dates

The following dates are illustrated in

Fig. 1 below;

Best case (late exhaustion) 2014 (for 84

x /8s) and 2017 (for 103 x /8s)

Most likely case Q3 2006 (for 84 x /8s)

and Q1 2007 (for 103 x /8s)

Worst case (early exhaustion) mid 2005

(for 84 x /8s) and mid 2006 (for 103 x /8s)

As a benchmark the current world population

is 6 x 109. IPv4 addressing range is 4 x 109 in comparison to

the IPv6 addressing range is (4 x 109) x (4 x 109) x (4 x 109)

x (4 x 109).

Fig 1 - Global demand for Cellular

and ADSL/Cable modem - exhaustion dates (best case, most likely,

and worst case)

Fig 1 - Global demand for Cellular

and ADSL/Cable modem - exhaustion dates (best case, most likely,

and worst case)

6.5 Assessment method

2

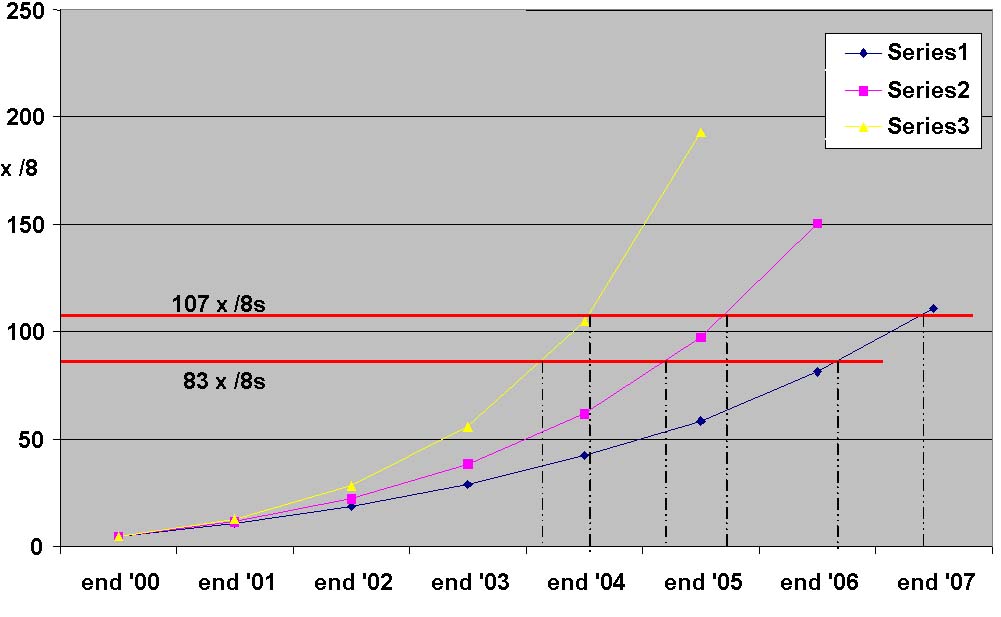

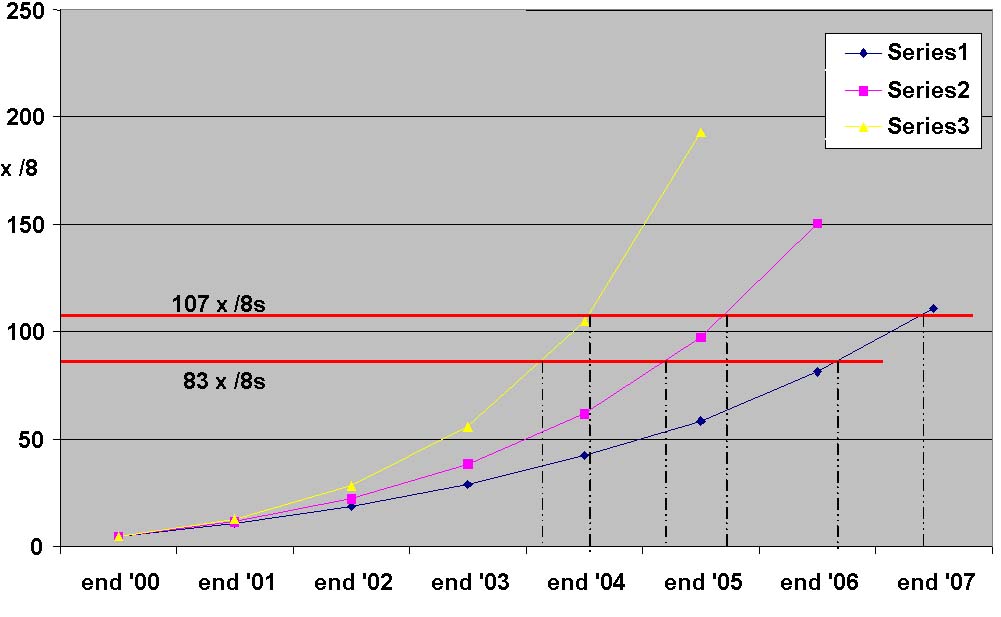

Method 2 is a completely different approach

that focuses on the current rate of global allocation of IPv4

registered address space, and makes clearly stated assumptions

about predicted global rates of allocation. It is independent

of whether private addressing is used and does not factor in

NATs, proxy servers or DHCP. This method simply considers the

rate of consumption of the remaining "/8" address blocks,

with no assumptions regarding which market sectors are creating

the demand or consuming the address space. This method is based

on the current rate of allocation of IPv4 Registered address

space globally from the three RIRs. It considers rates of 1.3,

1.5 and 1.8. global projections on various rates of allocation

of IPv4 address space from RIRs to LIRs. Future work on this

method will be based on historical data and compound growth rate

over previous years rather than just the % increase on the previous

year. The historical data is currently being gathered.

3 assumed rates of growth (global)

Series 1 - factor of 1.3 increase per annum year after year

Series 2 - factor of 1.5 increase per annum year after year

Series 3 - factor of 1.8 increase per annum year after year

Note

Year ending Dec 99 - global rate of increase was 1.8

Year ending Dec 00 - global rate of increase was 1.3

This method makes no assumptions regarding

which services or applications are creating the demand and consuming

the address space. This method does not factor in NATs, proxy

servers, or DHCP - it simply varies the rate of global allocation.

6.5.1 Series 1 -

Global factor of increase 1.3 per annum (year after year)

- Global rate of consumption of 4.68 /8s

per annum at end of 2000

- Two scenarios (i) 84 x /8s remaining and

(ii) 103 x /8s remaining

|

12 month time frame |

factor on previous year |

/8s consumed in this year |

running total of /8s consumed

"to date" |

|

end 00 |

1.3 |

4.68

|

4.68

|

|

end 01 |

1.3 |

6.08

|

10.76

|

|

end 02 |

1.3 |

7.91

|

18.67

|

|

