Registry Operator's Proposal

PRIOR TO REVIEWING THE DESCRIPTION OF TLD POLICIES OR THIS REGISTRY OPERATOR'S PROPOSAL, PLEASE REFER TO THE EXECUTIVE SUMMARY ATTACHED TO THE DESCRIPTION OF TLD POLICIES AS APPENDIX A .

I. GENERAL INFORMATION

D1. The first section of the Registry Operator's Proposal (after the signed copy of this page) should be a listing of the following information about the registry operator. Please key your responses to the designators (D1, D2, D3, etc.) below.

D2. The full legal name, principal address, telephone and fax numbers, and e-mail address of the registry operator.

Afilias, LLC

c/o Rita A. Rodin, Esq.

Skadden, Arps, Slate, Meagher & Flom LLP

Four Times Square

New York, NY 1003

Phone: (212) 735-3000

Fax: (212) 735-2000

E-Mail: rrodin@skadden.com

D3. The addresses and telephone and fax numbers of all other business locations of the registry operator.

None, at present.

D4. The registry operator's type of business entity (e.g., corporation, partnership, etc.) and law (e.g., Denmark) under which it is organized.

Afilias, LLC ("Afilias" or the "Company") is a limited liability company organized under the Delaware Limited Liability Company Act, as amended from time to time, in the United States of America.

D5. URL of registry operator's principal world wide web site.

http://www.afilias.com

D6. Dun & Bradstreet D-U-N-S Number (if any) of registry operator.

Afilias does not have a Dun & Bradstreet D-U-N-S number.

D7. Number of employees.

Afilias currently has a thirteen member Board of Managers, and no other employees.

D8. Registry operator's total revenue (in US dollars) in the last-ended fiscal year.

Afilias was formed on Monday, September 25, 2000; so it had no revenue during the last-ended fiscal year.

D9. Full names and positions of (i) all directors, (ii) all officers, (iii) all relevant managers, and (iv) any persons or entities owning five percent or more of registry operator.

Afilias currently has no officers. Each member of Afilias owns approximately 5.25% of the membership interests of Afilias. Please see Schedule A to the Afilias, LLC Operating Agreement ("Operating Agreement").

1st Domain.net, a division of G+D International LLC

Corporate Domains, Inc.

Domain Bank, Inc.

DomainInfo AB

DomainPeople, Inc.

Domain Registration Services

Enter-Price Multimedia AG (EPAG)

Internet Council of Registrars (CORE)

interQ, Inc.

NameSecure.com

Netnames International Ltd.

Network Solutions, Inc. Registrar Operations

Polar Software Ltd d/b/a Signdomains.com

Procurement Services International (Japan), Inc.

Register.com

Schlund + Partner AG

SiteName

Speednames, Inc.

Tucows, Inc.

The interim senior management team of Afilias consists of a thirteen-member Board of Managers. The present Managers elected by the members of Afilias are:

D10. Name, telephone and fax number, and e-mail address of person to contact for additional information regarding this proposal. If there are multiple people, please list all their names, telephone and fax numbers, and e-mail addresses and describe the areas as to which each should be contacted.

All inquiries regarding this proposal should be addressed to:

| Public Relations: Gertrude E. Bakel Phone: (212) 885-0490 Fax: (212) 885-0570 E-Mail:gbakel@hillandknowlton.com |

Legal: Rita A. Rodin, Esq. Phone: (212) 735-3000 Fax: (212) 735-2000 E-Mail:rrodin@skadden.com |

D11. The full legal name, principal address, telephone and fax numbers, e-mail address, and Dun & Bradstreet D-U-N-S Number (if any) of all subcontractors identified in item D15.3 below.

Afilias has signed a binding term sheet with Tucows, Inc. ("Tucows") pursuant to which Tucows will provide back-end registry services for Afilias.

Tucows' information is as follows:

Tucows, Inc.

535 Fifth Avenue, 17th Floor

New York, NY 10017

Telephone: 416-535-0123

Toll Free: (800) 371-6992

International Toll Free: IAC (800) 371-6992

Facsimile: 416-531-2516

E-mail:ross@tucows.com

D-U-N-S Number: None.

