.TEL Application

Registry Operator’s Proposal

October 2, 2000

Table of Contents

D2 Registry’s Name &

Headquarters Address

D9 Full names and positions of

Board, Officers and Management:

D10 Contacts regarding this

proposal

D13.1.2 Current Business

Operations

D13.1.3 Business History &

Intellectual Property

D13.1.4 Database and Internet

Related Experience

D13.1.8 General Liability Insurance

D13.2.1 Services to be Provided

D13.2.5. Estimated demand for

registry services for .tel.

D13.2.6. Resources required to

meet demand for .tel.

Staffing requirements: 90%

confidence scenario 2001 – 2004

Staffing requirements: 50%

confidence scenario 2001 – 2004

Staffing requirements: 10%

confidence scenario 2001 – 2004

Hardware and technology based

resources.

D13.2.7 Plans for acquiring

necessary systems and facilities

D13.2.8 Staff size/expansion capability

D13.2.9 Availability of

Additional Management Personnel

D13.2.10 Term of Registry

Agreement

D13.2.11 Expected Costs

Associated With Operation Of Registry:

D13.2.12 Expected Revenue

Associated With Proposed Registry:

D13.2.15 Registry Failure

Provisions

D13.3 PRO-FORMA FINANCIAL PROJECTIONS

D13.3.1 90% Confidence Level

Plan

D13.3.2 50% Confidence Level

Plan

D13.4 SUPPORTING DOCUMENTATION

D13.4.1 Registry Operator’s

Articles of Incorporation

D13.4.2 References (Industry and Trade)

D14

TECHNICAL CAPABILITIES AND PLAN

D15. The Technical Capabilities and Plan

D15.1 Detailed description of

Registry operator's technical capabilities

D15.2. Technical plan for the proposed registry operations.

D15.2.1. General description of

proposed facilities and systems.

D15.2.2. Registry-registrar model

and protocol.

D15.2.3. Database capabilities.

D15.2.4. Zone file generation.

D15.2.5. Zone file distribution and

publication.

D15.2.6. Billing and collection

systems.

D15.2.7. Data escrow and backup.

D15.2.8. Publicly accessible look

up/Whois service.

D15.2.12. System outage prevention.

D15.2.13. System recovery

procedures.

D15.2.14. Technical and other

support.

D1 GENERAL INFORMATION

D2 Registry’s Name & Headquarters Address

NetNumber.com, Inc ("NetNumberä")

650 Suffolk St., Suite 307

Lowell, MA 01854

D3 Other Locations

Network Facility #1:

EMC Corporation

Internet Services Group (ISG)

117 South Street

Hopkington, MA 01748

Network

Facility #2:

Exodus Communications, Inc.

175 Wyman St.

Waltham, MA 02451

D4 Type of Business Entity

NetNumber.com,

Inc. ("NetNumber") is a United States corporation organized under Delaware

Law and incorporated in August 1998.

D5 URL of Registry Operator

D6 Dun & Bradstreet Number

D-U-N-S Number: 14 - 348 - 8661

D7 Number of Employees

3 General & Administration

15 Development and 2nd

Line Operations (1st line

operations outsourced)

2 Business

Development

1 Intellectual

Property

D8 Revenue

NetNumber launched its Global Internet

Telephony Directory service in July 2000.

The NetNumber financing plan and GITDä

pricing structure call for free GITD registration through the end of 2001. Billing will begin for GITD service in

January 2002.

D9 Full names and positions of Board, Officers and Management:

Board

of Directors

Manny

Fernandez Chairman Gartner

Group.

John

Davis Former CTO of

AT&T and of Allied-Riser Communications.

John

White Former CIO Compaq

and Texas Instruments.

Roger

Nelson Former Chairman Ernst

& Young Consulting.

Joseph

Farrelly CIO of Seagram

& Co (recently acquired by Vivendi)

William

Turner Co-founder

Signature Capital.

Paul Finnigan President Emeritus, International Association For

Enhanced Voice Services (VMA). Founder VMI.

CEO of FinniganUSA.

Officers

Glenn

Marschel CEO and President

Robert H. Walter CTO, Development & Operations

Douglas J. Ranalli Founder, Chief Strategy Officer

Managers

Steve Darrington VP Finance & Administration

David P. Peek Director, Technology Strategy

Rick Turmel Director, Quality Assurance & Test

Scott Weaver Manager, Graphical User Interfaces

Chuck Santos Manager, Software Development

Alan Beaulieu Manager, Database Systems

Entities

owning five percent or more of registry operator.

Signature Capital,

LLC (www.signaturecapital.com)

Glenn Marschel, CEO and

President, NetNumber

Douglas Ranalli, Founder and Chief

Strategy Officer, NetNumber

D10 Contacts regarding this proposal

Douglas Ranalli

Founder & Strategy Officer

NetNumber

Telephone: 1.978.454.4210 ext 22

Facsimile: 1.978.454.5044

Email: dranalli@netnumber.com

Contact for: General

Application Inquiries

Robert H. Walter

CTO, VP Development and Operations

NetNumber

Telephone: 1.978.454.4210 x 24

Facsimile: 1.978.454.5044

Email: rwalter@netnumber.com

Contact for: Technical and operational

questions

Steve Darrington

VP Finance & Administration

NetNumber

Telephone: 1.978.454.4210 ext 35

Facsimile:

1.978.454.5044

Email: sdarrington@netnumber.com

Contact

for: Business plan and financial

questions

D11 Subcontractors Identified

EMC

Corporation

Internet Services Group (ISG)

117 South Street

Hopkington, MA 01748

Contact:

Brian Harnett

Senior Account Representative

617.618.3400

harnett_brian@emc.com

D13.1 BUSINESS CAPABILITIES

D13.1.1 Company Information

Corporate Structure: NetNumber.com, Inc. ("NetNumber™" or the "Company"), a Delaware corporation founded in August 1998 with headquarters located in Lowell, MA, USA is engaged in the business of providing global Internet directory services.

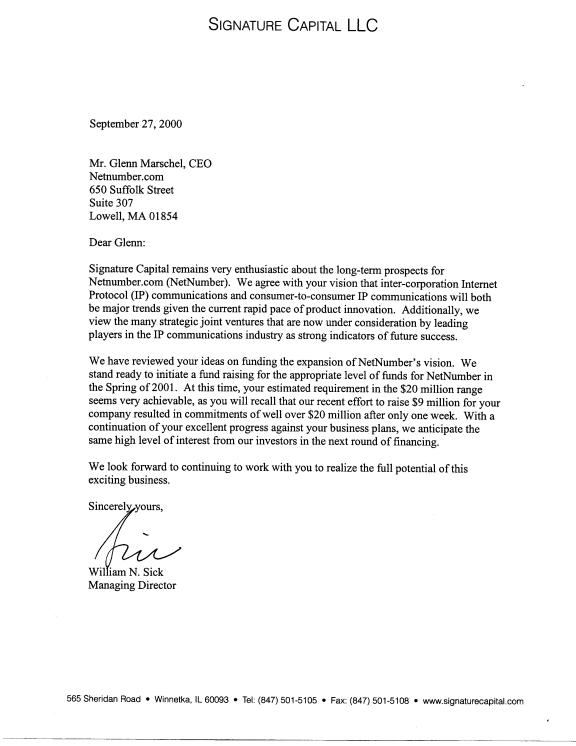

Capital Structure: NetNumber is a privately held venture capital backed corporation that has raised $9 million of equity financing and operates with the following high-level fully diluted ownership structure:

Founders 30%

Other Staff 18%

Venture Investors 42%

Strategic Alliances: NetNumber utilizes the services of several key outsourcing vendors to provide asset financing, asset hosting, Internet access/private peering, and 1st line 24x7 operations support. The Company's key strategic relationships include:

EMC Corporation (Back office, DNS & LDAP master site)

- Asset financing, hosting and on-demand data storage services.

- 24 x 7 1st line DBA and operations support staff.

- Initial assets originally deployed February 2000.

Exodus Communications (Back-up DNS & LDAP master site)

- Asset hosting and 24x7 1st line operations support.

- Private peering with multiple Tier-1 Internet backbone providers.

- Initial assets being deployed November 2000.

Level3 Communications (End-point DNS access nodes)

- Asset hosting and private peering with multiple Tier-1 Internet. backbone providers.

- 24x7 on-site operations support staff.

- Initial assets being deployed December 2000.

WorldCom Communications (End-point DNS access nodes)

- Asset hosting and private peering with multiple Tier-1 Carriers

- 24x7 on-site operations staff

- Initial assets being deployed Q1 2001.

