Sponsoring

Organization’s Proposal

I SPONSORING

ORGANIZATION’S STRUCTURE

C1 GENERAL

DESCRIPTION OF STRUCTURE AND ORGANIZATION

Telnic submits a Sponsoring Organization Proposal and

Application to operate and manage a new generic top-level domain called .TEL

that is dedicated to communications-over-the-Internet.

The vision of .TEL, a fundamental new

communications domain-addressing platform that will enrich the Internet, was

conceived in the mid-90’s, as was its parent Telnic (the .Tel Network

Information Center).

From these early beginnings Telnic has taken a

long-term view on the development of the .TEL concept, primarily because: (a)

technology and perception has had to catch-up with the idea, and most

importantly (b) the need to adopt .TEL into the DNS as part of the then IANA,

and now ICANN new gTLD initiatives.

Telnic was created to make .TEL happen.

Therefore the process of structuring and building the Telnic Organisation has

and will be ongoing and evolutionary. This is plainly because Telnic and .TEL

are contingent in many respects on the sanctioning of new gTLDs, and the

parameters and requirements that go with it.

As a result, Telnic is currently a limited operation focused and ready on the sole objective of making .TEL a reality. Most elements to achieve this aim are in place, including: an extremely high-level business plan; human-resources in place and in-waiting who are experienced and qualified in all necessary fields; and importantly sufficient financial resources and commitment ready to ensure that the new Telnic Registry will be unequalled to fulfil the requisite responsibilities to launch the project, and execute the proposal described in this application.

Telnic is therefore in the category of “Sponsoring Organization

Proposing to be Formed”. Details of

Telnic’s current staffing level and resources, including funding, are given in

the appropriate sections of this proposal.

We are presently a UK centric organization,

with plans on becoming acknowledged and accepted as a universal organization

and registry for .TEL, servicing the whole Internet community - be it in

developed countries or developing countries.

As part of our long-term planning and

development Telnic has considered the many and varied pivotal issues that will

have a bearing on the long-term development and stability of a new namespace

for .TEL. We have considered and planned for all legal aspects, all technical

aspects, all policy formulation aspects, and importantly all intellectual

property aspects that could restrict or hinder the implementation of the .TEL

namespace. In this respect Telnic has comprehensively protected the integrity

of .TEL.

C1.1 The Basic Principle of the Telnic .TEL gTLD

Telnic propose the creation of a new .TEL gTLD that will be task-related specific to Voice-Video-Data.

Like most good

ideas, the .TEL concept is simple. We propose a .TEL top-level domain - that

will eventually have relating subdomains - that will be universally recognised

and used as a DNS addressing system for people to “dial” and communicate using

any Internet enabled device with speech capability. Proof of working concept

have been undertaken with .TEL, including a defining practical demonstration

with Ericsson, using their broadband

next-generation UMTS platform. Please

refer to the confirmation of this in

the letter from Ericsson contained in the Appendix

It will

represent the next-generation of point-to-point addressing for

voice-video-data. By voice-video-data we mean that as the world enters an all

Internet Protocol (IP) environment when voice (voice-telephony) will become

just another data element, it will then be possible to combine this voice data

will other data such as video, imagery, and/or messaging to provide creative

Internet solutions and services that go far beyond conventional communication

services.

These new

exciting developments are being driven by the Internet, and in particular the

emerging mobile-Internet, and in parallel with these advances and convergences

we are seeing the emergence of a whole new-generation of devices that will

transform how we use and interface with the Internet. These devices, in their

many forms - whether personal communicators, wearable-devices, PDA types

devices, desk-top terminals – demand a new dedicated domain-name addressing

system such as .TEL.

The use of .TEL as a communications

addressing scheme opens up new frontiers in the use and application of

communications devices and networks. It will positively compliment and grow DNS

for virtually all Internet end-users, service providers, application

developers, even hardware producers.

.TEL has the potential of fulfilling most national, regional, and global Internet addressing specific to communications – that is Internet communications in the broadest sense. It will be a simple, universal, flexible, scaleable, versatile, intuitive, and user-friendly addressing structure.

· It will enhance DNS and enable the development and deployment of a wide range of new Internet applications, products and services.

· .TEL will be user-friendly and allow the flexibility to use more or less any characters: letters, digits, phrases, or a mixture of letters and digits to form domain name addresses – or “Telnames”.

· .TEL will allow a sub-addressing structure of country based two-character sub-domain names, ccSLDs, (e.g., us.tel or uk.tel) which will mirror to an extent traditional telephone country and area codes for over 200 countries.

· .TEL will create corporate addressing solutions below each corporate .TEL domain name to enable individual company departments to be contacted via simple and flexible communication architecture.

· .TEL will extend the methodology of the corporate .TEL solution to domestic homes, whereby any member of a family and any Internet enabled appliance can be contacted through the specific .TEL address mapped to that home.

As can be seen from the above, .TEL has the power to become a truly worldwide and universal platform that provides an uncomplicated IP-based telephone addressing system between any two or more Internet enabled devices, or between two or more devices where at least one is Internet enabled.

This means that .TEL lends radical new capabilities to how people will “dial” and communicate in the future, and could accelerate VoIP, mobile-computing, UMTS, and many other Internet related advances.

C2 ORGANIZATION

INFORMATION

The .TEL proposal is managed by Telnic, a private limited company registered in England and Wales under company registration number 03555437, operating out of the UK.

C2.1 Telnic Limited

· Telnic was incorporated under the name of Ixtel Limited, formed on 22 April 1998. The company changed its name to Telnic Limited in 1999.

· Telnic’s registered office address is at 211 Piccadilly, London W1V 9LD, England.

· Telnic’s bankers are National Westminster Bank plc of 169 Victoria Street, London SW1E 5BT, England.

· Telnic’s primary legal counsel is Squire, Sanders & Dempsey. Squire, Sanders & Dempsey is a global law firm, with 700 attorneys worldwide, with a leading telecoms and Internet law practice, based in its London office at Royex House, Aldermanbury Square, London EC2V 7HR, England.

· Telnic’s tax advisers are Simmons & Simmons of 21 Wilson Street, London EC2M 2TX, England.

· Telnic’s financial advisers are The CHART Group LP (“CHART”), of New York and Paris. Further information on CHART is set out in paragraph C.2.2 below.

· Telnic is an ordinary for-profit company, based in London, and is governed by the laws of England and Wales.

· Telnic’s Articles of Association are attached to this Sponsoring Organization’s Proposal.

C2.2 Role of CHART and the Funding of Telnic

CHART is a private investment company, based in New York, Paris and Dublin, with a shareholder base of approximately 50 influential families from over 20 different countries, in the Americas, Europe and Asia.

CHART has acted as incubator for the past nine months, in close relationship with its British investors, who have already spent four years developing the .TEL architecture. CHART has transformed the .TEL vision into a workable business plan, supported by substantial investment. CHART has also provided logistical support, and initiated a .TEL proof of concept with Ericsson UMTS Department. CHART’s partner in charge is Mr. Fabien Chalandon, who is also the nominated CHART director to sit on the Telnic Board of Directors.

CHART initiated the fundraising for Telnic in early July 2000, to support Telnic’s application for the launch of a new gTLD. The Telnic share offering is structured to focus on a two-stage fundraising process with both stages committed at the same time. The first round of finance is to fund the application, with the second round of finance to develop and launch the .TEL registration operation.

The fundraising is expected to close within the first two weeks of October 2000. Based on confirmed indications of interest, Telnic is anticipating first round financing of US$1.5 million to fund the application process. The second round of financing of US$12 million is contingent upon ICANN granting to Telnic the exclusive licence to operate the .TEL domain name. If ICANN grants a licence to Telnic, the Board may decide to approach investors for additional funding. Should the need arise, CHART is confident that it can raise further funds from both existing and new investors.

C3 ORGANIZATION

STRUCTURE

Since the announcement by ICANN, in July 2000, of its intention to consider applications for new gTLDs, Telnic has strengthened its organization by recruiting additional executives to assist with the gTLD application.