II. BUSINESS CAPABILITIES AND PLAN

D12. The second section of the Registry Operator's Proposal (after the "General Information" section) is a description of the registry operator's Business Capabilities and Plan. This section must include a comprehensive, professional-quality business plan that provides detailed, verified business and financial information about the registry operator. The topics listed below are representative of the type of subjects that will be covered in the Business Capabilities and Plan section of the Registry Operator's Proposal.

D13. The Business Capabilities and Plan section should consist of at least the following:

| D13.1. Detailed description of the registry operator's capabilities. This should describe general capabilities and activities. This description also offers the registry operator an opportunity to demonstrate the extent of its business and managerial expertise in activities relevant to the operation of the proposed registry. The following items should, at a bare minimum, be covered: |

| D13.1.1. Company information. Date of formation, legal status, primary location, size of staff, formal alliances, references, corporate or other structure, ownership structure. |

Formed on September 25, 2000 as a Delaware limited liability company owned by a consortium of nineteen (19) leading ICANN-accredited Internet domain name registrars ("Member Registrars"), Afilias was founded to operate an unsponsored, unrestricted generic Top Level Domain ("gTLD") registry. Appendix A provides brief descriptions of founding Member Registrars. Afilias is considering locating its headquarters in Europe, and will make a final decision upon approval of this application by ICANN.

Afilias' staff currently consists of a thirteen-person Board of Managers (the "Board") comprised of senior-level executives from the Member Registrars and elected by the Member Registrars. Four three-member Board committees will be formed comprising members of the Board, including an Executive Committee, an Audit Committee, a Nominating Committee and a Compensation Committee. Upon securing approval by ICANN to operate the gTLD, Afilias will hire executive and administrative staff of approximately 25 people over the first four months of operation.

Afilias has executed a term sheet with Tucows wherein a joint venture between Tucows and Q9 Registration Services will serve as the technology provider to Afilias ("Technology Provider" or "TP") and provide the technical infrastructure and database management of the TLD registry for at least the first two years of operations.

In addition to working with the TP, Afilias intends to utilize the technical expertise of its Member Registrars to transition the registry operations and develop its own technical infrastructure required to operate and manage the TLD registry starting in the third year of operations. Qualified representatives from Afilias will be selected to form a Technical Review Committee, which will provide guidance both during the development of the registry and on an ongoing basis. Section D15.1 provides short descriptions of the initial members of the Technical Review Committee.

As discussed in greater detail in the Operating Agreement, each Member Registrar currently owns approximately 5.25% of Afilias, and no Member Registrar will be allowed to own more than 11% of Afilias either as a result of any acquisition or potential consolidation among Member Registrars or otherwise. Afilias will issue two classes of membership interests. Class A membership interests will be issued to the founding Member Registrars.

To promote competition among registrars and incentivize non-member registrars to promote the new TLD, Afilias will also issue Class B membership to other ICANN-accredited registrars or other entities electing to take ownership positions in Afilias, in accordance with the Operating Agreement. Class B membership interests will represent a maximum of 60% of Afilias on a fully-diluted basis.

Because Afilias was only recently formed, it has no references or formal alliances. However, trade references for the individual Member Registrars are available upon request.

| D13.1.2. Current business operations. Core capabilities, services offered, products offered, duration of provision of services and products. |

Because Afilias was formed on September 25, 2000, it currently offers no products or services. The capabilities of the individual Member Registrars are described in Section D13.1.4 and in Appendix A.

| D13.1.3. Past business operations/entity history. History, date of formation, legal status/type of entity, initial services, duration of provision of services and products. |

Afilias was formed on September 25, 2000 as a limited liability company organized under the Delaware Limited Liability Company Act, as amended from time to time, in the United States of America.