SUN Microsystems (Network assets)

- Development and production hardware

- Architecture consulting

- Member of the SUN Start-up Essentials Program.

LSI Logic (Network assets)

- Enterprise storage systems

- Architecture consulting

For industry references please see section 13.4.2 "References" later in this document.

D13.1.2 Current Business Operations

NetNumber

currently provides two Internet directory services:

Global Internet-Telephony Directory (GITD™):

The GITD is a combination DNS and LDAP directory service that translates

telephone numbers into Internet addresses in support of all forms of

Internet-Telephony applications. The GITD is the outgrowth of a three

year technology development, intellectual property and standards body effort

launched by the NetNumber team in early 1997.

The GITD utilizes a two-tier logical control model to translate a telephone number ("e164 number") into any number of associated Internet addresses – (IP-phone, fax, e-mail, voicemail, PDA, etc.) The top-tier of the GITD was designed to operate like a top-level domain (TLD) of the Internet Domain Name System (DNS). As such, the top-tier of the GITD is a DNS-service that translates an e164 telephone number into the location or address of an appropriate second-tier directory that contains authoritative Internet address information for a given number. Just two months after the launch of service, the GITD, currently deployed under the domain "e164.com", has already begun to gain significant momentum with key Internet-Telephony technology vendors and service providers. If the ".tel" application is approved by ICANN, the GITD will become the first application to leverage the ".tel" TLD and the existing top-tier of the GITD currently operating under the domain "e164.com" will be migrated to the ".tel" TLD.

Virtual Private LDAP

Directory (VPD™): As a compliment to the GITD, NetNumber also

provides a fully

outsourced LDAP directory infrastructure that application vendors can utilize

to share directory information across distributed applications. The VPD

is a highly efficient mechanism for enterprise customers and service providers

to gain access to a secure, high-performance LDAP infrastructure without

having to build and deploy their own solution.

D13.1.3 Business History & Intellectual Property

The NetNumber team began working on Internet related directory service

opportunities in early 1997 under a technology development and intellectual

property effort launched by the team while working at Unifi Communications

("Unifi"). Unifi was an early

entrant into the fax-over-IP marketplace that began offering international fax

delivery services in 1992.

The directory services program at Unifi picked up momentum in mid-1997

when the team was asked to provide services in support of a joint industry

initiative between the Voice Mail Association (VMA) www.ivma.ch and the Electronic Messaging

Association (EMA) www.ema.org. The goal of the joint initiative was to

demonstrate that voicemail messages could be sent over the Internet between

disparate voicemail platforms using the VPIM protocol. The role of the directory service was to

translate a telephone number into the Internet address information necessary to

support the VPIM voice messaging protocol.

VPIM (Voice Profile for Internet Mail) is an IETF standard for voice

messaging on the Internet.

A key member of the NetNumber team, David Peek, was elected to the

position of Chairman of the Technical Working Group (TWG) of the joint EMA/VMA

initiative in December 1998. As

Chairman of the TWG, David coordinate the efforts of seven industry

participants including Lucent, Nortel, Comverse, Unisys, Glenayre, Alcatel and

Tecnomen in completing a series of VPIM trials, the last of which was performed

at the Telecom 99 event in Geneva.

These early industry support activities in 1997 and 1998 provided the

NetNumber team with direct experience in delivering the Internet-Telephony

directory services that represent the baseline application for the

".tel" TLD. This early work

also provided the foundation for the filing of multiple directory related

patents.

Intellectual Property : The NetNumber team has filed three comprehensive

patent applications, the first of which, dated June 1998, incorporates the

team's initial directory services work that began in early-1997. Outlined below

is a brief summary of the three applications that make up the core of the

NetNumber intellectual property position as it relates to the ".tel"

TLD. In total the three patents include

156 claims covering process concepts, application specific concepts and

implementation specific concepts relating to the use of a shared directory in

Internet-Telephony services.

METHOD AND APPARATUS FOR

CORRELATING A UNIQUE IDENTIFIER, SUCH AS A PSTN TELEPHONE NUMBER, TO AN

INTERNET ADDRESS TO ENABLE COMMUNICATIONS OVER THE INTERNET.

This patent describes the use of a shared "Directory Service" (DS) as

a mechanism for converting PSTN telephone numbers into the IP address

information necessary to establish a communications link over the Internet

between two unrelated communications platforms using standard telephone numbers

for addressing. The patent outlines over 50 claims relating to the use of a

shared directory in setting up real-time voice, voice messaging, remote

printing, and unified-messaging applications over the Internet using standard

telephone numbers for addressing. Specific attention is focused in this patent

on the implementation concepts incorporated into the directory service provided

by NetNumber including billing based on active usage rather than on

registration, and on the assignment of multiple IP-device addresses to a single

telephone number.

IDENTIFYING AND

REPLYING TO A CALLER

This patent application deals with the use of a shared directory service to

expand the role of the Internet in global voice messaging. The patent describes

the use of a shared Internet directory in enabling end-users to "reply for

free" to voicemail messages over an IP network using a shared directory to

convert a return telephone number into a reply address for an Internet enabled

voicemail, e-mail or unified-messaging system. The application includes over 50

claims covering various aspects of Internet voice messaging and directory

services.

REMOTE PRINTING OF A

DOCUMENT

This patent application deals with utilizing a shared Internet directory to

convert a telephone number into the IP address of an network enabled printer as

a mechanism for enabling a remote printing capability over the Internet.

D13.1.4 Database and Internet Related Experience

While at Unifi, the NetNumber team built a

global, secure Internet backbone infrastructure for carrying International fax

traffic for corporate customers located in the US, Japan, Hong Kong, China,

South Korea, Taiwan, Singapore, Australia, the UK, France and Germany. Unifi employed 675 people located in 10

wholly owned or majority owned country units and the Unifi IP-Fax distribution

network included 28 IP/PSTN gateway network nodes located in 16 countries.

Unifi experienced enormous revenue growth during the period 1992 – 1997

achieving a ranking of #20 on the INC 500 list of fastest growing private

companies in the US in 1997. At its

peak, Unifi was providing Fax-over-IP service on a 24x7 basis to 15,000

corporate customers located in nine countries, speaking seven different

languages.

While at Unifi, the NetNumber team gained invaluable insight into the

challenges of integrating the Internet and the PSTN at both the technical

interface level and at the addressing and customer service level. Specific experiences gained by the team

while at Unifi that will be relevant to the ".tel" TLD are as

follows:

·

Operational experience running a complex global database infrastructure

supporting multiple applications in a multi-lingual, 24x7 mission critical

environment.

·

Customer support experience running a 24x7, global, multi-lingual

customer support team providing services to 15,000 corporate clients.

The Global Internet-Telephony Directory and the ".tel" TLD

application are a direct outgrowth of the technical and operational skills

gained by the NetNumber team during the process of building the Unifi network

and service.

Deregulation of international

telecommunications brought an end to the underlying core business model for

Unifi Communications 1998. As a result,

the NetNumber team purchased a substantial base of intellectual property and

underlying technology from Unifi and launched NetNumber as a stand-alone

business with venture capital equity financing.

D13.1.5 Mission

"Turning telephone numbers into

Internet Numbers"

NetNumber's mission is

to provide secure, reliable, independent, network-based directory services to

facilitate the smooth convergence of global communications services between the

Public Switched Telephone Network (PSTN) and the emerging Internet-Telephony

industry.

D13.1.6 Management

The executive team and Board of Directors of NetNumber includes

individuals with direct experience in every aspect of the technology,

operations, customer segments, and standards bodies, associated with the

business of Internet directory services. Outlined below is background

information on the executive team and Board of Directors at NetNumber:

Manuel À Fernandez -

Director of the company

Mr. Fernandez (Manny) is presently Chairman of the GartnerGroup and a Managing

Partner of SI Ventures. GartnerGroup (www.gartner.com) is the world's largest

and most renowned IT research, advisory, measurement and consultative services

company. Manny has been Chairman of the Board of

GartnerGroup since April 1995, and director since January 1991. He also held the title of Chief Executive

Officer for GartnerGroup from April 1991 to December 1998. In fiscal 1998,

GartnerGroup revenues were approximately $650 million. Prior to GartnerGroup, Manny was President

and CEO of Dataquest, Inc., a leading IT market research and consulting firm

for suppliers of information technology and for the financial and investment

communities.

Mr. Fernandez holds a bachelor's degree in electrical engineering from

University of Florida, and completed post-graduate work in solid state

engineering at University of Florida and in business administration at the

Florida Institute of Technology.