Board of Directors

q Christopher Kemball, Non-Executive Chairman.

q Ray Pierce, Chief Executive Officer of Telnic

q Alan Price, Founding Director, and Senior Executive.

q Cathy Horton, partner of Squire, Sanders & Dempsey.

q Fabien Chalandon, Managing Director of CHART.

q William Holman, Managing Director of Thomson Financial.

Management Team

q Ray Pierce, Chief Executive Officer

q Alan Price, Senior Company Executive

q Martin Augier, Chief Financial Officer and Director of Operations

Curriculum vitaes in respect of the above-named individuals are attached hereto.

In addition, candidates have been identified for positions as Chief Technology Advisor and Head of Legal Operations. These individuals, and other key identified personel, are available to join Telnic in the event that the application to ICANN is successful.

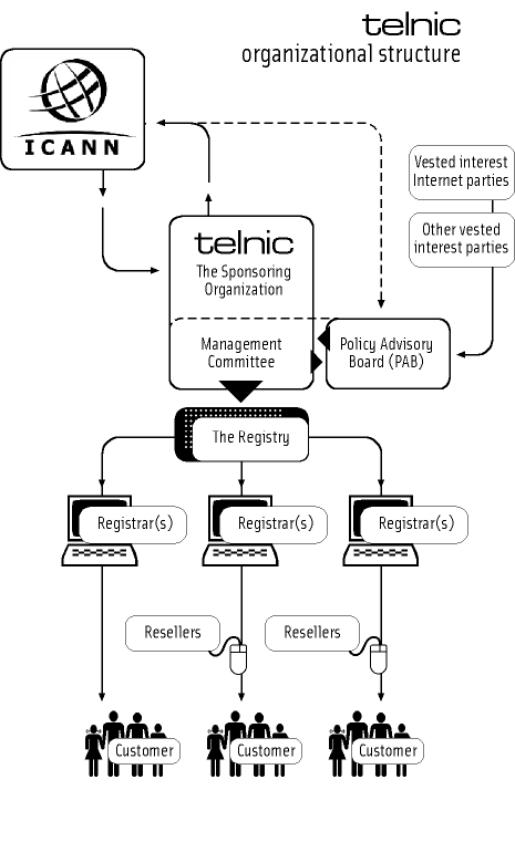

Telnic will also establish a Policy

Advisory Board (PAB), to act as an interface with ICANN and the Internet

community, and to ensure that Telnic’s policies are fair and reasonable in

respect of all Internet interest groups.

C4 ORGANIZATION

PURPOSE

The sole purpose of Telnic is to develop, launch, manage, and operate the new gTLD called .TEL. (Please refer to ‘Policies’ section).

Telnic envisages the launch of .TEL

to be a carefully controlled roll-out.

Telnic’s initial management team has considerable experience of start-up

business operations, and of building high-quality customer service operations

at extreme speed.

Telnic proposes to work with an

established Registry Operator, but Telnic is prepared to open the registration

process to ICANN Accredited Registrars. This process will be designed to ensure

that many Registrars can be appointed to operate the .TEL space to cope with

the expected rapid growth of demand.

Country-Code Registries will be appointed at national levels to operate

each ccSLD, and will be expected to appoint and manage an appropriate

resellers’ programme.

C5 Appropriateness to community

Telnic proposes to implement a unique and innovative domain name addressing system dedicated to voice-video-data delivery. This is a new communication addressing tool, which responds to the converging environment of the Internet and personal communications.

Therefore, Telnic considers that .TEL is a concept that possesses universal value to the Internet community, both present and future.

To develop the market for .TEL, three factors must be considered:

1. The rapid emergence of a wide range of devices. Internet enabled devices which provide mixed voice-video-data capabilities which are likely to converge with traditional telephone systems will need to be addressed.

2. The rapid growth of VoIP. Some forecasts say that the development of VOIP could represent as

much as 30% of telecom traffic by 2003.

3. The need for at least one .TEL address per VoIP Internet enabled device: as the Internet reaches the last mile, need for static IP addresses will dramatically increase as:

(a) any person or company worldwide that has Internet enabled devices capable of sending and receiving communications will need an IP address;

(b) every new Internet enabled device will need a dedicated new address, such as .TEL.; and

(c) an increasing number of electronic devices in the office and the home will become Internet enabled, and therefore require an IP address.

In summary, the .TEL concept when taken to its logical conclusion embraces the entire Internet community, it being the right time in the Internet’s evolution for this proposed new gTLD.

C6 Representation

C6.1 General Representation

Telnic’s business proposal is relevant to the global Internet community. To ensure that a wide range of interests within that community are taken into account in the formulation of Telnic’s commercial and technical policies, Telnic proposes to create a Policy Advisory Board, to advise Telnic’s Executive Management Committee and the Board of Directors.

Telnic is seeking an industry leader to chair its Policy Advisory Board. Cathy Horton, a leading Internet advisor and partner of Squire, Sanders & Dempsey has agreed to serve on the Policy Advisory Board.

The Policy Advisory Board will

operate separately from Telnic’s management structure, and will be able to set

its own terms of reference, in consultation with ICANN. Cathy Horton will be responsible for ensuring

that the members of the Board represent as wide as possible a range of interest

groups within the Internet community. The attached chart (Fig. C-1) shows how the

relationship between Telnic, the Policy Advisory Board, ICANN and the Internet

communities will be structured.

Internet communities will be represented on a local level within each territory by the creation of user groups, and an overall international user group, comprised of territorial representatives, will provide input on policy issues to the Policy Advisory Board.

C6.2 Telnic Foundation

Telnic is aware that predatory pricing in relation to domain names and the development of domain name space generally could affect the development of the Internet. Whilst Telnic has a responsibility to its investors, Telnic proposes to develop pricing policies, particularly for private individuals, which keep costs of domain name registration and maintenance as low as possible.

Telnic intends to

operate a fair pricing policy. Telnic

will also ensure that its business partners and suppliers are able to supply

Telnic services to a verified service level.

Nevertheless,

Telnic’s Board of Directors is aware that additional issues relating to

Telnic’s proposed services and fee structure will need to be considered in more

detail in the future. Telnic is also aware of the example of CORE, which has

introduced a policy of voluntarily donations to ICANN by way of “giving

something back” to the Internet community.

The financial performance of Telnic is subject to uncertainty at this stage. If ICANN grants a licence to Telnic, it will still be difficult to assess the full development potential of the .TEL domain name space, as this will depend on a number of factors, including the terms of any such licence, and the acceptability of the concept by the Internet community once launched. The financial projections which have been provided herein must be treated as largely illustrative until the terms of any licence granted becomes known.

In view of this uncertainty, Telnic proposes the following approach to the issue. Should any licence be granted to Telnic by ICANN, Telnic would agree to establish “The Telnic Foundation”. This would be a charitable body, funded by donations from Telnic. The initial remit of this body could, for example, be research based into open systems to ensure the continued development of the Internet for the benefit of the Internet community as a whole. However, a full remit would be agreed with ICANN at the appropriate time.

Both Telnic and ICANN could nominate independent trustees for The Telnic Foundation. It would be the responsibility of the trustees to establish detailed policies for The Telnic Foundation, and to administer its finances in an agreed manner to benefit the Internet community. The funding of The Telnic Foundation could be based on a registration volume formula, or a share of Telnic’s profits, once Telnic has satisfactorily recouped start-up costs.

C7 Openness & Transparency

Telnic believes that it will be in the interest of the Internet community at large if it conducts its activities with complete openness and transparency. Use of the Telnic.org website will be central to this openness.

As a company regulated by English company law, Telnic is obliged by law to publish its Annual Report and Company Accounts at Companies House. These financial records will be available for public inspection.

The creation of a Policy Advisory Board, and a system of user groups will ensure that the operation of the system is subject to wide scrutiny. The proceedings of these various bodies would be published on the Internet, to ensure a wide consultation process as issues emerge and are identified for decision-making.

C8 Initial Directors and Staff

The details of the initial Board of Directors of Telnic and staff are all detailed in section C3 above. However, for the sake of clarity the initial Directors will be:

q Christopher Kemball, Non-Executive Chairman

q Ray Pierce, Chief Executive Officer of Telnic

q Alan Price, Founding Director, and Senior Executive

q Cathy Horton, partner of Squire Sanders & Dempsey

q Fabien Chalandon, Managing Director of CHART

q William Holman, Managing Director of Thomson Financial

Please refer to appendix for CVs.