Because Afilias was formed on September 25, 2000, it has no real operational history and currently offers no services or products. The services and products offered by the individual Member Registrars are described in Section D.13.1.4 and in Appendix A.

| D13.1.4. Registry/database/Internet related experience and activities. Experience with database operation, Internet service provision. |

While Afilias is a newly formed entity and has no operating history, it is uniquely positioned to build on the core capabilities, technical expertise, operating experience, and extensive market penetration of its Member Registrars. In the aggregate, Afilias' Member Registrars registered over 10 million domain names in their last fiscal year, and represent approximately 80% of all active domain name registrations (DNR) transacted over the last 10 years. In addition to their strong position in the DNR market for the .com, .net, and .org top level domains, the Member Registrars collectively offer a wide range of related Internet services, including country-code DNR, country-code registry operations, Web hosting, ISP services, Web page design, unified messaging, and account management services. Appendix A provides additional information regarding the services provided by each of the founding Member Registrars.

While five companies were chosen to participate in the shared-registry-system test-bed, only three actually participated, two of which are Member Registrars of Afilias.

As a group, Member Registrars provide their services on a truly global basis, with 65% having offices in North America, 53% in Europe, 26% in Asia and the Pacific Rim, 5% in Australia and 5% in the Middle East. Including CORE's registrar members, some of which are not ICANN-accredited, Afilias' reach spans an additional 85 registrars in 23 countries. Figure 1 graphically depicts the worldwide headquarters locations of its Member Registrars, not including the 85 CORE member registrars. Collectively, Afilias benefits from substantial experience in providing DNR services since the inception of the Domain Name System, including the pioneering efforts of one member, Network Solutions, Inc., which has provided DNR registry and registrar services for the past eight years.

| D13.1.5. Mission. The registry operator's mission and how it relates to expansion into the registry operation field. |

Afilias' mission is to expand the Internet as a global resource that fosters communication, commerce and community by introducing, marketing, and managing a new global domain name to Internet users around the world. Through the introduction of a new unrestricted top-level domain name, Afilias will endeavor to transform the Internet into a truly global marketplace. Afilias will leverage the expertise and experience of its Member Registrars to operate a more efficient registry service in markets that are currently underserved by the existing registry service. Afilias is committed to enhancing the DNS while maintaining the stability of the Internet.

| D13.1.6. Management. Qualifications and experience of financial and business officers and other relevant employees. Please address/include past experience, resumes, references, biographies. |

As previously noted, Afilias' interim senior management team consists of a thirteen-member Board comprised of senior management executives from the Member Registrars. The Managers have been elected to the Board for terms ranging from one to three years and will elect a chairman to preside over the Board. The list of Managers on the Board and their respective terms is provided below. Resumes for each Managers are provided in Appendix B:

Three-Year Term Members

Kent Jordan, Vice President and General Counsel, Corporate Domains Inc.

Richard Lindsay, Director and General Manager, Systems Division, interQ, Inc.

John Wong, President, Domain Registration Services.

Bob Connelly, President, Procurement Services International (Japan), Inc.

Two-Year Term Members

Mickey Beyer Clausen, Co-Founder and Vice President, Business Development, Speednames

Eric Schaetzlein, Co-Founder and Senior Manager, Schlund & Partner AG.

Tom Barrett, CEO, Netnames International Ltd.

Jeff Field, Chairman and Founder, NameSecure.com, Inc.

Moshe Fogel, Vice President of Marketing and Business Development, SiteName

One-Year Term Members

Joseph Kibur, CEO, DomainPeople, Inc.

Phillipp Grabensee, Outside Legal Counsel, Enter-Price Multimedia AG.

Kenyon Stubbs, Chairman of the Executive Committee, Internet Council of Registrars; Vice President, Domain Bank, Inc.; Chairman of the ICANN Names Council

Govinda Leopold, CEO, 1st Domain.net, a division of G&D International, LLC.

The Board will elect the following four board committees that will set the direction of Afilias on an ongoing basis.

Executive Committee

The three-person Executive Committee shall be chiefly responsible for supervising the executive officers of Afilias and liasoning with them to provide Board input on management issues. Members of the Executive Committee will be elected by the Board upon approval from ICANN to operate the new TLD.

Audit Committee

The three-person Audit Committee will be responsible for recommending the independent public accountants as auditors for Afilias, reviewing the audit and management analysis performed by the independent public accountants, managing the internal accounting controls, and developing the audit planning process. Members of the Audit Committee will be elected by the Board to operate the new gTLD.