John H. Davis -

Director of the Company:

Mr. Davis (John) is presently Chief Technology Officer and a Director of Allied

Riser Communications, Inc., Dallas, TX.

Prior to joining Allied Riser Communications John held several key

positions with Bell Labs and AT&T.

At AT&T, John was the Chief Architect and Technology Officer for

AT&T Local Services, responsible for strategic technical planning,

implementation of the network and the operations infrastructure. While at

AT&T, John also filled key roles for management of AT&T's technical

resources including Group Technical Officer for Bell Labs and AT&T

Communications Services. During the dawn of the cellular era in the early 1980's,

John was responsible for the commercialization of AT&T's cellular product

line, including the installation of the first ten commercial cellular systems

in the United States. Prior to the cellular assignment, John conceived the

architecture and managed the development of what became the No. 5 Electronic

Switching System (5ESS), presently Lucent Technologies' flagship product line.

Mr. Davis received his BS from the Georgia Institute of Technology, a Masters

degree from the Massachusetts Institute of Technology (MIT), and a Ph.D. from

the University of Pennsylvania, all in the field of electrical engineering.

Roger R. Nelson -

Director of the Company:

Mr. Nelson (Roger) recently retired as Deputy Chairman of Ernst & Young

LLP. He was responsible for the E&Y

Consulting Practice, the world's third largest management consulting practice,

with $10.9 billion in revenues in fiscal 1998, offices in 31 countries, and

more than 15,500 consultants around the world.

Roger has over 30 years of experience managing Ernst & Young's

consulting practice. Roger was a member of the Ernst & Young U.S.

Management Committee, Chairman of the U.S. Consulting Services Executive

Committee, Chairman of the U.S. Consulting Services Network, Chairman of the

Ernst & Young Global Services Council, a member of the Ernst & Young

International Executive Committee, as well as the International Council. His

expertise lies in financial planning and control, information systems,

performance measurement and general management projects for major

multinationals.

Mr. Nelson is a graduate of Northern Illinois University with a B.S. Degree in

Accounting.

John W. White -

Non-executive Chairman:

Mr. White (John) recently retired as Vice President and Chief Information

Officer for Compaq Computer Corporation. In this role, John served as a member

of the executive management team for Compaq and managed Compaq's worldwide

management information systems activities. Prior to Compaq, John had a 28-year

career with Texas Instruments where he served in various management and

technical roles, including 13 years as vice president and Chief Information

Officer and 5 years as President of the Information Technology Group. At Texas

Instruments he was responsible for the deployment of worldwide standardized management

information systems, implementation of a global voice and data network, and for

developing the Information Technology business, including the IEF CASE tool.

John also spent 4 years with Electronic Data Systems developing the EDS on-line

transaction processing system for the health care, life insurance, and banking

industries. John is currently serving on the board, advisory board, and as an

advisor for several companies including CITRIX Systems (board member), TIBCO

Software (chairman of the advisory board), ECOM Worldwide (board member),

MetaSolv Software (chairman of the board), Encentris (board member), and

eTopware (chairman of the board).

Mr. White has a B.S. in mathematics and physics from Central Missouri State

University and a M.S. in mathematics from the University of Kansas.

Paul Finnigan -

Director and industry consultant to the Company:

Mr. Finnigan is CEO of FINNIGAN USA (FUSA), a voice messaging consulting

firm. FUSA clients include major

network providers, technology vendors and companies worldwide. Paul was the Founder (1980) and former

Chairman of Voicemail International (VMI), a pioneer of the voice services

industry. VMI introduced the first voice mail and interactive voice response

services in the U.S., Europe and the Pacific Rim (1980 - 1985). VMI customers

included telephone companies, airlines, movie and television producers,

financial institutions, medical information services and many others.

Paul is the President Emeritus of the International Association for

Enhanced Voice Services (VMA) and is recognized worldwide as a visionary and

innovator of voice products and services.

Joseph Farrelly -

Director of the Company:

Mr. Farrelly (Joe) is presently Senior Vice President and Chief Information

Officer (CIO) of Joseph E. Seagram & Sons, Inc., a $20+ billion

entertainment and liquor manufacturer and marketer. From 1992 to 1998, Joe was

Executive Vice President and Chief Information Officer of Nabisco, an $8.4

billion food manufacturer. From 1988 to 1992, he was Corporate Vice President

of Information Systems Development for Automatic Data Processing (ADP), a $2.5

billion computer services company. Between 1980 and 1988, he was Vice President

of Research and Development at Applied Data Research (ADR), a software company,

where he directed the development and support services of ADR's mainframe and

personal computer software products. Joe is currently a member of the Research

Board in New York City (a leading information technology analysis company) and

participates in Gartner Group's Information Technology Executive Program.

Mr. Farrelly has a B.A. in Mathematics from Providence College, and an M.B.A.

from the University of Connecticut.

William J. Turner -

Director of the Company:

Mr. Turner

(Bill) is manager and co-founder of Signature Capital, a venture capital firm,

which raised $9 million of equity for NetNumber™ in early 2000. From 1983 to

1989, Bill served in multiple capacities, including President and COO of

Automatic Data Processing ("ADP"), a computer services firm with over

$2 billion in revenues at the time. In 1989, Bill formed Turner and Partners, a

management services firm, and had multiple leveraged buyout firms as clients,

including Forstmann Little, where he had responsibility as Executive Chairman

and/or CEO for over 30 separate business units with combined sales of over $3

billion. From 1979 to 1983 Bill was employed at the Texas Instruments Consumer

Products Division where he held several senior positions including V.P. of

Sales and Marketing as well as President. He has served on the Board of

Directors of the Federal Home Loan Mortgage Corporation (Freddie Mac-NYSE)

since 1990 and since 1996 on the board of Faroudja, Inc. (FDJA-NASDAQ). He also

serves on the Boards of several private venture capital stage companies

including Hand Technologies, Inc., McCabe & Associates, Inc., Acoustic

Technologies, Inc., VIRxSYS, Inc., and Additech, Inc.

Mr. Turner has a Business Administration Degree in mathematics from the

University of Maine and a Master of Business Administration Degree from

Northeastern University.

Glenn Marschel – CEO

and Board Member:

Glenn

brings both world-class management skills to the NetNumber team as well as

specific experience in the global communications space. Prior to joining NetNumber as CEO, Mr.

Marschel (Glenn) was Chief Executive Officer, President, and Co-Chairman of

Faroudja, Inc. (FDJA-NASDAQ), a public video processing technology

company. Prior to Faroudja, Glenn was

CEO of Paging Network Inc. (PageNet), a provider of wireless messaging services

with 9 million subscribers. Prior to

PageNet, Glenn served as Vice Chairman of First Financial Management

Corporation, a leading worldwide provider of credit card transaction

processing, healthcare claims processing and document management/imaging

services with revenues exceeding $3.0 billion. He began his business career at

CSI Computer Systems in 1970, and joined Automated Data Processing (ADP) in

1972, a $5 billion company in the information processing industry. Mr. Marschel

was employed by ADP from 1972 to 1994, and served as President of several of

ADP's largest businesses, including the Automotive and Employer Services

divisions, after holding other senior positions in sales, client services,

strategy, and marketing.

Mr. Marschel received a BS degree from the University of Missouri, and attended

the Stanford University Executive Development Program. He serves on the board

of SABRE Holdings, Inc., Travelocity and Additech, Inc.

Douglas J. Ranalli,

Founder, Chief Strategy Officer and Board Member:

NetNumber.com

is Mr. Ranalli's (Doug's) third start-up business. Doug is a seasoned leader

and entrepreneur who started his first business as an undergraduate student

while earning an Engineering degree at Cornell University. This first business

was a magazine for college students called "Student Life" that grew

to a controlled circulation of 1.2 million copies reaching a total audience of

over 4 million college students before being sold to Time, Inc. in 1987. After

selling Student Life, Doug enrolled in the Harvard MBA program where he

researched eight different business ideas before starting his second business,

Fax International (later named Unifi Communications), in the spring of 1991.

Fax International/Unifi was an international IP-Fax business that hit #20 on

the INC 500 list of fastest growing private companies in the US in 1997 before

deregulation of international telecommunications brought an end to the

company's underlying business model. Doug is the subject of multiple case studies

developed by the Harvard Business School. The HBS case study "Fax

International Japan" is currently being utilized by a variety of MBA

programs around the world and is available through HBS Publishing.