C9 Selection of Directors

This section C9 is covered in detail in sections 16 to 20 of the *Proposed Articles of Association attached to this document. All references below are to the Proposed Articles of Association.

* The appendix includes both the existing Articles of Association

and the Proposed Articles of Association.

The latter will be approved by the Telnic Board at the next Board

Meeting scheduled to take place on October 12th 2000.

C9.1 Initial Selection

The initial Directors were selected by a process of a combination of:

1. individuals who have been involved with the process since the inception of the project, and

2. individuals

who have specific skills particular to the success of the operation.

C9.2 Number

C9.3 Disqualification of

Directors

C9.3.1 Retirement

C9.3.2 Vacation

of Office

C9.4.2 Removal

C10 Policy Making Procedure

This section, including Powers of

Directors, Interest in Contracts etc., is dealt with in detail in Sections 16

to 20 in the Articles of Association which is appended to this document. We are

proposing full policy and guidelines in further

sections.

In addition to the provisions of its Articles of Association, Telnic recognizes that there are wider Internet-related policy issues which must be addressed on a continuous basis if Telnic is to operate in this name-space. For this reason, Telnic proposes the establishment of a Policy Advisory Board. The Policy Advisory Board is independent of Telnic, and the Board will be responsible for identifying policy issues, creating dialogue with the Internet community, liaising with ICANN, and advising Telnic in respect of the policy formation.

C11 Meetings and Communication

The policy making procedures of the Company relating to the Directors, and including the proceedings of the Directors, i.e., quorum, alternates, casting votes, telephone meetings etc., are dealt with in Section 18 of the Articles of Association which is appended to this document. Please refer to the Policies section of this proposal.

C12 Fiscal Information

(this information is considered commercially sensitive and we have requested

that all of section C12 be kept confidential)

For the purposes of Telnic’s application, funding has been arranged in the sum of US$1.5 million, with further funding of US$12 million agreed on a second round. CHART has been responsible for organizing this fundraising. (See separate letter from Chart). Investors in Telnic will come from the international Internet community.

Basis of Fees

The whole basis of this proposal is that we see the .TEL space as a way to streamline the method, and simultaneously reduce the costs, of communication throughout the world. To this extent, we have attempted to price the service accordingly, more as a public service rather than an expensive and exclusive facility. Therefore, we have built in assumptions - in an open and deliberately nurtured competitive .TEL market place - which will leave very small margins for the operators of the service, including Sponsors, Registry Operators, and possibly Registrars and Resellers.

Also, we have assumed that the Registry Operator will only deal with Accredited Registrars and not directly with the public, thereby providing, as soon as is practicable, a high degree of competition and a virtual open playing field immediately.

The level of fees in the first years are set at the level of US$10 and US$8 in order to offset the investment required in a start-up operation.

Key Details:

|

Details |

Yr.1 |

Yr.2 |

Yr.3 |

Yr.4 |

Yr.5 |

|

|

|

|

|

|

|

|

Fee Level to Registrars (US$) |

$10 |

$8 |

$6.5 |

$5.5 |

$5.25 |

|

|

|

|

|

|

|

|

No. of New Domains |

1,090k |

1,625k |

3,500k |

6,120k |

9,780k |

|

|

|

|

|

|

|

|

Cumulative no. of Domains at Year End |

1,090k |

2,715k |

5,942k |

11,452k |

19,899k |

|

|

|

|

|

|

|

|

Headcount |

35 |

62 |

80 |

108 |

108 |

For the purposes of this proposal we have assumed that fees would be payable in two year instalments.

Five Year

Financial Projections

|

|

YEAR 1 |

YEAR 2 |

YEAR 3 |

YEAR 4 |

YEAR 5 |

|

TOTAL INCOME |

$39,055,200 |

$35,308,000 |

$73,171,800 |

$100,304,325 |

$118,736,888 |

|

|

|

|

|

|

|

|

TOTAL COST OF REVENUES |

$31,886,820 |

$13,924,190 |

$40,106,985 |

$49,826,649 |

$59,056,487 |

|

GROSS PROFIT |

$7,168,380 |

$21,383,810 |

$33,064,815 |

$50,477,676 |

$59,680,401 |

|

|

|

|

|

|

|

|

TOTAL COST OF SALES |

$4,632,312 |

$3,288,480 |

$6,028,308 |

$7,431,980 |

$8,664,563 |

|

TOTAL MARKETING |

$2,489,600 |

$3,313,006 |

$3,989,943 |

$4,637,623 |

$4,637,623 |

|

TECHNOLOGY DEVELOPMENT |

$115,200 |

$138,240 |

$172,800 |

$211,200 |

$259,200 |

|

TOTAL G&A |

$6,484,240 |

$6,953,301 |

$8,472,617 |

$10,822,072 |

$11,106,235 |

|

TOTAL OPERATING EXPENSES |

$13,721,352 |

$13,693,026 |

$18,663,668 |

$23,102,874 |

$24,667,621 |

|

|

|

|

|

|

|

|

INCOME (LOSS) FROM OPERATIONS |

-$6,552,972 |

$7,690,784 |

$14,401,147 |

$27,374,802 |

$35,012,780 |

|

|

|

|

|

|

|

|

TAX |

$0 |

$2,307,235 |

$4,320,344 |

$8,212,441 |

$10,503,834 |

|

NET PROFIT |

-$6,552,972 |

$5,383,549 |

$10,080,803 |

$19,162,361 |

$24,508,946 |

|

CUMULATIVE NET PROFIT |

-$6,552,972 |

-$1,169,423 |

$8,911,379 |

$28,073,741 |

$52,582,687 |

|

|

|

|

|

|

|

|

CASH FLOW |

$12,677,628 |

$3,809,949 |

$25,186,803 |

$30,025,721 |

$30,176,786 |

|

CHANGE IN WORKING CAPITAL REQUIREMENT |

$8,396,640 |

-$2,837,531 |

$4,354,067 |

$2,926,936 |

$1,810,900 |

|

NET CASH GENERATED |

$4,280,988 |

$6,647,480 |

$20,832,736 |

$27,098,785 |

$28,365,886 |

|

CUMULATIVE NET CASH |

$4,280,988 |

$10,928,468 |

$31,761,203 |

$58,859,989 |

$87,225,875 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

YEAR 1 |

YEAR 2 |

YEAR 3 |

YEAR 4 |

YEAR 5 |

|

GROSS MARGIN |

18.35% |

60.56% |

45.19% |

50.32% |

50.26% |

|

OPERATING MARGIN |

-16.78% |

21.78% |

19.68% |

27.29% |

29.49% |

|

NET MARGIN |

-16.78% |

15.25% |

13.78% |

19.10% |

20.64% |

|

FREE CASH GENERATED |

10.96% |

18.83% |

28.47% |

27.02% |

23.89% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CUSTOMER BASE |

YEAR 1 |

YEAR 2 |

YEAR 3 |

YEAR 4 |

YEAR 5 |

|

NEW IN THE YEAR |

1,090,000 |

1,625,000 |

3,500,000 |

6,120,000 |

9,780,000 |

|

2 YEARS+ OLD RENEWED (1) |

0 |

0 |

817,500 |

1,831,875 |

3,998,906 |

|

1 YEAR OLD PREPAID |

0 |

1,090,000 |

1,625,000 |

3,500,000 |

6,120,000 |

|

TOTAL YEAR END DOMAINS |

1,090,000 |

2,715,000 |

5,942,500 |

11,451,875 |

19,898,906 |

|

ATTRITION |

0 |

0 |

272,500 |

610,625 |

1,332,969 |

|

(1) NET OF ATTRITION |

|

|

|

|

|

|

NEW+RENEWALS SOLD IN THE YEAR |

1,090,000 |

1,625,000 |

4,317,500 |

7,951,875 |

13,778,906 |

The company is not yet operational, consequently there are no historical records with respect to audits, annual reports or annual statements. The summary above is however the culmination of an extremely complex spreadsheet model which includes a detailed P&L by Month, Cash Flow statements, Balance Sheets and a variety of Accounting statistics. This model is available to ICANN should it be required and we are happy to respond to detailed questions.