Nominating Committee

The three-person Nominating Committee will be responsible for reviewing and recommending candidates to the Board for Board vacancies, recommending criteria for Managers' tenure and nomination criteria. Members of the Nominating Committee will be elected by the Board upon approval from ICANN to operate the new gTLD.

Compensation Committee

The three-person Compensation Committee will be responsible for reviewing and recommending salary levels, increases, and benefit programs for officers and employees of Afilias. Members of the Compensation Committee will be elected by the Board.

Upon approval from ICANN to operate the new gTLD, Afilias will recruit, either through its own efforts or through a retained executive search firm, a senior management and administrative team for Afilias. Key executive-level positions will include the following:

President

Responsible for coordinating the efforts of the other executives, the Board and Executive Committee, implementing the overall vision and mission of Afilias and interfacing with ICANN on significant policy issues.

Chief Financial Officer

Responsible for managing the financial viability of Afilias and managing revenue recognition related to the billing and collection of registration fees from its registrar customer base. The Chief Financial Officer will manage a 2-person staff, including a Staff Accountant and an Accounts Operations Manager responsible for billing.

Chief Operating Officer/Chief Technical Officer

Responsible for managing the technical operations of Afilias. The Chief Technology Officer will manage the relationships with Afilias' technology vendors and sub-contractors, liaison with Afilias' Technology Review Committee, manage the transition of the registry operations from Tucows to Afilias during the second year of operations, and recruit the necessary technical staff to operate the registry on an ongoing basis.

Chief Marketing Officer

Responsible for implementing Afilias' marketing plan as outlined in Section 13.2.4 and developing ongoing marketing, branding, and public relations initiatives. The Chief Marketing Officer will also be responsible for transitioning Afilias' marketing function from outsourced professional service providers to an internal staff within Afilias, as required.

Vice President, Policy and Registrar Relations

Responsible for ensuring high-quality customer support for Afilias' registrar customers and for refining and developing additional policy in conjunction with ICANN relating to services provided to such registrar customers. Afilias expects this role to be critical during the Sunrise Period described in Section E15 of the Description of TLD Policies, during which time domain name registrations must be vetted against trademark registrations. This person will also serve as an ombudsman, assisting in dispute resolutions as set forth in Section E15 of the Description of gTLD Policies.

Additional administrative staff positions required to operate Afilias may include a Human Resources/Office Manager and a General Counsel. Proposed salaries associated with each executive, administration, and staff position identified above can be found in the Headcount Worksheet within Appendix C.

| D13.1.7. Staff/employees. Current staff size, demonstrated ability to expand employee base, hiring policy, employee training, space for additional staff. |

As of the date of the application, Afilias will consist of its Board of Managers, with no additional executive or administrative staff. Afilias will benefit from the collective experience of its participating Member Registrars to transfer the expertise required to build its staff within six months of approval of the application by ICANN, enabling Afilias to set a target date to begin offering its services in Q3 2000. High-growth Member Registrars, including Tucows, Register.com, Inc. and Network Solutions, Inc. have proven capabilities for scaling their staff to meet the needs at peak level demands, and Afilias will benefit from the transfer of knowledge from its Member Registrars to successfully build its staff as demand levels require.

In addition to its elected Board, Afilias has retained a variety of professional service providers to assist in its development and in the preparation of this proposal to ICANN. Specifically, Afilias has retained Skadden, Arps, Slate, Meagher & Flom, LLP as its outside legal counsel to advise it during its formation and to coordinate the efforts of Member Registrars in preparing this proposal for ICANN. Afilias has also retained Hill and Knowlton to assist it in developing an international public relations campaign. As a subsidiary of WPP, Hill and Knowlton also brings the expertise of Blanc & Otus, and the advertising and marketing expertise of OgilvyOne. Finally, Afilias has retained KPMG to provide business planning advisory services relating to the development of its business plan.

| D13.1.8. Commercial general liability insurance. Address/include amount of insurance policy, provider of policy, plans for obtaining additional insurance. |

Afilias has partnered with Frank Crystal & Co., Inc. to obtain commercial general liability insurance coverage with an aggregate liability limit of $2,000,000. Afilias will also obtain additional insurance as deemed appropriate by management that will provide additional protection to Afilias for risks inherent in its operations, including potential liability for intellectual property infringement and for negligent acts, errors or omissions that may arise out of the processing of electronic data for others and for related computer services. Afilias is committed to ensuring that appropriate policies are secured at all times and will consult with ICANN on an ongoing basis regarding appropriate levels of coverage.