Mr. Ranalli holds degrees in Industrial Engineering (BS) from Cornell

University and an MBA from the Harvard Business School. Mr. Ranalli is also the

holder of multiple communications related patents.

Bob Walter, age 37,

CTO and Vice President, Development and Operations:

Prior to

joining NetNumber™ in November 1999, Mr. Walter (Bob) was a consultant at Cisco

Systems. Prior to consulting at Cisco, Bob was VP of Architecture and

Technology at Unifi Communications. In this capacity, Bob was responsible for

UNIFI's messaging services architecture and technology. Previously, he was the

chief architect of UNIFI's Enterprise Network Interface (ENI); a reusable

framework of Java/CORBA distributed services capturing the domain of reliable

message delivery with support for rendering, real-time status and on-line

customer registration. Prior to joining UNIFI in August of 1997, Bob was lead

architect on Pratt & Whitney Aircraft's Virtual Jet Engine program, a large

scale, object-oriented distributed system involving the simulation and optimization

of multi-dimensional jet engine propulsion systems.

Mr. Walter holds degrees in Mechanical Engineering (BSME) from the University

of Massachusetts Dartmouth, a Masters Degree in Computer Science (MCS -

Software Engineering Option) from Florida Atlantic University and a Certificate

of Graduate Studies in Software Engineering from Software Engineering Institute

of Carnegie Mellon University.

Steve Darrington, age

26, VP Finance & Administration:

Steve has thirteen years

of international finance experience including five years as corporate

controller of the Economist Newspaper in London. For the last six years Steve has held senior finance positions in

venture organizations, most recently UCT International, a biotechnology

clinical trials company, which he sold on behalf of DLJ Phoenix Venture

Partners in January 2000.

Steve attended Leicester

and Manchester Business schools gaining Bachelors and Masters degrees in

Business Administration. Steve is a

Fellow of The Association of Chartered Certified Accountants.

Dave Peek, age 36,

Director of Technology Strategy:

Mr. Peek

(David) represents NetNumber™ on multiple Internet and Telecommunications

standards bodies. David is currently representing NetNumber™ as a participant

in the Electronic Messaging Association's VPIM initiative and as Chairman of

the Voice Mail Association's (VMA) technical working group on directory

services. Prior to joining NetNumber.com, David filled the same role at Unifi

Communications. While at Unifi, David was invited to speak on multiple

occasions at voice industry conferences held by both the EMA and by CTExpo.

During the period 1993 - 1996 he was a development manager at Lernout &

Hauspie Speech Products.

Mr. Peek holds degrees a BS degree in Computer Science with a minor in Business

Administration from the University of Lowell.

Thomas Sosnowski

Ph.D., Consultant, Intellectual Property:

Prior to

joining NetNumber.com in a consulting capacity, Dr. Sosnowski (Tom) was

Executive Director at Unifi Communications responsible for Research and

Intellectual Property from 1994 - 1998. Prior to that time, Tom was the Vice

President and Director of Engineering of Unifi. Tom was the creative force

behind the design, development, and worldwide homologation of the FaxLink intelligent

routing device. Tom began his career with Bell Laboratories where he was

engaged in applied research in laser physics, optical wave-guide technology,

and telecommunications terminal and switching systems. He then held management

positions at GTE Laboratories and Eikonix before founding Sosnowski Associates

in 1986.

Dr. Sosnowski holds a BS in Engineering Science from Pennsylvania State

University, and a Ph.D. in Engineering from Case-Western Reserve University. He

is a senior member of IEEE, the author of more than 20 technical publications

and a holder of 10 patents.

D13.1.7 Staff/Employees

Current staff: The

current staff of NetNumber includes 21 people, the majority of whom are

dedicated to technology development and 2nd line technical operations

activities. In addition to the full

time staff, NetNumber leverages a large base of contract staff through its key

vendor relationships. NetNumber has

chosen to embrace the emerging model of leveraging outsourced services to

compliment a base of core full-time staff.

Outsourced services and staff are being utilized by NetNumber in the

following areas of activity:

-

Asset hosting

-

First line operations support

-

Accounting

-

Billing

-

Legal & contractual

-

Facilities management

See Section D15 "Technical Capabilities and Plan" for a

discussion of end-to-end quality control mechanisms incorporated into the

Registry plan. The current level of

full-time staff and contract staff is consistent with the operational demands

of the business at this time. However,

the ".tel" Registry business plan calls for a steady addition of

staff in 2001. Key areas of staff

expansion will be as follows:

-

Business development and marketing support

-

Customer support

Expansion capabilities:

NetNumber's headquarters facility is fully configured to support the

addition of 16 new full-time staff with no incremental asset costs or

operational costs. Additional expansion

space is available on demand in the existing physical facility and in surrounding

office buildings.

NetNumber is located in the Boston metropolitan area which is one of the

world's predominant locations for the development of Internet-Telephony

technology. Related companies operating

in the immediate area include 3Com, PingTel, Cisco, CMGI, EMC, iBasis, iperia

and Sonus networks. In addition, the

NetNumber team has direct experience with, and access to, a pool of over 350

experienced technology development and customer service staff in the Boston

area that worked at Unifi Communications.

Employee Training & Hiring Policies: NetNumber is an equal opportunity

employer. Every employee owns stock or

has stock options in the business and every employee goes through a training

program run by the top management of the business. NetNumber intends to continue the policies of 100% stock

participation and top-management lead training for the foreseeable future.

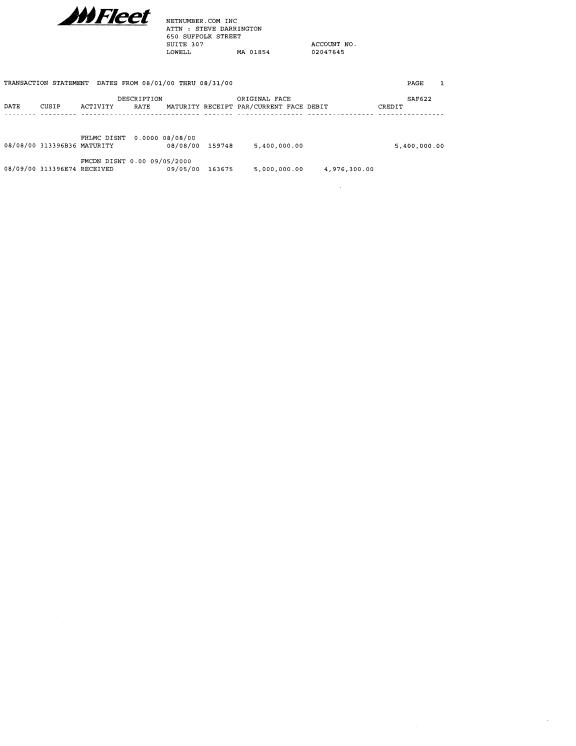

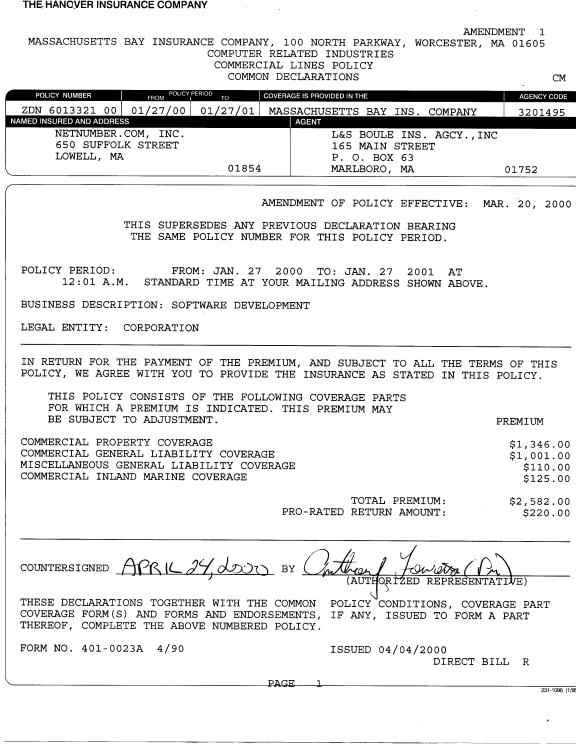

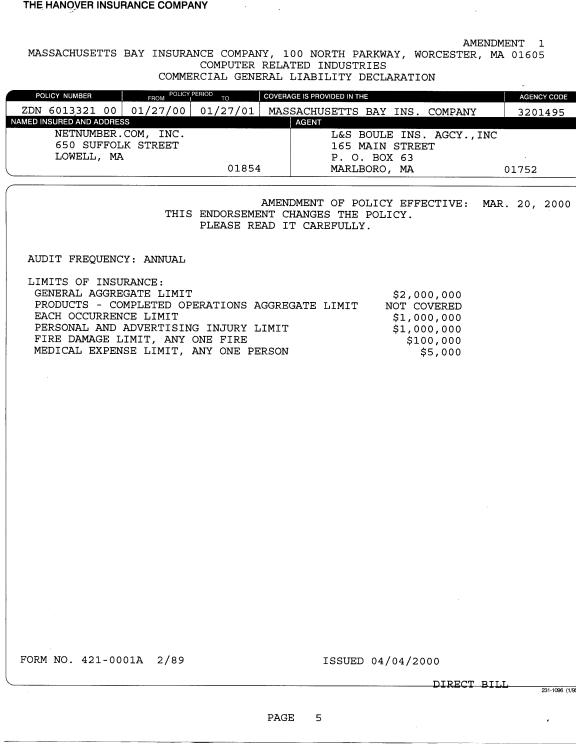

D13.1.8 General Liability Insurance

NetNumber has a current

$2 million general liability policy with the Massachusetts Bay Insurance

Company.