C13 Liability

C13.1 Indemnity

C13.2 Insurance

Both these subjects are dealt

with in Article 23 of the Articles of Association (as attached).

C14 Amendment of Articles of Incorporation

Amendments to the Articles of Association is governed by English company law, which, in brief, states that the Articles of Association can only be amended by way of passing a special resolution of the members of the company. Once the members pass the special resolution, the amended Articles of Associations will require approval of the Board of Directors. Changes of this nature to the company’s constitutional documents require filing at Companies House.

C15 Reconsideration and Review

As an English company, certain

company documents will have to be filed at Companies House therefore, Telnic’s

affairs will be the subject of public scrutiny. The result is that the affairs of Telnic will always be capable

of assessment by ICANN and other interested parties. Should issues emerge that require adaptation of Telnic policies,

these can be discussed, particularly within the remit of the Policy Advisory

Board. Telnic will need to take account

of this advice in formulating its ongoing policies.

II Proposed extent of Policy-Formulation

Authority

C16 DELEGATION OF

POLICY-FORMULATION AUTHORITY

C16.1 Scope of authority sought

Our organization seeks a very basic

management and development remit for .TEL. It is a necessary authority that is

a consequence and result, and a natural evolution to creating the namespace.

Telnic will sit firmly within present Internet constitutions and governing frameworks – such as the ICANN Disputes Policy, or Accredited Registrar Policies. However there are mitigating circumstances, as we explain further in this document, applicable to .TEL that dictate the forming of a small focused policy-formulation structure that would be accountable to ICANN - and probably involve ICANN.

The scope of authority required by Telnic to fully develop and implement .TEL is comprised of and is limited to:

1. the consensus led development and implementation of all subdomains below the gTLD of .TEL; and

2. the development of policy guidelines and structures regarding country codes, and other possible future sub-level domains. This would be confined to the following issues and remits:

Deciding

all subdomains

q determining whether subdomains will be restricted or unrestricted; and

q ensuring that all sub-addressing is implemented in a stable, equitable and consistent manner.

In addition to the above policy terms of reference, Telnic and its management would be honoured to be chosen as guardian of the .TEL gTLD - accountable to ICANN and the Internet community and would act as:

q a coordinating body for related technical and other integral matters;

q a body that strives to protect the integrity of .TEL; and

q a registry and focal point to co-ordinate and liaise with ICANN and other Internet bodies on a cross-section of applicable matters.

In the fast moving and changing environment of especially the mobile-Internet, it is believed that there may be a need to determine additional policy that could arise in due course within the .TEL domain. It may therefore be necessary to establish a periodical review system with ICANN to keep abreast of such changes.

C16.2 Reasons/justifications for seeking authority

With any new gTLD, there is demand to introduce subdomains and to demarcate these along restricted or unrestricted lines, taking into account the many parameters and issues. .TEL is no exception to this.

Telnic believes therefore, that a dedicated and transparent managing entity is essential to develop and coordinate the special needs of .TEL.

With respect to country code SLDs under .TEL, it is Telnic’s opinion that these should be developed and organized on the basis of being a public service that takes into account national circumstances within the respective country. Towards this goal, Telnic understands the importance of organizing and developing structures that facilitate (a) all guidelines and narrow policies to develop these specific subdomains; and (b) systems for the selection and management of country code SLDs within respective countries.

This work and development will be consensus led, transparent and equitable, working within, and subject to, established Internet policies and principles as enshrined by ICANN.

C16.3. Method of guaranteeing

that your organization will administer the policy in the interest of the

Internet at large: and

Telnic will put in place a representative system to assist and guide the development of any “small-footprint” guidelines and policies (see section C16.1). Central to this will be the adoption of a fixed Policy Advisory Board, made-up of various experienced and qualified people who are knowledgeable and representative in fields appropriate to .TEL.

Telnic believes that the

representation and participation by ICANN on its Policy Advisory Board would be

both beneficial and productive. This will be on the basis of the following

organizational chart. (Please see Fig. C-1 in the following pages).

As stated above, Telnic will ensure that all decision-making will be

transparent and open to the public at the Telnic.org web site. With full

history and access to decisions and all relevant publications and related

matters.

Overall, this is a broad subject that will need to be discussed and shaped in detail with ICANN.

C16.4. Whether variation from

existing ICANN policies is intended at the opening of the new TLD

As stated in C16.4 above, Telnic does not wish to deviate from the key principles established by ICANN. Telnic’s objective is to adopt mainly existing structures to meet the special requirements of the .TEL namespace. Telnic propose a two-phase rollout for .TEL to create a stable and measured environment for its introduction. This strategy should also allow sufficient time to develop Telnic’s consensus-led guidelines for its various subdomains.

‘Phase 1’ of rollout will be only for second-level registrations. ‘Phase 2’ will be for agreed subdomains. It is in this ‘Phase 2’ that Telnic wishes to over-lay various narrow guidelines and principles. (Please see Fig. C-2 in the following pages).

(Fig. C-1)

* 'Phase 1' will be approx 12-18 months

duration, thereafter 'Phase 2' will be implemented. CcSLDs will be implemented

in ‘Phase 2’. ** A temporary quarantine will apply in ‘Phase

1’ to ensure that the proper structuring and implementation of .TEL, with all

essential subdomain, is done in a stable and coordinated way, considering all

factors. C17 Identification of

Registry Operator The details of the Registry Operator

are:- CentralNic www.centralnic.com 163

New King’s Road London SW6 4SN United

Kingdom Email:

info@centralnic.com Tel: +44(0)20 7751 9000 Fax: +44(0)20 7736 9253 C18 CONTRACT WITH REGISTRY OPERATOR C18.2 Proposed Terms of Contract The proposed terms of a contract

between CentralNic and Telnic are contained in an agreement signed by both

parties and included in the Appendix.

APPENDIX

TO SPONSORING ORGANIZATION’s PROPOSAL

C

Vs FOR TELNIC DIRECTORS AND SENIOR MANAGEMENT CHRISTOPHER KEMBALL CHAIRMAN, TELNIC LIMITED Christopher Kemball, 53, is an experienced

senior executive, with a background in Corporate Finance and Capital Markets.

In recent years his capital markets experience has been focussed particularly

on telecommunications and related sectors. From 1992 to 1999 he worked for Baring

Bros, later ING Barings in several capacities. From 1994 to 1997 he was Global

Head of Emerging Markets for Corporate Finance. After ING acquired Barings in

1997 he became Regional Head of Corporate Finance for EMEA in the combined

firm, responsible for 500 staff in 11 international offices. Finally, in 1999

he became a member of the European Management Committee in ING Barings Limited,

with responsibility for major client relationships and transactions in the

region. In this role he he was rsponsible for teams carrying out major

transactions in Poland, and capital raisings in the cellular telephone sector

in Russia, Romania and Slovakia. From 1986 to 1992 he was Managing Director

and Partner in Dillon Read & Co Inc initially based in New York, and

subsequently Co-Head of Europe, based in London. In this role he was

responsible for developing the successful joint venture in London between

Dillon read and Societe Generale de Belgique. He conceived and executed the

firm’s strategy in corporate finance, European equity research and brokerage,

and asset management, particularly development capital. He acquired extensive

experience in the development capital sphere, raising 5 private equity funds in

UK, France and Spain, the largest of which raised £200 mn. In 1992. The

partners of Dillon Read bought the business from the owners, Travelers Insurance

Company of the US. At that time Barings bought a 40% equity stake, conditional

on Dillon Read transferring its European operations to Barings. This resulted

in Mr Kemball transferring with the business to the Barings organization. From 1975 to 1986 Mr Kemball was Director,

Corporate Finance for Kleinwort Benson Limited. From 1984 to 1986 he was based

in New York, focusing on US/UK mergers and capital raising. Prior to 1984 he

was based in the UK corporate finance department in London, where he worked on

a wide range of UK IPOs, equity capital issues, and mergers and acquisitions

for publicly quoted companies. This included work on a number of UK

privatisations of government owned corporations, requiring close liaison with

the UK Treasury and other government departments. From 1968 to 1975, Mr Kemball served in the