end 03 |

1.3 |

10.28

|

28.96

|

|

end 04 |

1.3 |

13.37

|

42.33

|

|

end 05 |

1.3 |

17.38

|

58.70

|

|

end 06 |

1.3 |

22.59

|

81.29

|

|

end 07 |

1.3 |

29.37

|

110.67

|

6.5.2 Series 2 -

Global factor of increase 1.5 per annum (year after year)

- Global rate of consumption of 4.68 /8s

per annum at end of 2000

- Two scenarios (i) 84 x /8s remaining and

(ii) 103 x /8s remaining

|

12 month time frame |

factor on previous year |

/8s consumed in this year |

running total of /8s consumed

"to date" |

|

end 00 |

1.3 |

4.68

|

4.68

|

|

end 01 |

1.5 |

7.02

|

11.70

|

|

end 02 |

1.5 |

10.53

|

22.23

|

|

end 03 |

1.5 |

15.79

|

38.03

|

|

end 04 |

1.5 |

23.69

|

61.72

|

|

end 05 |

1.5 |

35.54

|

97.26

|

|

end 06 |

1.5 |

53.31

|

150.29

|

6.5.3 Series 3 -

Global factor of increase 1.8 per annum (year after year)

- Global rate of consumption of 4.68 /8s

per annum at end of 2000

- Two scenarios (i) 84 x /8s remaining,

and (ii) 103 x /8s remaining

|

12 month time frame |

factor on previous year |

/8s consumed in this year |

running total of /8s consumed

"to date" |

|

end 00 |

1.3 |

4.68

|

4.68

|

|

end 01 |

1.8 |

8.42

|

13.10

|

|

end 02 |

1.8 |

15.16

|

28.27

|

|

end 03 |

1.8 |

27.29

|

55.56

|

|

end 04 |

1.8 |

49.13

|

104.69

|

|

end 05 |

1.8 |

88.43

|

193.12

|

6.6 Method 2 - summary

of exhaustion dates

The following dates are illustrated in

Fig. 2 below;

Increased based on increased rate of 1.3

per annum year on year; 2006 (for 84 x /8s) and 2007 (for 103

x /8s)

Increased based on increased rate of 1.5

per annum year on year; mid 2005 (for 84 x /8s) and end 2005

(for 103 x /8s)

Increased based on increased rate of 1.8

per annum year on year; mid 2004 (for 84 x /8s) and end 2004

(for 103 x /8s)

Fig 2 - Global demand based on

assessed rates of global allocation

Fig 2 - Global demand based on

assessed rates of global allocation

6.7 Comparison of

projected exhaustion dates for each method.

|

Method 1 |

Method 2 |

|

Best

case (late exhaustion)·

- 2014 ( for 84 x /8s )

- 2017 ( for 103 x /8s )

|

Increase of 1.3 per annum year on

year

- end 2006 ( for 84 x /8s )

- mid 2007 ( for 103 x /8s )

|

|

Most likely case

- Q3 2007 ( for 84 x /8s )

- end 2007 ( for 103 x /8s )

|

Increase of 1.5 per annum year on

year

- mid 2005 ( for 84 x /8s )

- end 2005 ( for 103 x /8s )

|

|

Worst

case (early exhaust)

- Q4 2005 ( for 84 x /8s )

- Q1 2006 ( for 103 x /8s )

|

Increase of 1.8 per annum year on

year

- mid 2004 ( for 84 x /8s )

- end 2004 ( for 103 x /8s )

|

6.8 Conclusions

Two very different methods have been reviewed,

the first based on projections for terminals and lines (not addresses),

the second based on projected registered IP address allocations.