Massachusetts

Bay Insurance Company

100

North Parkway

Worcester,

MA 01605

NetNumber has engaged William Gallagher Associates,

the leading high-technology insurance broker in the United States to complete a

detailed insurance audit and RFP process.

Additional insurance coverage tied to the creation of the

".tel" TLD will be incorporated into the audit and RFP.

William

T. Frain, III

Vice

President

William

Gallagher Associates

200

State Street

Boston,

MA 02109

617-261-6700

D13.2 REGISTRY BUSINESS PLAN

D13.2.1 Services to be Provided

".tel" TLD: NetNumber's primary service will be the operation of the ".tel" TLD as the Registry operator. Registry services will be provided to all accredited Registrars on a non-discriminatory basis. Services included under the ".tel" Registry umbrella are as follows:

Whois Services: NetNumber will provided a common Whois database service for all ".tel" Registrars as a built-in component of the Registry service.

Update Services: NetNumber will provide a shared Registry update system and associated "Registry Update Protocol" specification for use by all ".tel" Registrars. Update services will be included in the Registry fee structure.

Conflict Resolution Tool: NetNumber will provide a shared "Conflict Resolution Tool" (CRT) for use by all ".tel" Registrars as part of the Registry service. The CRT will provide a common mechanism for identifying and resolving registration conflicts between different Registrars. The CRT service will be provided as part of the Registry function.

Conflict Resolution Center: NetNumber will provide a staff of conflict resolution service personnel to assist Registrars in resolving conflicts that are not automatically resolved via the use of the CRT. CRC staff services will be billed on an hourly basis to the Registrars involved in the conflict as per the ".tel" Conflict Resolution Policy.

Initial Registrar Services: NetNumber will operate the first accredited Registrar service for the ".tel" TLD as a tool for advancing momentum for the ".tel" TLD. However, the Company's Registrar service is not expected to be an important aspect of the NetNumber business plan so no revenue projections are being made for Registrar services at this time. NetNumber's objective is to recruit Registrars on a global basis and place primary focus on providing Registry services.

D13.2.2 Revenue Model

The NetNumber revenue model for inclusion of entries in the ".tel" TLD is a flat fee of US$6.0 or Euro 7.0 per year.

Registrars will be billed one twelfth (1/12) of the yearly fee on a monthly basis for each entry in the Registry.

D13.2.3

Market

The market for the GITD is defined by any current

e164 telephone number subscriber (individual, corporation or service provider)

who wants to register a telephone number and associated Internet addresses on

the Internet. Initial market experience

with the GITD has shown that early adopters will be individuals and

corporations investing in voice over IP technology.

Market projections

call for more than 60 million IP-voice end points by the end of 2005.

Market size data

references :

2001 2002 2003 2004 2005

Infotechtrends 1999

forecast

IP voice enterprise platform ports (000’s)* 3,700 10,800 23,300 37,308 54,862

3 Com forecast for

IP PBX Port

sales of NBX100 product (000’s)A 2,000

Probe research industry projections 1999

IP voice end users (000’s) 3,700 10,800 23,300 39,300 66,024

* Years 2004 and 2005 extrapolated from

previous years trends.

A : Internet week Jun 19, 2000 / Phillips group research) 3Com market leader in IP PBX sales.

D13.2.4. Marketing Plan

NetNumber has

defined a multi-stage marketing plan for the ".tel" TLD that is

designed to make ".tel" a piece of core infrastructure for the

emerging Internet-Telephony industry:

Stage 1: Vendor

Integration Agreements: The first

step in tying the ".tel" TLD to the growth of the industry involves

gaining agreement from technology vendors to integrate a global directory

service based on the ".tel" TLD into their IP-communications products. NetNumber started discussions with multiple

equipment vendors in the July timeframe and has already launched GITD

integration work with several key vendors.

For references regarding vendor integration activities please contact

the following:

Tom Gentles

Service Provider Group

3Com Corporation

Karim Faris

Level3 Communications

Stage 2: Industry

Education: NetNumber is actively

engaged in working with all of the key Internet-Telephony industry groups that

will be affected by the ".tel" TLD.

NetNumber is a member of the following organizations:

International Association for Enhanced Voice

Services (VMA) www.ivma.ch

Telemessaging Industry Association (TMIA) www.tmia.org

Electronic Messaging Association (EMA) www.ema.org

Softswitch Consortium www.softswitch.org

Telemanagement Forum www.tmforum.org

Stage 3: Registrar Recruitment:

The final stage of linking the ".tel" TLD to the growth of the

Internet-Telephony industry is based on bringing a large number of Registrars

into the process. The Registrar process

fits perfectly into the role played by Internet-Telephony service

providers. Examples of potential

Registrars include CLEC's (Competitive Local Exchange Carriers), Communications

ASP's (Application Service Providers) and Broadband Service Providers (DSL and

Packet-Cable).

NetNumber has engaged in

early discussions with potential Registrars from all of the customers segments

outlined above. Detailed discussions

will begin as soon as a decision is reached regarding the creation of the

".tel" TLD.

D13.2.5. Estimated demand for registry services for .tel.

NetNumber has created three demand scenarios as follows:

A. Slow

“early adopter” penetration into closed business community user groups (90%

confidence level).

B. Moderate penetration into wider

corporate community. (50% confidence level).

C. Widespread

uptake in corporate user base with initial penetration into domestic market.

(10% confidence level).

The graph below illustrates

the market projections for growth of IP-telephony end-points, (See Info-tech and Probe research trend lines

below) and three market penetration scenarios for end-point registrations

in the ".tel" Registry.

The table below

outlines NetNumber's three market penetration scenarios:

2001 2002 2003 2004

Scenario A – 90%

confidence 10% 12.5%

15% 17.5%

Scenario B – 50%

confidence 12.5% 15%

20% 25%

Scenario C – 10% confidence 15% 17.5%

25% 35%

D13.2.6. Resources required to meet demand for .tel.

The resources required to meet demand for .tel are divided into two

categories :

1.

Staff

2.

Hardware and

technology based resources

Staff resources:

The following

tables outline the planned staffing requirements under the 90%, 50% and 10%

confidence plans.

The current

NetNumber facility in Lowell, MA has capacity for 16 additional full-time staff

with no increase in asset or housing costs. The pro forma plan makes allowances

for the cost elements of additional office space when headcount grows beyond

the current space.