British Army, achieving the rank of Acting Major. He served in Germany, and saw

active service in Northern Ireland and the Sultanate of Oman. He was awarded

the MBE (Gallantry) and the Sultan’s Distinguished Service Medal for Gallantry. At the end of 1999 Mr Kemball left ING

Barings at his own request to pursue a Non-Executive and advisory career. He is

currently a Non-Executive at BPT Plc, The Davis Services Group Plc, and Control

Risks Group Limited. Mr Kemball has a degree in law from

Cambridge University. FABIEN CHALANDON NON-EXECUTIVE DIRECTOR, TELNIC LIMITED Fabien Chalandon , 47, is a French

national, and is a senior banker for CHART in Europe. He has extensive

experience in corporate finance, and from 1992 until recently was a private

banker to one of the wealthiest families in France, running their investment

company and their personal finances. He has been involved in the Telnic project

since the end of 1999, as acting-Chief Executive Officer, and has been

responsible for structuring the initial fund-raising to launch the project. Mr Chalandon started his business career

with Lazard Freres et Cie in Paris (1977), where he was active in the field of

corporate finance in France, as well as business developments in Brazil. He

remained with Lazards until 1983, with a one-year interruption, in 1979, when

he was Commercial Attache at the French Embassy in Brazil. Between 1883 and 1986, Mr Chalandon ran his

own advisory firm, based in London, specialising n the oil-refining and

distribution sectors. From 1986 to 1988, Mr Chalandon was a main board director

of Parafrance, a French media group, where he carried out a restructuring. From 1988 to 1992 Mr Chalandon was a senior

corporate finance executive with the US investment bank Dillon Read, based in

its London office, and focussed on extending its French business activities in

mergers and acquisitions, private equity investment, and debt financing. Mr Chalandon has extensive business experience

in Europe, Brazil, Venezuela, India the Far East, and USA in mergers and

acquisitions, private equity, wealth management, and in operating companies in

France. Mr Chalandon sits on the boards of four private equity funds, Hibernia

Capital Partners in Ireland, Access Capital Partners, Three Cities Research

Europe, and Banexi Ventures II in France, is a co-gerant of the Paris based

oil-exploration company Madison/CHART

Energy and a board member of

Sogeres, the third largest catering group in France, and of Teraillon

Ltd., a world leader in scales. Mr Chalandon is an occasional writer on

political topics in several major French daily newspapers, is a graduate

of HEC and a Chevalier de la Legion

d’Honneur, the top French honour granted to him for his contribution to french

financial and political affairs, at the personal request of the French

President, Mr J Chirac. RAYMOND F PIERCE CHIEF EXECUTIVE OFFICER, TELNIC. Ray Pierce, 54, is a seasoned senior

executive, with experience at the highest level in general management, business

development and marketing. He has been involved in the launch and development

of three major businesses – Guardian Direct (a subsidiary of Guardian Royal

Exchange (GRE) Plc), The Mortgage Corporation (a subsidiary of Salomon Inc),

and American Express Financial Services. His senior management career

culminated in his appointment in 1997 to the Main Board of GRE, then one of the

top-100 companies on the UK Stock Exchange From 1993 to 1999 he worked for GRE,

joining the company initially to establish Guardian Direct, a direct insurance

underwriter. Guardian Direct grew rapidly, and within 3 years was the third

largest direct writer in the UK market for motor, home and health insurance,

employing some 1000 staff in a virtual call-centre system. In 1997, Guardian

Direct was named winner of the “European Call Centre of the Year” award, for

outstanding customer service. During his GRE career, Pierce was also

appointed Managing Director for all UK General Insurance, in January 1997,

responsible for three major business units and over 5000 staff. He was also

responsible for rolling out the Guardian Direct business in other territories,

specifically South Africa and Ireland. Finally, in 1997 he was appointed to the

GRE Main Board, with worldwide responsibility for Marketing. From 1992 to 1993 he was Chief Executive of

Robson Rhodes, Chartered Accountants and Management Consultants. Prior to that

period, from 1986 to 1991 he was a founding director of The Mortgage

Corporation, a subsidiary of Salomon Inc, based in the UK. Pierce was initially

Director of Marketing and Sales, and in 1990 became Chief Executive. From 1982

to 1986 he was a Vice-President with American Express with responsibilities

covering the UK and Ireland. He was initially responsible for Strategic

Planning and Business Development, and in 1984 became responsible for Consumer

Marketing for all Amex Card, Travellers Cheques and Travel products. Pierce has a first degree in Economics and

Philosophy from the University of East Anglia, and a post-graduate

qualification in Operational Research from Brunel University. He is Chairman of

the Council of SPARKS (Medical Research) Charity, and a Trustee of the National

Motor Museum in the UK. He is currently Chairman of Dragons Plc, a

small quoted UK company in the Health and Fitness sector, and Chairman of

Homeowners Friendly Society Limited, a mutual financial organisation. MARTIN K AUGIER CHIEF FINANCIAL OFFICER AND DIRECTOR OF OPERATIONS Martin Augier, 49, is an experienced finance and operational executive who

has held senior positions in a number of major companies. From 1996 to 1999 he worked for Guardian Royal

Exchange (GRE) initially as the

individual in charge of the integration of the RAC Insurance Service acquisition

with Guardian Direct. This required the

consolidation of the acquired operation, the closure of 5 different offices and

the assimilation of the remainder into the Guardian Direct Operation. This created a virtual Telephone Service

operation in 4 sites with over 1000 people linked. After this he was asked to direct the Y2k project for GRE

the parent company in the UK. This £50m

project was swiftly brought under control and GRE suffered no mishaps on the change of Millennium. During this period he was made Executive

Operations Director for GRE in the UK with a specific remit to restructure the

entire operational base of the Company.

In the process of this project the Company was acquired by AXA and

Martin elected to accept the termination package to pursue other business

ventures. Between 1992 &1996 Martin worked as an Internal

Consultant to Hill Samuel Bank a subsidiary of TSB who were going through a

very difficult time. His role consisted

mainly of managing the closure, sale or restructuring of a number of operating

units of the Bank. Eventually after the

merger of Lloyds & TSB it was decided to close the Bank. During 1989 and 1990 Martin was the Executive Operations

Director for the Household Finance Corporation which was going through a major

changes and rationalisation. Martin was

responsible in the time he was there for Opening a New Operating Centre for the

Bank to handle all the Back Office functions previously handled in the

Branches. This was a £20m project which

resulted in the sustained reduction of 150 back office jobs. Prior to this Martin spent 15 years at American Express

where he started as an Internal Auditor and ended as Vice president of

Operations for the UK. It was in this

job that Martin gained the experience which has served him so well. He was responsible for all the customer

service activities for the American Express Card Operation. He introduced the EFTPOS programme for

American Express in Europe and was responsible for many innovations while he

was VP of Operations and Finance Controller for the UK. Prior to working at American Express Martin was an

articled clerk at a small firm of Chartered Accountants in London, he qualified

at his first attempt and one of the youngest ever to qualify as a Chartered

Accountant at the age of 21. Currently Martin is currently involved

property development and 3 New Car Franchises in Sussex and also undertakes

occasional consulting assignments. CATHY BOSWORTH HORTON DIRECTOR AND PARTNER OF SQUIRE, SANDERS