| D13.2. Business plan for the proposed registry operations. This section should present a comprehensive business plan for the proposed registry operations. In addition to providing basic information concerning the viability of the proposed operations, this section offers the registry operator an opportunity to demonstrate that it has carefully analyzed the financial and operational aspects of the proposal. At a minimum, factors that should be addressed are: |

| D13.2.1. Services to be provided.A full description of the registry services to be provided. |

As a registry operator, Afilias will provide the following services and support to its registrar customers:

1) Registration Services

a) Domain Name Registration

Afilias' core service will focus on registering domain names submitted by its ICANN-accredited registrar customers to its TLD registry. Afilias will register the domain names submitted by registrars as a general policy for a term ranging from two to ten years, as selected by registrar customers. Afilias will implement a five-day grace period to cancel a registration, which will trigger a refund to the registrar.

b) Domain Name Renewal

After two years of operation, Afilias will provide domain name renewal services whereby registrars may renew domain names with the registry on behalf of their registrant customers for an additional term, which can range in length from one to ten years in yearly increments. In addition, as further described in Section E10 of the Description of TLD Policies, Afilias will automatically renew registrations by one year when domain registrations expire. Renewals, however, may be canceled by registrars for a refund of the renewal fee within 45 days of the renewal.

c) Registrar Transfer

When a registrant transfers a registration from one registrar to another, Afilias will automatically extend the term of the registration for an additional year.

d) Whois Lookup

Afilias will operate a registry-level Whois service to allow third parties to conduct searches on domain names to determine their availability and ownership.

e) Registrar Billing/Status Reports

Afilias will provide customized billing and registration activity reports to registrar customers to provide continuous communication regarding account status and requests for minimum account deposits.

2) TLD Marketing

Through its appointed marketing partners, Afilias will market and brand the new TLD worldwide. Through these marketing efforts, Afilias acts to fulfill ICANN's mission to enhance the functionality and usability of the Internet on a global basis. These marketing efforts are intended to create enhanced global awareness of the Internet, its growth, and its evolution from a saturated dot-com brand to a resource with broad appeal that transcends cultural boundaries.

The overarching strategy for Afilias is to create a brand that brings the Internet and domain name registration to individuals and businesses everywhere. In addition to investing in the brand by advertising it in a range of markets worldwide, Afilias is uniquely positioned to utilize its Member Registrars to market the TLD to their registrant customers, triggering a viral, cost-effective marketing campaign.

3) Rebate Program

Afilias will institute a rebate program during each year of operation. Through this rebate program, "active registrars" (defined as those ICANN-accredited registrars that have registered domain names in the new TLD) will be eligible to receive a rebate based on the amount of domain names registered in the registry. Afilias will allocate 25% of cash on hand (less allocations for operating expenses) to distribute among these active registrars. This amount will be distributed to the registrars in proportion to the number of registrations registered by that registrar during the relevant period.

| D13.2.2 Revenue model. A full description of the revenue model, including rates to be charged for various services. |

Afilias will derive revenue chiefly through domain name registration and domain name renewal fees.

Domain Name Registration Fees

Afilias will charge US$5.75 for each domain name registration per year. Registrars will be required to register each domain name for a minimum of two years and a maximum of ten years in one-year increments. As such, registrars will be billed US$11.50 for each two-year initial registration. Afilias will collect registration fees for the total term at the time of registration.

Domain Name Renewal Fees

Similarly, for registration renewals, Afilias will charge registrars $5.75 for each renewal year. If a registrant wishes to renew a registration, the renewal must be for a term of between one and ten years. These revenues will begin during the third year of operations when the first round of two-year registrations become due for renewal. Afilias will collect renewal fees for the total renewal term at the onset of the renewal term.