Staffing requirements: 90% confidence

scenario 2001 – 2004

|

NetNumber staffing plan |

|

2001 |

Q1 |

Q2 |

Q3 |

Q4 |

||

|

|

|

|

|

|

|

|

|

|

|

Staff Included in Cost of Service |

|

|

|

|

|

|||

|

Operations |

|

|

|

3 |

4 |

4 |

4 |

|

|

Service delivery |

|

|

|

3 |

4 |

4 |

4 |

|

|

|

|

|

|

|

|

|

|

|

|

Staff included in Operating Expenses |

|

|

|

|

|

|||

|

Research & Development |

|

|

9 |

9 |

9 |

9 |

||

|

Selling and Business Development |

|

5 |

6 |

6 |

6 |

|||

|

Finance & Administration |

|

|

3 |

3 |

3 |

3 |

||

|

Executive Management |

|

|

2 |

2 |

3 |

3 |

||

|

|

|

|

|

|

|

|

|

|

|

Total Staff |

|

|

|

25 |

28 |

29 |

29 |

|

|

NetNumber staffing plan |

|

2002 |

Q1 |

Q2 |

Q3 |

Q4 |

||

|

|

|

|

|

|

|

|

|

|

|

Staff Included in Cost of Service |

|

|

|

|

|

|||

|

Operations |

|

|

|

4 |

4 |

4 |

5 |

|

|

Service delivery |

|

|

|

4 |

4 |

4 |

6 |

|

|

|

|

|

|

|

|

|

|

|

|

Staff included in Operating Expenses |

|

|

|

|

|

|||

|

Research & Development |

|

|

10 |

11 |

11 |

11 |

||

|

Selling and Business Development |

|

7 |

7 |

7 |

8 |

|||

|

Finance & Administration |

|

|

4 |

4 |

4 |

4 |

||

|

Executive Management |

|

|

3 |

3 |

3 |

3 |

||

|

|

|

|

|

|

|

|

|

|

|

Total Staff |

|

|

|

32 |

33 |

33 |

37 |

|

|

NetNumber staffing plan |

|

2003 |

Q1 |

Q2 |

Q3 |

Q4 |

||

|

|

|

|

|

|

|

|

|

|

|

Staff Included in Cost of Service |

|

|

|

|

|

|||

|

Operations |

|

|

|

5 |

5 |

6 |

6 |

|

|

Service delivery |

|

|

|

6 |

7 |

8 |

9 |

|

|

|

|

|

|

|

|

|

|

|

|

Staff included in Operating Expenses |

|

|

|

|

|

|||

|

Research & Development |

|

|

13 |

13 |

15 |

15 |

||

|

Selling and Business Development |

|

8 |

8 |

8 |

8 |

|||

|

Finance & Administration |

|

|

4 |

5 |

6 |

6 |

||

|

Executive Management |

|

|

3 |

3 |

3 |

3 |

||

|

|

|

|

|

|

|

|

|

|

|

Total Staff |

|

|

|

39 |

41 |

46 |

47 |

|

|

NetNumber staffing plan |

|

2004 |

Q1 |

Q2 |

Q3 |

Q4 |

||

|

|

|

|

|

|

|

|

|

|

|

Staff Included in Cost of Service |

|

|

|

|

|

|||

|

Operations |

|

|

|

7 |

7 |

8 |

8 |

|

|

Service delivery |

|

|

|

12 |

14 |

16 |

18 |

|

|

|

|

|

|

|

|

|

|

|

|

Staff included in Operating Expenses |

|

|

|

|

|

|||

|

Research & Development |

|

|

16 |

16 |

16 |

16 |

||

|

Selling and Business Development |

|

8 |

9 |

9 |

9 |

|||

|

Finance & Administration |

|

|

6 |

7 |

7 |

8 |

||

|

Executive Management |

|

|

3 |

3 |

3 |

4 |

||

|

|

|

|

|

|

|

|

|

|

|

Total Staff |

|

|

|

52 |

56 |

59 |

63 |

|

Staffing requirements: 50% confidence scenario 2001 – 2004

|

NetNumber staffing plan |

|

2001 |

Q1 |

Q2 |

Q3 |

Q4 |

||

|

|

|

|

|

|

|

|

|

|

|

Staff Included in Cost of Service |

|

|

|

|

|

|||

|

Operations |

|

|

|

3 |

4 |

4 |

4 |

|

|

Service delivery |

|

|

|

3 |

4 |

4 |

4 |

|

|

|

|

|

|

|

|

|

|

|

|

Staff included in Operating Expenses |

|

|

|

|

|

|||

|

Research & Development |

|

|

9 |

9 |

9 |

9 |

||

|

Selling and Business Development |

|

5 |

6 |

6 |

6 |

|||

|

Finance & Administration |

|

|

3 |

3 |

3 |

3 |

||

|

Executive Management |

|

|

2 |

2 |

3 |

3 |

||

|

|

|

|

|

|

|

|

|

|

|

Total Staff |

|

|

|

25 |

28 |

29 |

29 |

|

|

NetNumber staffing plan |

|

2002 |

Q1 |

Q2 |

Q3 |

Q4 |

||

|

|

|

|

|

|

|

|

|

|

|

Staff Included in Cost of Service |

|

|

|

|

|

|||

|

Operations |

|

|

|

4 |

4 |

4 |

5 |

|

|

Service delivery |

|

|

|

4 |

4 |

4 |

6 |

|

|

|

|

|

|

|

|

|

|

|

|

Staff included in Operating Expenses |

|

|

|

|

|

|||

|

Research & Development |

|

|

10 |

11 |

11 |

11 |

||

|

Selling and Business Development |

|

7 |

7 |

7 |

8 |

|||

|

Finance & Administration |

|

|

4 |

4 |

4 |

4 |

||

|

Executive Management |

|

|

3 |

3 |

3 |

3 |

||

|

|

|

|

|

|

|

|

|

|

|

Total Staff |

|

|

|

32 |

33 |

33 |

37 |

|

|

NetNumber staffing plan |

|

2003 |

Q1 |

Q2 |

Q3 |

Q4 |

||

|

|

|

|

|

|

|

|

|

|

|

Staff Included in Cost of Service |

|

|

|

|

|

|||

|

Operations |

|

|

|

5 |

6 |

6 |

7 |

|

|

Service delivery |

|

|

|

7 |

8 |

9 |

10 |

|

|

|

|

|

|

|

|

|

|

|

|

Staff included in Operating Expenses |

|

|

|

|

|

|||

|

Research & Development |

|

|

13 |

13 |

15 |

15 |

||

|

Selling and Business Development |

|

8 |

8 |

9 |

9 |

|||

|

Finance & Administration |

|

|

5 |

6 |

7 |

8 |

||

|

Executive Management |

|

|

3 |

3 |

3 |

3 |

||

|

|

|

|

|

|

|

|

|

|

|

Total Staff |

|

|

|

41 |

44 |

49 |

52 |

|

|

NetNumber staffing plan |

|

2004 |

Q1 |

Q2 |

Q3 |

Q4 |

||

|

|

|

|

|

|

|

|

|

|

|

Staff Included in Cost of Service |

|

|

|

|

|

|||

|

Operations |

|

|

|

8 |

9 |

10 |

11 |

|

|

Service delivery |

|

|

|

12 |

14 |

18 |

20 |

|

|

|

|

|

|

|

|

|

|

|

|

Staff included in Operating Expenses |

|

|

|

|

|

|||

|

Research & Development |

|

|

16 |

16 |

16 |

16 |

||

|

Selling and Business Development |

|

9 |

10 |

11 |

12 |

|||

|

Finance & Administration |

|

|

8 |

9 |

10 |

10 |

||

|

Executive Management |

|

|

4 |

4 |

5 |

5 |

||

|

|

|

|

|

|

|

|

|

|

|

Total Staff |

|

|

|

57 |

62 |

70 |

74 |

|

Staffing requirements: 10% confidence scenario 2001 – 2004

|

NetNumber staffing plan |

|

2001 |

Q1 |

Q2 |

Q3 |

Q4 |

||

|

|

|

|

|

|

|

|

|

|

|

Staff Included in Cost of Service |

|

|

|

|

|

|||

|

Operations |

|

|

|

3 |

4 |

4 |

4 |

|

|

Service delivery |

|

|

|

3 |

4 |

4 |

4 |

|

|

|

|

|

|

|

|

|

|

|

|

Staff included in Operating Expenses |

|

|

|

|

|

|||

|

Research & Development |

|

|

9 |

9 |

9 |

9 |

||

|

Selling and Business Development |

|

5 |

6 |

6 |

6 |

|||

|

Finance & Administration |

|

|

3 |

3 |

3 |

3 |

||

|

Executive Management |

|

|

2 |

2 |

3 |

3 |

||

|

|

|

|

|

|

|

|

|

|

|

Total Staff |

|

|

|

25 |

28 |

29 |

29 |

|

|

NetNumber staffing plan |

|

2002 |

Q1 |

Q2 |

Q3 |

Q4 |

||

|

|

|

|

|

|

|

|

|

|

|

Staff Included in Cost of Service |

|

|

|

|

|

|||

|

Operations |

|

|

|

4 |

4 |

4 |

5 |

|

|

Service delivery |

|

|

|

4 |

4 |

5 |

8 |

|

|

|

|

|

|

|

|

|

|

|

|

Staff included in Operating Expenses |

|

|

|

|

|

|||

|

Research & Development |

|

|

10 |

11 |

11 |

11 |

||

|

Selling and Business Development |

|

7 |