& DEMPSEY FULL DETAILS ARE INCLUDED IN THE REGISTRY

OPERATOR’S PROPOSAL

ALAN PRICE FOUNDER, AND SENIOR EXECUTIVE OF TELNIC LIMITED Alan Price is 45, a UK national, and founding director

of Telnic Limited. Mr Price is a telecommunications and Internet expert,

with extensive and in-depth knowledge and experience of the technological,

business and legal issues raised in this revolutionary medium. Alan Price has a

long experience in television and multimedia, this being prior to his work in

telecommunications and the Internet. This included a career at Independent Television

in the UK, and VideoPitchUK, a multimedia production company providing services

to the advertising industry. Since the early 1990's, Mr Price has been an advisor

and consultant providing specialist advice and development on multimedia,

telecommunications, numbering, interactive and Internet projects. Clients

include: British Airways, Daily Mail, RAC, Save & Prosper, Freepages-Scoot,

and the establishing of the UK National Lottery. He is also founder and a

director of Dial It Communications Limited, a leader in the field of interactive

directory and information systems, and the company is also a Telecommunication

Service License holder. Mr Price is also an advisor to various groups,

including Oftel (the UK telecommunications regulator), and he has been involved

on several working and development groups for Oftel including: Developing

Numbering Administration, and Provision of Directory Information. Mr Price was a founding member of the Internet Council

of Registrars (CORE) when it was originally formed. This was with Networks of

the UK, who are now not part of CORE. He developed and led this project with

Networks. He is also the founder and developer of NET TVÔ in

the UK, a new interactive platform for the converged Internet-television

environment. WILLIAM G HOLMAN NON-EXECUTIVE DIRECTOR, TELNIC LIMITED William Holman has extensive international

experience in financial and operational management. His current executive

position is as Managing Director, Latin America for Thomson Financial, based in

New York. He is responsible for regional development and management of all

activities for this $1.4 bn. financial information company. The business is

active in local market client development, joint ventures in e-publishing and

local Internet information distribution. From 1993 to 1996, Mr Holman held senior

positions with ING/Barings in New York, first as President and Chief Executive

Office of Baring Brothers and Co., a managed NYSE firm with revenues of $140,

involved in research, underwriting and sales of international securities from

28 markets to North American institutional investors. He then became a senior

Managing Director in ING/Barings (US) Securities Holdings, where he managed the

firm’s equity division, and was a member of the ING Regional Management

Committee. From 1988 to 1993 he was with The Thomson

Corporation in Stamford Connecticut, where he was a Director of First Call

Corporation, a global fixed-income research distribution service for

institutions, and prior to that he held the position of Chief Financial Officer

of Thomson Financial Services, which was at that time a $500 mn. financial

information services group. From 1982 to 1988 he held positions in Shearson

Lehman Brothers and British and

Commonwealth Holdings. Mr Holman has degrees from the University

of Pennsylvania, New York University and an MBA from Columbia University. He

also has a Graduate Diploma from Oxford University, and worked in the fine arts

world before entering the financial community. THE COMPANIES ACT 1985 PRIVATE COMPANY LIMITED BY SHARES ARTICLES OF ASSOCIATION (adopted by Special Resolution passed on ·

September 2000) OF TELNIC LIMITED Registered Number

3555437 Incorporated 28

April 1998 CONTENTS 5. Redeemable Shares and purchase of own shares 6. Annual Accounts and Annual General Meetings 12. Restricted and Permitted Transfers 17. Disqualification of Directors

THE COMPANIES ACT 1985 COMPANY LIMITED BY SHARES ARTICLES OF ASSOCIATION OF TELNIC LIMITED adopted by Special Resolution passed on ·

September 2000)

1.1

The regulations contained or incorporated in Table A in the

Schedule to the Companies (Tables A to F) Regulations 1985 as amended as at the

date of adoption of these Articles (“Table A”) shall, except where the

same are excluded or varied by or are inconsistent with these Articles, apply

to the Company. 1.2

The regulations numbered 3, 40, 41, 50, 53, 54, 64 to 68

(inclusive), 73 to 78 (inclusive), 81, 87, 89, 93 to 98 (inclusive) and 112 of

Table A shall not apply to the Company and in lieu thereof and in addition to

the remaining regulations of Table A (subject to the modifications hereinafter

expressed) the Articles hereinafter contained shall constitute the regulations

of the Company. 1.3

No other regulations set out in any statute or statutory

instrument concerning companies shall apply as regulations of the Company. 2.1

Definitions In these Articles unless the

context otherwise requires: “Accounts” shall have the meaning given to such term in

Article 6.1. “Act” means the Companies Act 1985. “Allocation Notice” shall have the meaning given in Article 13.9. “Annual Business Plan” means the annual business plan of the

Company current in respect of each financial year of the Company prepared in

accordance with clause 6.4 of the Subscription and Shareholders’ Agreement. “’A’ Ordinary Shares” means the preferred ‘A’ ordinary shares

of £0.02 each in the capital of the Company, the rights and restrictions

attaching to which are set out in these Articles. “Applicant” shall have the meaning given in Article 13.9. “Appropriate Offer” shall bear the meaning given to such

term in Article 14.2. “Completion Articles” means these articles of association in

their present form or as amended from time to time and the expressions “this Article” and “Article” shall be construed

accordingly. “Board” means the board of directors of the Company from

time to time or any duly authorised committee thereof. “Chart Director” means the Director appointed by Chart in

accordance with clause 7.4 of the Subscription and Shareholders’ Agreement from

time to time. “Chief Executive Officer” means the Director appointed

pursuant to clause 7.6 of the Subscription and Shareholders’ Agreement from

time to time. “Companies Acts” means every statute concerning companies

and all orders, regulations and other subordinate legislation made under each

of them from time to time in force insofar as the same applies to the Company (whether

or not called a Companies Act or within the statutory citation of the Act). “connected person” means a person connected with

another within the meaning of Section 839 of the Income and Corporation Taxes

Act 1988 and the term “connected with”

shall be construed accordingly. “Controlling Interest” means an interest (within the meaning

of Section 324, and Part I of Schedule 13 of the Act) in shares in a company

conferring, in aggregate, 50 per cent. or more of the total voting rights

conferred by all the issued shares in such company. “Conversion Date” means the earlier of a Sale Date, a

Listing Date or the first date after the date upon which these Articles are

adopted by the Company upon which the Company pays any dividend in respect of

any of the Shares (whether such dividend is satisfied by the payment of money

by the Company or by the transfer of any of the Company’s assets), if any. “Convertible Deferred Non-Voting Ordinary Shares” means the

convertible deferred non-voting ordinary shares of £0.02 each in the capital of

the Company. “Deed of Adherence” means a deed supplemental to the

Subscription and Shareholders’ Agreement substantially in the form set out in

schedule 6 thereof whereby a person who acquires Shares may be bound by, and be

entitled to the benefit of, certain provisions of, the Subscription and

Shareholders’ Agreement. “Directors” means the directors of the Company from time to

time. “Employee” means a director or employee of any Group

Company. “Excess Shares” shall have the meaning given in Article 13.9. “Family Transfer” shall have the meaning given in Article 12.4. “Family Trust” means, in relation to any Shareholder or his

Privileged Relations, a trust whether arising under: (A) a settlement inter vivos; or (B) a testamentary disposition; or (C) on an intestacy in respect of which Shares are

held and under which no beneficial interest in the Shares in question is for

the time being vested in any person other than the Shareholder or a Privileged

Relation of such Shareholder and no power of control over the voting rights

conferred by such Shares is for the time being exercisable by or subject to the

consent of any person other than the trustees of the Family Trust concerned or

the Shareholder concerned or his Privileged Relations. “Financial Period” means an accounting period in respect of

which the Company prepares its accounts in accordance with the Companies Acts. “First Share Option Scheme” means the unapproved share option

scheme in respect of ·

Ordinary Shares to be adopted on or about · September 2000, exercisable in accordance with the

terms thereof at £· per

Ordinary Share. “Founders” means the persons whose names are set out in part

1 of schedule 1 of the Subscription and Shareholders’ Agreement and “Founder” includes any of them. “Group” means the Company and all the other companies which

are subsidiaries of the Company and the expression “Group Company” shall be construed accordingly. “Investment Fund” shall have the meaning given in Article 12.7(B). “Investment Manager” shall have the meaning given in Article

12.7(A). “Investor Group” shall have the meaning given in Article

14.2. “Investors” means the persons whose names are set out in

part 2 of schedule 1 of the Subscription and Shareholders’ Agreement plus any

person who has acceded to the Subscription and Shareholders’ Agreement as an

Investor, and “Investor”

includes any of them. “Investor

Majority” means the holders from time to time of at least 50 per cent.

