Searching

the Web and Domain Names

1. Methodology

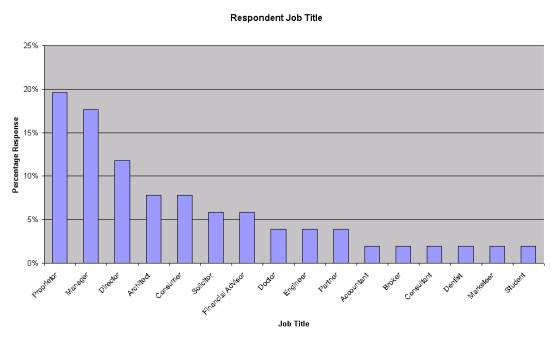

1.1 Job title of respondents

1.2 Areas of business in which respondents

operate:

|

Business |

Number of Respondents |

|

Consumers |

12 |

|

Accountants |

5 |

|

Architects |

5 |

|

Medical |

4 |

|

Engineers |

5 |

|

Financial Planners or Brokers |

5 |

|

Health Organisations and Hospitals |

4 |

|

Insurance Agents |

5 |

|

Law Firms |

3 |

|

Solicitors |

3 |

|

Other |

1 |

1.3 Company List

|

AM Services |

Deppek Consultants Ltd |

|

A. Blakeborough |

Dhanda Insurance Services |

|

A. McKain |

Fiat Spares |

|

Abwood Marine Ltd |

Financial Trade Service –

Tradex |

|

Acorn Insurance &

Financial |

General Star International |

|

Aina Khan Partnership (

Solicitors ) |

Institute of Occupational

Medicine |

|

Aintree Park Group Practice |

Local Health Council – Paisley

Scotland |

|

Alan Johnson Partnership |

Newspace Insurance Services

Ltd |

|

Alexander Douglas Moffat |

Paul Trodden |

|

Alexander Marley Gordon |

Premersey Liverpool Ltd |

|

Allcock & Grieves |

Pritchard – Jeffs & Co. |

|

Aluko Brooks |

Salhan Nijjar |

|

Andrew Finch |

Silverdale Financial Service |

|

Andrew John Pearson |

The Lanes Dental Surgery |

|

Bunday & Rogers |

The Newcastle Nuffield Hospital |

|

Bupa – Edinburgh Hospital |

The Oaks Business Centre |

|

Burdett Cleaver Partnership |

Touchstone Financial Services |

|

Clarke & Partner |

Whitelaw Wells Ltd |

|

Cripps, Harris and Hall |

Winning McSporran |

|

D & S Hartley |

|

2. Searching the Web

2.1 Finding a site for the first time

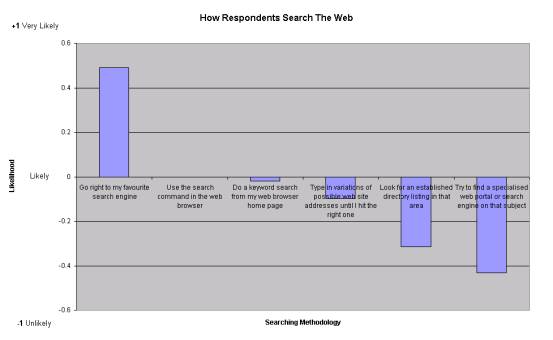

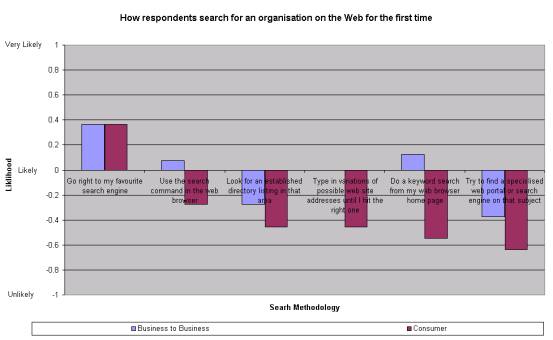

When respondents are looking for a specific person or organisation for the first time 61% are ‘very’ likely to go straight to their favourite search engine, whilst 63% are ‘unlikely’ to try to find a specialised web portal or search engine.