7 |

8 |

8 |

|||

|

Finance & Administration |

|

|

4 |

4 |

5 |

5 |

||

|

Executive Management |

|

|

3 |

3 |

3 |

3 |

||

|

|

|

|

|

|

|

|

|

|

|

Total Staff |

|

|

|

32 |

33 |

36 |

40 |

|

|

NetNumber staffing plan |

|

2003 |

Q1 |

Q2 |

Q3 |

Q4 |

||

|

|

|

|

|

|

|

|

|

|

|

Staff Included in Cost of Service |

|

|

|

|

|

|||

|

Operations |

|

|

|

6 |

6 |

7 |

8 |

|

|

Service delivery |

|

|

|

8 |

9 |

10 |

12 |

|

|

|

|

|

|

|

|

|

|

|

|

Staff included in Operating Expenses |

|

|

|

|

|

|||

|

Research & Development |

|

|

13 |

13 |

15 |

15 |

||

|

Selling and Business Development |

|

8 |

8 |

9 |

10 |

|||

|

Finance & Administration |

|

|

5 |

6 |

8 |

8 |

||

|

Executive Management |

|

|

3 |

3 |

4 |

4 |

||

|

|

|

|

|

|

|

|

|

|

|

Total Staff |

|

|

|

43 |

45 |

53 |

57 |

|

|

NetNumber staffing plan |

|

2004 |

Q1 |

Q2 |

Q3 |

Q4 |

||

|

|

|

|

|

|

|

|

|

|

|

Staff Included in Cost of Service |

|

|

|

|

|

|||

|

Operations |

|

|

|

9 |

10 |

12 |

13 |

|

|

Service delivery |

|

|

|

14 |

16 |

20 |

22 |

|

|

|

|

|

|

|

|

|

|

|

|

Staff included in Operating Expenses |

|

|

|

|

|

|||

|

Research & Development |

|

|

16 |

16 |

16 |

16 |

||

|

Selling and Business Development |

|

11 |

12 |

13 |

14 |

|||

|

Finance & Administration |

|

|

8 |

9 |

9 |

10 |

||

|

Executive Management |

|

|

4 |

5 |

5 |

6 |

||

|

|

|

|

|

|

|

|

|

|

|

Total Staff |

|

|

|

62 |

68 |

75 |

81 |

|

Hardware and technology based resources.

The following tables illustrate the two main component parts (and

associated costs) of the

".tel" Registry – Master sites and Edge sites. The initial deployment of the

".tel" Registry represents the deployment of two Master sites

and four Edge sites.

As of the date of

this document, NetNumber has already deployed one fully redundant Master site

and one fully redundant Edge site. In

addition, assets for the deployment of the next Master site and the next two

Edge sites have been purchased and are currently in pre-deployment testing in

NetNumber's office. The full deployment

of two complete Master sites and four Edge sites will be finished during Q4

2000 and Q1 2001.

The physical

hardware component requirements and costs associated with the initial

".tel" Registry deployment is outlined below in detailed spreadsheet

format. Performance testing on the

currently deployed production assets indicate that the initial ".tel"

Registry asset deployment will deliver the following results using the

operating assumptions outlined below:

Queries per second: 15,840 (at

60% system utilization)

Average query size 250

bytes

Number of times

each number is queried per day 50 (positive and negative queries)

Percentage of daily

queries during peak hour 25%

Maximum system

utilization 60%

Using the above assumptions this “baseline” GITD deployment is scaled to

manage up to 2.4 million directory entries, each being queried an average of 50

times per day.

Index

of tables

A.

Consolidated

Master site cost summary

B.

Master site –

DNS Master

C.

Master site –

Back office (NNBO)

D.

Master site –

Web Systems (WEB)

E.

Master site –

Whois Systems (WHO)

F.

Master site –

Registry Update Protocol Systems (RUP)

G.

Master site –

Cost summary

H.

Slave site –

DNS Slave

I.

Slave site –

LDAP Slave

Table

A : Consolidated Master Site cost summary

|

Description |

Quantity |

Non Recurring

Unit Cost |

Annual Recurring

Unit Cost |

Non Recuring

Cost |

Recurring

Monthly Cost |

Monthly

Recurring Costs (24M) |

|

DNS Master |

1 |

|

|

$68,074 |

$186 |

$3,022 |

|

NNBO |

1 |

|

|

$204,188 |

$3,936 |

$12,443 |

|

WEB |

1 |

|

|

$121,778 |

$185 |

$5,259 |

|

WHO |

1 |

|

|

$118,778 |

$185 |

$5,134 |

|

RRP |

1 |

|

|

$118,778 |

$185 |

$5,134 |

|

Installation Fees |

1 |

$20,000 |

$0 |

$20,000 |

$0 |

$833 |

|

Storage Array |

1 |

$191,299 |

$10,175 |

$191,299 |

$10,175 |

$18,146 |

|

SAN Switches |

2 |

$5,795 |

$0 |

$11,590 |

$0 |

$483 |

|

Network Switches |

4 |

$1,500 |

$0 |

$6,000 |

$0 |

$250 |

|

Backup |

1 |

$1,995 |

$2,000 |

$1,995 |

$2,000 |

$2,083 |

|

Firewall |

2 |

$16,000 |

$7,000 |

$32,000 |

$14,000 |

$15,333 |

|

Load Balancing |

2 |

$20,995 |

|

$41,990 |

$0 |

$1,750 |

|

Monitoring Service |

1 |

$995 |

|

$995 |

$0 |

$41 |

|

Rack Space |

2 |

$1,210 |

$1,100 |

$2,420 |

$2,200 |

$2,301 |

|

Bandwidth |

2 |

$3,850 |

$8,880 |

$7,700 |

$17,760 |

$18,081 |

|

|

|

|

|

$947,585 |

$50,812 |

$90,295 |

Table

B : Master site – DNS Master

|

Description |

Quantity |

Non Recurring

Unit Cost |

Yearly Recurring

Unit Cost |

Non Recuring

Cost |

Monthly

Recurring Cost |

Monthly

Recurring Cost (24M) |

|

Hardware (see hardware detail) |

1 |

$61,444 |

$0 |

$61,444 |

$0 |

$2,560 |

|

Disk Array Storage |

|

|

|

$0 |

$0 |

$0 |

|

Veritas HA VCS |

1 |

$6,630 |

$2,229 |

$6,630 |

$186 |

$462 |

|

BIND 9 |

2 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

|

|

|

|

$68,074 |

$186 |

$3,022 |

|

DLS Hardware

Detail |

|

|

|

|

|

|

|

Description |

Quantity |

Unit Cost |

Total Cost |

|

|

|

|

Sun 420R |

1 |

$55,000 |

$55,000 |

|

|

|

|

Memory Upgrade |

0 |

$3,240 |

$0 |

|

|

|

|

Quad Fast Ethernet Cards |

2 |

$1,077 |

$2,154 |

|

|

|

|

Redundant Power Supply |

0 |

$695 |

$0 |

|

|

|

|

JNI Fibre Cards |

2 |

$1,995 |

$3,990 |

|

|

|

|

Fibre Cables |

2 |

$150 |

$300 |

|

|

|

|

|

|

|

$61,444 |

|

|

|

Table C : Master site – Back office (NNBO)

|

|

||||||

|

Description |

Quantity |

Non Recurring

Unit Cost |

Yearly Recurring

Unit Cost |

Non Recuring

Cost |

Monthly

Recurring Cost |

Monthly

Recurring Cost (24M) |

|

Hardware |

2 |

$61,444 |

$0 |

$122,888 |

$0 |

$5,120 |

|

Disk Array Storage |

|

|

|

$0 |

$0 |

$0 |

|

Veritas HA VCS |

2 |

$6,630 |

$2,229 |

$13,260 |

$372 |

$924 |

|

Oracle Enterprise Edition - 180 units |

1 |

$68,040 |

$42,768 |

$68,040 |

$3,564 |

$6,399 |

|

|

|

|

|

$204,188 |

$3,936 |

$12,443 |

|

Hardware Detail |

|

|

|

|

|

|

|

Description |

Quantity |

Unit Cost |

Total Cost |

|

|

|

|

Sun 420R |

1 |

$55,000 |

$55,000 |

|

|

|

|

Memory Upgrade |

0 |

$3,240 |

$0 |

|

|

|

|

Quad Fast Ethernet Cards |

2 |

$1,077 |

$2,154 |

|

|

|

|

Redundant Power Supply |

0 |

$695 |

$0 |

|

|

|

|

JNI Fibre Cards |

2 |

$1,995 |

$3,990 |

|

|

|

|

Fibre Cables |

2 |

$150 |

$300 |

|

|

|

|

|

|

|

$61,444 |

|

|

|

|

|

|

|

|

|

|

|

Table D : Master site – Web Systems (WEB)