(in nominal value) of the ‘A’ Ordinary Shares held by the Investors from time

to time. “Issue Price” means, in respect of a Share, the

aggregate of the amount paid up or credited as paid up in respect of the

nominal value thereof and any share premium thereon. “Listing” means the admission of any part of the equity

share capital of the Company to the Official List of the UK Listing Authority

and admission to trading on the Stock Exchange or the grant of permission to

deal in the same on any other Recognised Investment Exchange. “Listing Date” means the date upon which a Listing becomes

effective. “London Stock Exchange” means The London Stock Exchange

Limited. “Ordinary Shares” means

the ordinary shares of £0.02 each in the capital of the Company, the rights and

restrictions attached to which are set out in these Articles. “Original Transferor” shall have the meaning given in

Article 12.5. “Privileged Relation” means the wife or husband (or common

law wife or husband) or adult child or adult grandchild (including any adopted

adult child or adopted adult grandchild) of a Shareholder. “Proportionate Entitlement” shall have the meaning given in

Article 13.9. “Recognised Investment Exchange” means a recognised

investment exchange within the meaning of Section 207 of the Financial Services

Act 1986 or Section 285 of the Financial Services and Markets Act 2000. “Relevant Shares” means (to the extent the same remain for

the time being held by a transferee of Shares acquired by means of a transfer

permitted by Article 12) the Shares originally transferred to such person and

any additional Shares issued to such person by way of capitalisation or

acquired by such person in exercise of any right or option granted or arising

by virtue of the holding of such Shares or any of them or the membership

thereby conferred. “Sale Date” means the date upon which an acquisition of

Shares is completed and, as a result, any person (or persons acting in concert

with him) acquire a number of equity shares in the capital of the Company as,

when aggregated with any such equity shares, if any, held by such person or

persons on that date result in such person or persons acquiring a Controlling

Interest (and the term “Sale”

shall be construed accordingly). “Sale Price” shall have the meaning given to such term in

Article 13.1. “Sale

Shares” shall have the meaning given in Article 13.1. “Second Share Option Scheme” means the unapproved share

option scheme in respect of ·

Ordinary Shares to be adopted on or about · September 2000, exercisable in accordance with the

terms thereof at £· per

Ordinary Share. “Senior

Employee” means an employee of

any Group Company whose basic salary exceeds £125,000 per annum. “Settlor” shall have the meaning given to such term in

Articles 12.3 and 13.3. “Shares” means the “A” Ordinary

Shares, the Ordinary Shares and the Convertible Deferred Non-Voting Ordinary

Shares or any of them as the context so requires, and the expression “Shareholder” shall be construed

accordingly. “Stock Exchange” means The London Stock Exchange Limited. “Subscription and Shareholders’ Agreement” means the

Agreement dated ·

September 2000 between (1) the Company, (2) the Founders, (3) Chart and (4) the

Investors as amended from time to time. “Termination Date” means the

date on which a person ceases to be a director or employee of any Group Company

and does not continue to be a director or employee of any Group Company. “Total Transfer Condition” shall have the meaning given in

Article 13.6. “Transfer Notice” shall have the meaning given to such term

in Article 13.1 save that, where the context admits, such term shall

also include a Transfer Notice deemed to have been served pursuant to any other

regulation of these Articles. “Transferor” shall have the meaning given in Article 13.1. “Transferor Group Company” shall have the meaning given in

Article 12.5. “Trust Transfer” shall have the meaning given in Article 12.3. “UK Listing Authority” means the competent authority for the

time being for the purposes of Part IV of the Financial Services Act 1986 or

Part VI of the Financial Services and Markets Act 2000. (A)

Any words or expressions defined in the Companies Acts shall

bear the same meaning in these Articles. (B)

References to statutory provisions shall be construed as

references to those provisions as amended or re-enacted or as their application

is modified by other provisions from time to time and shall include references

to any provisions of which they are re-enactments (whether with or without

modification). (C)

The headings, sub-headings and any contents pages are inserted

for convenience only and shall not affect the construction of these Articles. (D)

References to a “person”

include any individual, company, body corporate, corporation sole or aggregate,

government, state or agency of a state, firm, partnership, joint venture,

association, organisation or trust (in each case whether or not having separate

legal personality and irrespective of the jurisdiction in or under the law of

which it was incorporated or exists) and a reference to any of them shall

include a reference to the others. (E)

Where for any purpose an ordinary resolution of the Company is

required, a special or extraordinary resolution shall also be effective, and

where an extraordinary resolution is required a special resolution shall also

be effective. 3.1

Authorised Share

Capital The share capital of the Company

as at the date of the adoption of these Articles is £· divided into · ‘A’

Ordinary Shares, ·

Ordinary Shares and 8,960 Convertible Deferred Non-Voting Ordinary Shares. 3.2

Rights and Restrictions The special rights and

restrictions attached to and imposed on each class of Shares are as set out in

these Articles. Subject to the provisions of,

respectively, the Companies Acts, these Articles, the Subscription and

Shareholders’ Agreement and to any direction to the contrary which may be given

by ordinary or other resolution of the Company, any unissued Shares (whether

forming part of the original or any increased capital) shall be at the disposal

of the Directors who may offer, allot, grant options over or grant any right or

rights to subscribe for such Shares or any right or rights to convert any

security into such Shares or otherwise dispose of them to such persons, at such

times, for such consideration and upon such terms and conditions as the

Directors may determine. For the purposes of Section 80 of

the Act and save as hereinafter provided, the Directors are generally and

unconditionally authorised to exercise all powers of the Company to allot

relevant securities (as defined in the said Section) up to an aggregate nominal

amount of £·

PROVIDED ALWAYS THAT no relevant securities shall be allotted other than in

accordance with the terms of these Articles, the Subscription and Shareholders’

Agreement, the rules of the First Share

Option Scheme and of the Second Share Option Scheme and such authority shall

expire at the conclusion of the next annual general meeting of the Company. 4.3

Pre-emption Section 89(1) of the Act shall not

apply to the Company. 5.1

Issue, purchase and

payment Subject to the provisions of the

Companies Acts and these Articles the Company may: (A)

issue Shares on terms that they are (or are at the option of

the Company or the members concerned) liable to be redeemed; (B)

purchase shares (including any redeemable shares); and (C)

make payment in respect of the redemption or purchase

(pursuant to Sections 159 and 160 or, as the case may be, Section 162 of the

Act and the relevant powers above) of any of its own shares otherwise than out

of distributable profits of the Company or the proceeds of a fresh issue of

shares to the extent permitted by Sections 171 and 172 of the Act. Within 3 months of the end of each

Financial Period, the Directors shall cause to be prepared and, so far as

within their power, audited, in accordance with the provisions of the Companies

Acts: (A)

a balance sheet of the Company, and, if the Company then has any subsidiaries, a consolidated

balance sheet of the Company and such subsidiaries as at the end of such

Financial Period; (B)

a profit and loss account of the Company, and, if the Company

then has any subsidiaries, a consolidated profit and loss account of the

Company and such subsidiaries for such Financial Period; and (C)

a statement setting out the source and use of the Company’s

funds in such Financial Period and, if the Company then has any subsidiaries, a

consolidated statement of the source and use of the Company and its

subsidiaries’ funds in such Financial Period including, in each such case, the

notes thereto and the directors’ report and auditors’ report thereon (which

said balance sheet and profit and loss account, notes and reports are

collectively referred to herein as the “Accounts”). An annual general meeting of the

Company shall be held within 4 months of the end of each Financial Period, at

such time and place as the Directors shall determine, and the Directors shall

cause to be laid before each such annual general meeting the Accounts for the

immediately preceding Financial Period together with the respective reports

thereon of the Directors and of the Auditors, such reports complying with the

provisions of the Companies Acts. In the event of a winding-up of

the Company or other return of capital the assets of the Company available for

distribution to shareholders remaining after payment of all other debts and

liabilities of the Company and of the costs, charges and expenses of any such

winding-up shall be applied in the following manner and order of priority: (A)

first, in paying to the holders of the ‘A’ Ordinary Shares (in

proportion to the numbers of ‘A’ Ordinary Shares held by each of them) all

unpaid accruals of any dividends declared but not paid at such date in respect

thereof; and (B)

second, in paying to the holders of the Ordinary Shares (in

proportion to the numbers of Ordinary Shares held by each of them) all unpaid

accruals of any dividends declared but not paid at such date in respect

thereof; (C)

third, in paying to the holders of the ‘A’ Ordinary Shares (in

proportion to the number of ‘A’ Ordinary Shares held by each of them) the Issue

Price of such “A” Ordinary Shares; and (D)

fourth, in paying to the holders of Ordinary Shares (in

proportion to the number of Ordinary Shares held by each of them) the Issue Price

of such Ordinary Shares; and (E)

last, in distributing the balance amongst the holders of the

‘A’ Ordinary Shares and the Ordinary Shares pari

passu as if they were all shares of the same class. Subject to any special rights or

restrictions as to voting attached to any Shares by or in accordance with these

Articles, on a show of hands, every holder of Ordinary Shares and/or of “A”