Whilst its accepted that method 1 best case is very difficult

to extrapolate, in general there is close agreement between both

sets of results in what is considered the mid-range case and

the "worst case' scenarios for both approaches. Its also

accepted that as yet there is little industry consensus on this

issue, or a killer application that alone will drive a transition

to v6 in the short term, but what cannot be denied is that demand

for address space will continue to grow. All major vendors have

stable Beta code available and equipment specifications are looking

to include v6 capabilities. Against such a background the figures

put forward above do not appear outlandish.

What is critical is that the industry works

together in a co-ordinated manner to address the outstanding

issues and to set in place policy and procedures that meets the

needs of the fast emerging global market place.

7. The ASO and its

policies

The Address Supporting Organisation (ASO),

is one of three ICANN Supporting Organisations. The purpose of

the ASO being 'to review and develop recommendations on Internet

policy and structure in relation to the system of IP addresses,

and to advise the ICANN Board on these matters'.

An archive of the ASO meetings can be found

at: http://aso.icann.org/meetings/

At the November 2000 ICANN meeting an update

on the ASO (Address Council) was presented which not only covered

the role of the AC and its make up but also included issues for

the wider addressing community. This recognised that whilst the

role of the AC was not to develop policy it should in fact oversee

and co-ordinate the policy development process facilitated by

the Regional Internet Registries. This will become even more

important once LACNIC and AfriNIC are fully operational. It was

also shown that work was underway by each or the RIRs to review

the other RIRs policy and procedure documents and to identify

differences as well as looking to address questions over the

openness of the AC. The presentation can be found at: http://aso.icann.org/meetings/other/LA2000/index.html

This presentation also identified a number

of issues that needed to be considered by the addressing community.

On that list were global v regional address policies, rapid market

changes like GPRS, questions over the emerging RIRs, IPv6 deployment

and the need to understand IPv4 address consumption. Some of

those issues have been covered to varying degrees within this

report.

The fact that market differences can lead

to different policy needs in different parts of the world was

also put forward. This is not disputed, but what does need to

be fully understood is 'why and where'. If a policy is one market

is likely to restrict development and growth in another market,

it is certainly isn't viable to promote a single global approach.

Accepting this as the 'norm' without any justification is equally

difficult.

The presentation concluded with an acknowledgement

of the activities realised in the past year under the umbrella

of the ICANN Ad Hoc group on addressing, and it was particularly

noteworthy that a specific reference was made to the members

of the Ad Hoc editorial group to take part in the regional policy

for a discussions concerning these issues.

Its also worth noting that in their presentation

to the GAC (Government Advisory Committee) at the ICANN meeting

in California (November 2000), when talking about global policy

formation, the three existing RIRs stressed the need for open

policy forums with 'final approval by the community'. It acknowledged

the need for responsive policy development that was 'fair to

all' and that co-ordination by RIRs on global policy was a prime

requirement for globalisation of the Internet, accepting that

local implementations may differ must policies must converge.

[8]. The way forward

In line with the decision made at the ICANN

meeting at Marina del Rey, California (13 to 16 November 2000)

the Ad Hoc group will be put forward for formal closure at the

ICANN meeting in Melbourne, Australia (9 to 13 March 2001), following

submission of this closure report.

Since the formation of the Ad Hoc group

the methodologies, working practices, procedures and relationships

between the RIRs, the Address Council and the Address Supporting

Organisation have become clearer. The work of the Ad Hoc group

has produced a detailed bibliography pointing to documents that

describe the intersection between addressing requirements for

IP and other technologies as well as undertaking a wide review

of future drivers and address space requirements. The Address

Council has acknowledged the need for this work as well as the

need for additional policy co-ordination and more involvement

of the wider addressing community.

When coupled with the acceptance that an

open and transparent approach is a fundamental requirement, particularly

where global address policy formation is the goal, this effort

provides a clear indication that close co-operation and involvement

of all sectors of the industry is a necessity. With the emergence

of additional Regional Internet Registries this will become even

more important.

Having completed the task set for the Ad

Hoc Group it is proposed that ICANN should continue to seek assurance,

and regularly test, that the goals set for the Address Supporting

Organisation when it was originally conceived, are fully met

within the existing arrangement.

Questions concerning the layout, construction and

functionality of this site should be

sent to webmaster@icann.org.

Page Updated 23-March-2001

(c) 2000-2001 The Internet

Corporation for Assigned Names and Numbers

All rights reserved.

|