|

|

||||||

|

Description |

Quantity |

Non Recurring

Unit Cost |

Yearly Recurring

Unit Cost |

Non Recuring

Cost |

Monthly

Recurring Cost |

Monthly

Recurring Cost (24M) |

|

Hardware |

2 |

$56,077 |

$0 |

$112,154 |

$0 |

$4,673 |

|

Disk Array Storage |

|

|

|

$0 |

$0 |

$0 |

|

Veritas Foundation Suite |

2 |

$3,312 |

$1,112 |

$6,624 |

$185 |

$461 |

|

Stronghold 3 |

2 |

$1,000 |

$0 |

$2,000 |

$0 |

$83 |

|

Jrun 3 |

2 |

$500 |

$0 |

$1,000 |

$0 |

$42 |

|

|

|

|

|

$121,778 |

$185 |

$5,259 |

|

Hardware Detail |

|

|

|

|

|

|

|

Description |

Quantity |

Unit Cost |

Total Cost |

|

|

|

|

Sun 420R |

1 |

$55,000 |

$55,000 |

|

|

|

|

Memory Upgrade |

0 |

$3,240 |

$0 |

|

|

|

|

Quad Fast Ethernet Cards |

1 |

$1,077 |

$1,077 |

|

|

|

|

Redundant Power Supply |

0 |

$695 |

$0 |

|

|

|

|

JNI Fibre Cards |

0 |

$1,995 |

$0 |

|

|

|

|

Fibre Cables |

0 |

$150 |

$0 |

|

|

|

|

|

|

|

$56,077 |

|

|

|

|

|

|

|

|

|

|

|

Table E : Master site – Whois Systems (WHO)

|

|

||||||

|

Description |

Quantity |

Non Recurring

Unit Cost |

Yearly Recurring

Unit Cost |

Non Recuring

Cost |

Monthly

Recurring Cost |

Monthly

Recurring Cost (24M) |

|

Hardware |

2 |

$56,077 |

$0 |

$112,154 |

$0 |

$4,673 |

|

Disk Array Storage |

|

|

|

$0 |

$0 |

$0 |

|

Veritas Foundation Suite |

2 |

$3,312 |

$1,112 |

$6,624 |

$185 |

$461 |

|

|

|

|

|

$118,778 |

$185 |

$5,134 |

|

|

|

|

|

|

|

|

|

Hardware Detail |

|

|

|

|||

|

Description |

Quantity |

Unit Cost |

Total Cost |

|

|

|

|

Sun 420R |

1 |

$55,000 |

$55,000 |

|

|

|

|

Memory Upgrade |

0 |

$3,240 |

$0 |

|

|

|

|

Quad Fast Ethernet Cards |

1 |

$1,077 |

$1,077 |

|

|

|

|

Redundant Power Supply |

0 |

$695 |

$0 |

|

|

|

|

JNI Fibre Cards |

0 |

$1,995 |

$0 |

|

|

|

|

Fibre Cables |

0 |

$150 |

$0 |

|

|

|

|

|

|

|

$56,077 |

|

|

|

|

|

|

|

|

|

|

|

Table F : Master site – Registry Registrar Protocol

Systems (RRP)

|

|

||||||

|

Description |

Quantity |

Non Recurring

Unit Cost |

Yearly Recurring

Unit Cost |

Non Recuring

Cost |

Monthly

Recurring Cost |

Monthly

Recurring Cost (24M) |

|

Hardware |

2 |

$56,077 |

$0 |

$112,154 |

$0 |

$4,673 |

|

Disk Array Storage |

|

|

|

$0 |

$0 |

$0 |

|

Veritas Foundation Suite |

2 |

$3,312 |

$1,112 |

$6,624 |

$185 |

$461 |

|

|

|

|

|

$118,778 |

$185 |

$5,134 |

|

|

|

|

|

|

|

|

|

Hardware Detail |

|

|

|

|||

|

Description |

Quantity |

Unit Cost |

Total Cost |

|

|

|

|

Sun 420R |

1 |

$55,000 |

$55,000 |

|

|

|

|

Memory Upgrade |

0 |

$3,240 |

$0 |

|

|

|

|

Quad Fast Ethernet Cards |

1 |

$1,077 |

$1,077 |

|

|

|

|

Redundant Power Supply |

0 |

$695 |

$0 |

|

|

|

|

JNI Fibre Cards |

0 |

$1,995 |

$0 |

|

|

|

|

Fibre Cables |

0 |

$150 |

$0 |

|

|

|

|

|

|

|

$56,077 |

|

|

|

|

|

|

|

|

|

|

|

Table G : Consolidated Edge site – Cost summary.

|

Description |

Quantity |

Non Recurring

Unit Cost |

Recurring Unit

Cost |

Non Recuring

Cost |

Recurring

Monthly Cost |

Monthly

Recurring Costs (24M) |

|

DNS Edge |

1 |

|

|

$118,778 |

$185 |

$5,134 |

|

Network Switches |

4 |

$1,500 |

$0 |

$6,000 |

$0 |

$250 |

|

Firewall |

2 |

$16,000 |

$7,000 |

$32,000 |

$14,000 |

$15,333 |

|

Load Balancing |

2 |

$20,995 |

$0 |

$41,990 |

$0 |

$1,750 |

|

Monitoring Service |

1 |

$995 |

|

$995 |

$0 |

$41 |

|

Rack Space |

1 |

$1,210 |

$1,100 |

$1,210 |

$1,100 |

$1,150 |

|

Bandwidth |

2 |

$3,850 |

$8,880 |

$7,700 |

$17,760 |

$18,081 |

|

|

|

|

|

$208,673 |

$33,045 |

$41,740 |

Table H : Edge site – DNS Edge Server

|

Description |

Quantity |

Non Recurring

Unit Cost |

Yearly Recurring

Unit Cost |

Non Recurring

Cost |

Monthly

Recurring Cost |

Monthly

Recurring Cost (24M) |

|

Hardware |

2 |

$56,077 |

$0 |

$112,154 |

$0 |

$4,673 |

|

Veritas Foundation Suite |

2 |

$3,312 |

$1,112 |

$6,624 |

$185 |

$461 |

|

BIND 9 |

2 |

$0 |

$0 |

$0 |

$0 |

$0 |

|

|

|

|

|

$118,778 |

$185 |

$5,134 |

|

|

|

|

|

|

|

|

|

Hardware Detail |

|

|

|

|||

|

Description |

Quantity |

Unit Cost |

Total Cost |

|

|

|

|

Sun 420R |

1 |

$55,000 |

$55,000 |

|

|

|

|

Memory Upgrade |

0 |

$3,240 |

$0 |

|

|

|

|

Quad Fast Ethernet Cards |

1 |

$1,077 |

$1,077 |

|

|

|

|

Redundant Power Supply |

0 |

$695 |

$0 |

|

|

|

|

JNI Fibre Cards |

0 |

$1,995 |

$0 |

|

|

|

|

Fibre Cables |

0 |

$150 |

$0 |

|

|

|

|

|

|

|

$56,077 |

|

|

|

D13.2.7 Plans for acquiring

necessary systems and facilities

Over the past year, NetNumber has established the following

systems & facilities.

- Headquarters facility for 40 people.

- $9 million equity financing

- Hired executive team: CEO, CTO, CSO, VP Finance, VP Sales

- Hired 15 person development and operations team

- Acquired $1 million enterprise class network operations equipment

- Executed operating lease on additional $1 million hardware and software

- Deployed first production release of Global Internet-Telephony Directory.

- Established strong strategic relationships with key vendors

The projected

systems and facility investments necessary to execute the ".tel"

Registry business plan fall well within the resources, skills, and experience

of the team.

D13.2.8 Staff size/expansion

capability

Despite

operating in a tight technical labor market in the Boston area, the NetNumber

team has already demonstrated its ability to hire technical and operations

staff as required. In this regard the

NetNumber team is benefiting greatly from having built a large development and

operations staff in the exact same geographic area while at Unifi

Communications. Access to necessary

staff will not be a limiting factor in the operation of the ".tel"

Registry.

D13.2.9

Availability of Additional Management Personnel

NetNumber is well down the path of completing its executive team. Outlined below is a summary of filled and outstanding positions. Access to management will not be a limiting factor in the operation of the ".tel" Registry.