Ordinary Shares who (being an individual) is present in person or by proxy or

(being a corporation) is present by a representative not being himself a holder

of Ordinary Shares and/or of “A” Ordinary Shares shall have one vote and on a

poll every holder of Ordinary Shares and/or of “A” Ordinary Shares who is

present in person or by proxy or (being a corporation) is present by a

representative or by proxy shall (except as hereinafter provided) have one vote

for every Ordinary Share and one vote for every “A” Ordinary Share of which, in

each case, he is or represents the holder.

The holders of Convertible Deferred Non-Voting Ordinary Shares shall

have no rights to vote in respect of such Convertible Deferred Non-Voting

Ordinary Shares, either on a show of hands or on a poll. 8.2

Written Resolutions Subject to the provisions of the

Companies Acts, a resolution in writing signed by all the members of the

Company who would be entitled to receive notice of and to attend and vote at a

general meeting of the Company, or by their duly appointed attorneys, shall be

as valid and effectual as if it had been passed at a general meeting of the

Company duly convened and held. Any

such resolution may be contained in one document or in several documents in the

same terms each signed by one or more of the members or their duly appointed

attorneys and signature, in the case of a body corporate which is a member,

shall be sufficient if made by a director or the secretary thereof or by its

duly authorised representative. 9.1

Listing and Sale On a Conversion Date, each of the

Convertible Deferred Non-Voting Ordinary Shares then in issue shall

automatically convert into one Ordinary Share.

Each Ordinary Share arising on conversion shall be credited as paid up

as to the same extent as that to which the Convertible Deferred Non-Voting

Ordinary Share which was converted was paid up or credited as paid up. Any

conversion pursuant to this Article 9.1 shall be made on the following terms: (A)

it shall be effected at no cost to the holders of the

Convertible Deferred Non-Voting Ordinary Shares concerned; (B)

on the Conversion Date the Company shall issue to the persons

entitled thereto certificates for the Ordinary Shares resulting from the

conversion and the certificates for the Convertible Deferred Non-Voting

Ordinary Shares falling to be converted shall be deemed invalid for all

purposes and the holders thereof shall be bound to deliver their Convertible

Deferred Non-Voting Ordinary Share certificates (or such indemnity in lieu

thereof as the Company may reasonably require) to the Company forthwith for

cancellation; and (C)

the Ordinary Shares arising on conversion of any Convertible

Deferred Non-Voting Ordinary Shares shall in all respects rank as one class of

shares with the existing Ordinary Shares then in issue. Subject to the provisions of the

Companies Acts and to the provisions of these Articles the Company may by

ordinary resolution from time to time declare dividends to be paid to the

members according to their respective rights and priorities and interests in

the profits available for distribution. No dividend shall be declared in

excess of the amount recommended by the Board and the determination of the

Board as to the amount of the profits available for dividends shall be

conclusive. The Company may, upon the

recommendation of the Board, by ordinary resolution direct payment of a

dividend in whole or in part by the distribution of specific assets (and in

particular of paid up shares or debentures of any Group Company) and the Board

shall give effect to such resolution. Every dividend shall be apportioned and paid to the

appropriate shareholders proportionately according to the amounts of nominal

value paid up or credited as paid up on the Shares of the relevant class held

by them respectively during any portion or portions of the period in respect of

which the dividend is payable and shall accrue on a daily basis and, for the

purpose of such apportionment, the Shares shall be treated as if they comprised

a single class. The special rights attached to any

class of Shares may (unless otherwise provided by the terms of issue of the

Shares of that class) be varied or abrogated, whether or not the Company is

being wound up, either with the consent in writing of the holders of 75 per

cent. (in nominal value) of the issued Shares of that class or with the

sanction of an extraordinary resolution passed at a separate general meeting of

such holders, but not otherwise. All

the provisions of these Articles relating to general meetings of the Company

shall apply mutatis mutandis to every

such separate meeting, except that: (A)

the necessary quorum shall

be two persons present in person or by proxy or by a duly authorised

representative of a member which is a corporation, together holding not less

than one half (in nominal value) of the issued Shares of the class or, at any

adjourned meeting of such holders, one person so present holding not less than

one-quarter (in nominal value) of the issued Shares of the relevant class; and (B)

any holder of shares of the class present in person or by proxy

or by a duly authorised representative of a member which is a corporation may

demand a poll. (A)

Convertible Deferred Non-Voting Ordinary Shares may not be

transferred, and references in Article 12 and Article 13 to “Shares” shall,

accordingly, be read as references to all Shares other than Convertible

Deferred Non-Voting Ordinary Shares. Any Shares may be transferred

pursuant to an Appropriate Offer. A transfer of any Shares held by a

Shareholder or a Privileged Relation of a Shareholder (the “Settlor”) may be made to

trustees upon a Family Trust and, on a change of trustees, by such trustees to

the new trustees of the same Family Trust without restrictions as to price or

otherwise (a “Trust Transfer”)

PROVIDED THAT: (A)

the Company will not incur any costs in connection with the

setting up or administration of the Family Trust concerned; and (B)

before a Trust Transfer is effected, the trustees of such

Family Trust shall give a written notice to the Company (in a form reasonably

acceptable to the Company) that there is no provision under the terms of the

Family Trust which would expressly prohibit the trustees thereof from (a)

giving, on a Sale or Listing, such warranties and indemnities (subject only to

reasonable limits upon such trustees’ liability) as trustees of such Family

Trust to enable such Sale or Listing to be effected and (b) observing any

restrictions (whether relating to the disposal of any Relevant Shares comprised

in the assets of such Family Trust or otherwise) pursuant to the arrangements

relating to the Sale or Listing. Such

notice shall also include an acknowledgement from the trustees that they may be

asked to give warranties and indemnities in connection with a Sale or a Listing

and may be asked to restrict distributions in respect of any Relevant Shares to

the beneficiaries under such Family Trust during any period in which there are

outstanding contingent liabilities under such warranties and indemnities. A Shareholder may transfer all or

any of his holding of Shares or any beneficial interest therein for whatever

consideration to his Privileged Relations (a "Family Transfer") and a Privileged Relation or the

trustees of a Family Trust of a Shareholder may transfer all or any of his (or

its) Relevant Shares or any beneficial interest therein to another Privileged

Relation of that Shareholder or to that Shareholder (also a "Family Transfer") PROVIDED

THAT: (A)

before a Family Transfer is effected, the transferee shall

give a written acknowledgement to the Company (in a form reasonably acceptable

to the Company) that, in the event of a Sale or Listing, such transferee may be

asked to give warranties and indemnities (subject only to reasonable limits on

liability) to enable such Sale or Listing to be effected and that such

transferee will observe any restrictions upon him (whether relating to the

disposal of any Relevant Shares (if any) held by him immediately after such

Sale or Listing or otherwise) pursuant to the arrangements relating to the Sale

or Listing; and (B)

subject as provided below any person who acquires, whether

directly or indirectly, any shares or any beneficial interest therein pursuant

to this Article 12.4 shall serve forthwith, (or if he does not he shall be

deemed to have served, a Transfer Notice in respect of the Relevant Shares) if the

person is a spouse of a Shareholder and she ceases to be the spouse of that

Shareholder PROVIDED ALWAYS THAT if the Shareholder remains a Shareholder at

that time and the Shareholder so notifies his former spouse within 14 days of