Afilias has chosen a flat annual registration and renewal fee revenue structure for two primary reasons. First, registrars have become accustomed to the annual-fee pricing structure developed by Verisign Global Registry Services in its relationships with ICANN-accredited registrars. Second, Afilias believes that Internet-based commerce is currently not well-suited for discrete micro-payments based on specific transactions performed by the registry.

| D 13.2.3. Market. Market definition, size, demand, accessibility. |

Market Definition

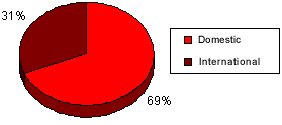

The market is defined as the total worldwide number of registered domain names. In terms of unrestricted TLDs, 69% are registered in the US.

Web Address Volume to Date - Domestic vs. International

*Source: NSI (dotcom.com)

universe

of .com, .net, .org sites

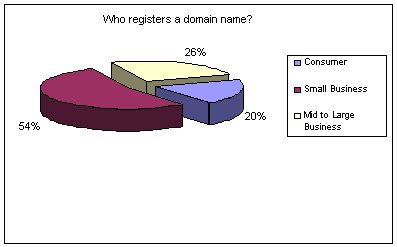

Current Registrant Profile

According to recent statistics*, 80% of domain names have been registered by businesses and 20% by consumers. Of businesses, 67% employ 1-4 people. This suggests three distinct groups:

Registrant Motivation

Understanding why people register domain names will help tailor Afilias' key messages to meet the needs of the various customer segments.

This group of registrants primarily registers domain names for the purpose of setting up personal or non-business homepages.

Typically, a small business will register a new domain name when launching a new business, product, or service to communicate the new offering.

These companies generally register new domain names to publicize new products and services, to protect trademarks, and to increase brand awareness. This group of registrants frequently register similarly spelled domain names to protect their brand assets.

Market Size

There is not a direct correlation between the number of Internet users and the number of domain names registered in any given market. However, countries with high penetration rates typically have high registration rates. The following sections demonstrate this premise.

Internet Users

The following chart indicates the number of Internet users and penetration rates in several major markets. Users are defined as adults over 18 who have accessed the Internet within the past 30 days.

| Region | Country | Dec-99 | |

| # Online (M) | Penetration | ||

| North America | USA | 106,600 | 59% |

| Canada | 13,600 | 56% | |

| subtotal | 120,200 | 58% | |

| Europe | UK | 20,400 | 33% |

| Germany | 30,700 | 29% | |

| Netherlands | 7,600 | 40% | |

| Italy | 15,100 | 16% | |

| France | 15,800 | 22% | |

| Sweden | 3,600 | 53% | |

| Spain | 9,800 | 18% | |

| Belgium | 3,700 | 28% | |

| Switzerland | 3,400 | 45% | |

| Russia | 5,300 | 5% | |

| Poland | 5,200 | 11% | |

| Other | 12,864 | 21% | |

| subtotal | 133,464 | 27% | |

| Latin America | Mexico | 5,500 | 27% |

| Brazil | 6,900 | 21% | |

| Argentina | 2,600 | 13% | |

| Other | 3,700 | 17% | |

| subtotal | 18,700 | 20% | |

| Asia/Pacific | Japan | 57,100 | 33% |

| Australia | 8,000 | 48% | |

| Taiwan | 8,600 | 29% | |

| South Korea | 16,500 | 31% | |

| Hong Kong | 2,700 | 35% | |

| China | 8,100 | 12% | |

| Malaysia | 2,900 | 23% | |

| Other | 6,967 | 13% | |

| subtotal | 110,867 | 28% | |

source: Angus Reid "Faces of the Web" study, Jan. 2000

Some markets, such as China, which have large populations, do not necessarily have high penetration rates, but do have a high number of Internet users when compared to markets, such as Australia, where the population is relatively small.