In the following graph ranking is applied to give an overall result for each area, it is clear that the majority will go straight to their favourite search engine.

|

|

Very Likely |

Likely |

Unlikely |

|

Do a keyword search from my web browser home

page |

35% |

27% |

37% |

|

Look for an established directory listing in

that area |

16% |

37% |

47% |

|

Type in variations of possible web site

addresses until I hit the right one |

24% |

43% |

33% |

|

Go right to my favourite search engine |

61% |

27% |

12% |

|

Use the search command in the web browser |

33% |

33% |

33% |

|

Try to find a specialised web portal or search

engine on that subject |

20% |

18% |

63% |

2.1.i Difference

in search methodology between business to business and consumer respondents.

Business-to-business and consumers are both most likely to go straight to their favourite search engines to look for a specific person or organisation. The following graph indicates that consumers are only really ‘likely’ to use their search engines to find a specific entity. Whereas, as well as going straight to their favourite search engine, business-to-business respondents are ‘likely’ to use a search command in a web browser and conduct a keyword search from their browser homepage.

The biggest difference between the two is the use of variations of addresses, which business-to-business respondents are far more likely to do than consumers – perhaps due to a greater familiarity with the workings of the Internet.

2.2 Experience

with search engines

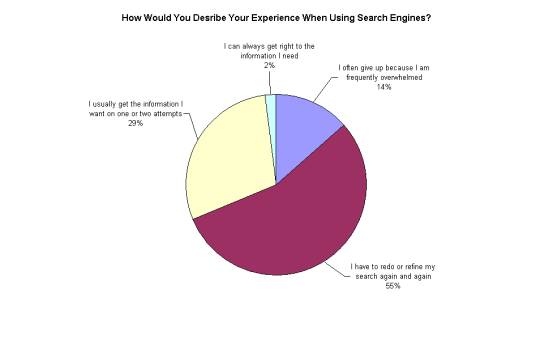

Where search engines are utilised, at present there appears to be a high level of inaccuracy, as 56% of the respondents have to complete numerous search attempts to find a specific person or organisation. Only 2% of respondents could find the correct information that they searched for. This is despite the high propensity of respondents to search using such an engine.

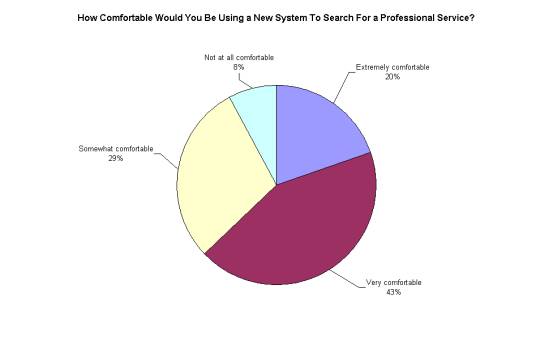

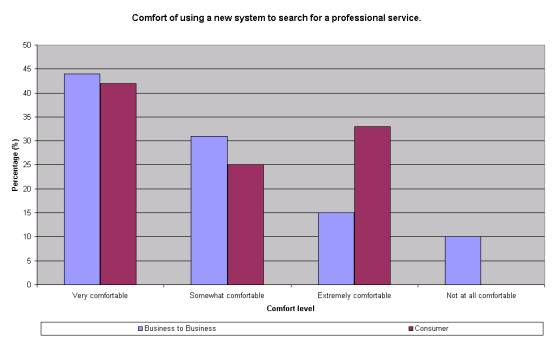

2.3 Usefulness of a system that pre-filters

websites and listings?