Current Worldwide Registrations

The following chart indicates the total number of domain names, including .com, .net, .org, and all ccTLDs, registered worldwide.

| Region | Country | Dec-99 Domains |

| North America | USA | 24,863,000 |

| Canada | 1,669,000 | |

| subtotal | 26,532,000 | |

| Europe | UK | 1,901,000 |

| Germany | 1,702,000 | |

| Netherlands | 820,000 | |

| Italy | 658,000 | |

| France | 779,000 | |

| Sweden | 594,000 | |

| Spain | 415,000 | |

| Belgium | 320,000 | |

| Switzerland | 306,000 | |

| Russia | 214,000 | |

| Poland | 183,000 | |

| Other | 2,364,000 | |

| subtotal | 10,256,000 | |

| Latin America | Mexico | 404,000 |

| Brazil | 446,000 | |

| Argentina | 142,000 | |

| Other | 80,000 | |

| subtotal | 1,072,000 | |

| Asia/Pacific | Japan | 2,636,000 |

| Australia | 1,090,000 | |

| Taiwan | 597,000 | |

| South Korea | 283,000 | |

| Hong Kong | 114,000 | |

| China | 71,000 | |

| Malaysia | 59,000 | |

| Other | 515,000 | |

| Subtotal | 5,365,000 | |

| TOTAL | 43,225,000 |

source: Center for Next Generation Internet

Accessibility

While certain developing markets are believed to represent tremendous growth potential, restrictive government policies as well as an inadequate infrastructure offer limited growth potential in the near future. For example, there are 1.09 million domain names registered in Australia, which has an online population of 8 million, while in China, there are 71,000 registered domain names, despite a total population of 8.1 million Internet users. In Latin America, two countries account for a total 80% of all registered domains in the region.

Market Demand

Even though growth rates in other countries and regions are higher than in the US, the absolute number of new Internet users in the US is still increasing, due to sophistication of the market and the large potential base of users. The same holds true for the growth of domain name registrations. In all likelihood, the US will continue to represent the largest market in terms of future registrations.

The following chart indicates the projected number of Internet users in major markets over the next three years.

| Dec-00 | Dec-01 | Dec-02 | |||||

| Region | Country | # Online (M) | growth> | # Online (M) | growth | # Online (M) | growth |