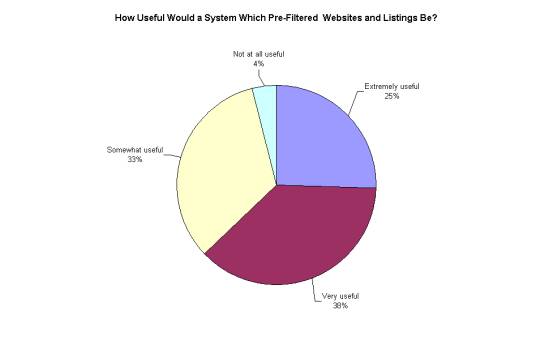

The option of a system which would pre-filter information for only certified sites proved to be a very popular idea, with 96% of the respondents believing it would be of some use. While a quarter of respondents believed it would be extremely useful. Only 4% did not see a use for such a system

3.

Domain Names

3.1 Which professional categories should be

found under .pro?

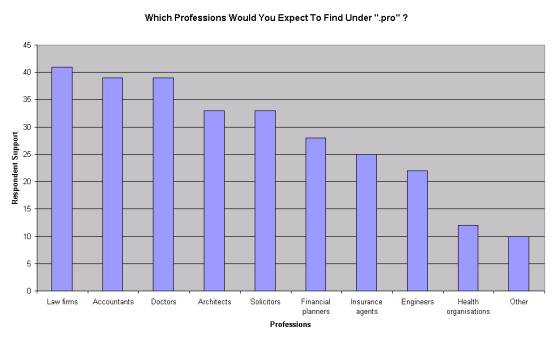

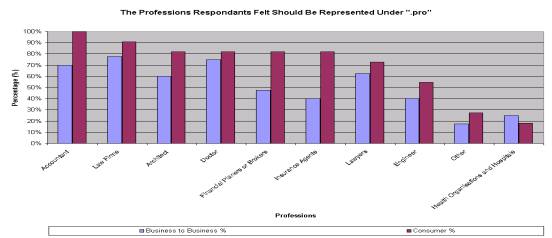

80% of the respondents felt that law firms should appear under the .pro suffix, whereas only 24% believed that health organisations and hospitals should appear in this category.

The following table and graph show which licensed professional services the respondents believe should appear under the “.pro” suffix:

|

Professional

Category |

Percentage of Respondents |

|

Law firms |

80% |

|

Accountants |

76% |

|

Doctors |

76% |

|

Architects |

65% |

|

Solicitors |

65% |

|

Financial planners |

55% |

|

Insurance agents |

49% |

|

Engineers |

43% |

|

Health organisations |

24% |

|

Other |

20% |

Verbatims:

|

|

|

|

|

The use of the word .pro aroused some amusement both among researches and respondents, ‘Don’t know, it sounds very vulgar.’ (Proprietor, Business to Business), due to its preponderance in the vernacular.[1]

3.1i The

difference between business to business and consumer responses.

3.2 The most appropriate way to

authenticate that the individual or organisation listed as .pro is licensed to

practice their profession:

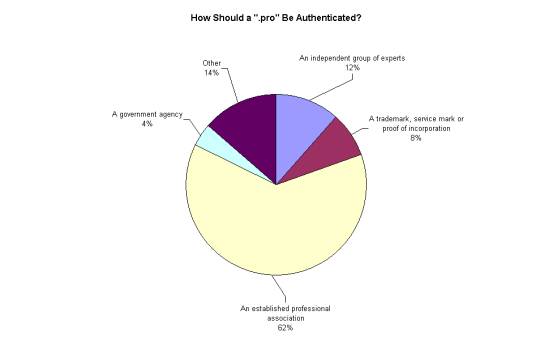

62% of respondents feel that the most appropriate method of authenticating that a .pro individual or organisation is licensed to practice their profession is if the organisation or individual is an established professional association.

Only 4% of the respondents feel that the organisation being licensed by a government agency was sufficient to authenticate that the organisation is licensed to practice their profession.

Verbatims:

|

An independent organisation. Architect, Business to

Business |

Don’t know, variable for each category IT Officer,

Business to Business |