| North America | USA | 139,600 | 30.96% | 153,600 | 10.03% | 160,800 | 4.69% |

| Canada | 17,000 | 25.00% | 18,500 | 8.82% | 20,400 | 10.27% | |

| subtotal | 156,600 | 30.28% | 172,100 | 9.90% | 181,200 | 5.29% | |

| Europe | UK | 34,100 | 67.16% | 41,400 | 21.41% | 47,600 | 14.98% |

| Germany | 49,700 | 61.89% | 66,700 | 34.21% | 76,200 | 14.24% | |

| Netherlands | 11,600 | 52.63% | 13,700 | 18.10% | 15,600 | 13.87% | |

| Italy | 28,400 | 88.08% | 38,700 | 36.27% | 49,100 | 26.87% | |

| France | 28,000 | 77.22% | 35,900 | 28.21% | 42,400 | 18.11% | |

| Sweden | 4,300 | 19.44% | 4,700 | 9.30% | 5,000 | 6.38% | |

| Spain | 14,700 | 50.00% | 19,600 | 33.33% | 24,000 | 22.45% | |

| Belgium | 6,200 | 67.57% | 8,200 | 32.26% | 9,400 | 14.63% | |

| Switzerland | 4,800 | 41.18% | 5,500 | 14.58% | 6,200 | 12.73% | |

| Russia | 11,700 | 120.75% | 21,200 | 81.20% | 30,700 | 44.81% | |

| Poland | 9,000 | 73.08% | 11,800 | 31.11% | 15,600 | 32.20% | |

| Other | 18,311 | 42.34% | 22,188 | 21.17% | 25,319 | 14.11% | |

| subtotal | 220,811 | 65.45% | 289,588 | 31.15% | 347,119 | 19.87% | |

| Latin America | Mexico | 11,400 | 107.27% | 12,200 | 7.02% | 13,000 | 6.56% |

| Brazil | 13,100 | 89.86% | 18,700 | 42.75% | 21,400 | 14.44% | |

| Argentina | 5,600 | 115.38% | 7,600 | 35.71% | 10,000 | 31.58% | |

| Other | 8,825 | 138.51% | 12,900 | 46.17% | 15,878 | 23.09% | |

| subtotal | 38,925 | 108.16% | 51,400 | 32.05% | 60,278 | 17.27% | |

| Asia/Pacific | Japan | 86,800 | 52.01% | 114,200 | 31.57% | 143,600 | 25.74% |

| Australia | 10,800 | 35.00% | 12,300 | 13.89% | 13,500 | 9.76% | |

| Taiwan | 15,100 | 75.58% | 18,700 | 23.84% | 21,900 | 17.11% | |

| South Korea | 29,200 | 76.97% | 33,000 | 13.01% | 41,000 | 24.24% | |

| Hong Kong | 3,900 | 44.44% | 4,800 | 23.08% | 5,600 | 16.67% | |

| China | 22,300 | 175.31% | 27,700 | 24.22% | 33,100 | 19.49% | |

| Malaysia | 5,000 | 72.41% | 6,200 | 24.00% | 8,200 | 32.26% | |

| Other | 21,833 | 213.36% | 33,479 | 53.34% | 45,384 | 35.56% | |

| subtotal | 194,933 | 75.83% | 250,379 | 28.44% | 312,284 | 24.72% | |

Ogilvy Interactive Analytics department, based on Angus Reid '99 data

The total number of domain names registered in 1999 was 43,225,000. By the end of 2000, this number will increase to 57,222,000. Growth is expected to decline thereafter, despite reports that countries such as China, India, and Indonesia will experience an Internet boom.

The following chart indicates projected growth of domain name registrations in major markets over the next three years:

| Dec-00 | Dec-01 | Dec-02 | |||||

| Region | Country | growth(%) | growth(#) | growth(%) | growth(#) | growth(%) | growth(#) |

| North America | USA | 36.42% | 9,055,000 | 20.88% | 7,082,000 | 12.20% | 5,000,000 |

| Canada | 29.00% | 484,000 | 16.12% | 347,000 | 10.00% | 250,000 | |

| subtotal | 35.95% | 9,539,000 | 20.60% | 7,429,000 | 12.07% | 5,250,000 | |

| Europe | UK | 18.88% | 359,000 | 10.62% | 240,000 | 8.00% | 200,000 |

| Germany | 19.27% | 328,000 | 8.37% | 170,000 | 11.36% | 250,000 | |

| Netherlands | 28.78% | 236,000 | 15.53% | 164,000 | 10.66% | 130,000 | |

| Italy | 60.03% | 395,000 | 32.00% | 337,000 | 21.58% | 300,000 | |

| France | 19.26% | 150,000 | 8.72% | 81,000 | 8.91% | 90,000 | |

| Sweden | 15.49% | 92,000 | 7.87% | 54,000 | 7.43% | 55,000 | |

| Spain | 37.35% | 155,000 | 17.54% | 100,000 | 16.42% | 110,000 | |

| Belgium | 17.50% | 56,000 | 9.04% | 34,000 | 7.32% | 30,000 | |

| Switzerland | 15.69% | 48,000 | 5.93% | 21,000 | 9.33% | 35,000 | |

| Russia | 25.23% | 54,000 | 11.94% | 32,000 | 13.33% | 40,000 | |

| Poland | 15.85% | 29,000 | 8.49% | 18,000 | 6.52% | 15,000 | |

| Other | 21.24% | 502,000 | 10.62% | 304,300 | 8.49% | 269,288 | |

| subtotal | 23.44% | 2,404,000 | 12.29% | 1,555,300 | 10.72% | 1,524,288 | |

| Latin America | Mexico | 80.69% | 326,000 | 36.99% | 270,000 | 31.00% | 310,000 |

| Brazil | 39.91% | 178,000 | 21.79% | 136,000 | 14.47% | 110,000 | |

| Argentina | 40.14% | 57,000 | 23.12% | 46,000 | 12.24% | 30,000 | |

| Other | 27.50% | 22,000 | 13.75% | 14,025 | 9.17% | 10,636 | |

| subtotal | 54.38% | 583,000 | 28.16% | 466,025 | 21.72% | 460,636 | |

| Asia/Pacific | Japan | 27.20% | 717,000 | 13.33% | 447,000 | 11.84% | 450,000 |

| Australia | 20.09% | 219,000 | 10.77% | 141,000 | 8.28% | 120,000 | |

| Taiwan | 40.03% | 239,000 | 19.74% | 165,000 | 14.89% | 149,000 | |

| South Korea | 8.83% | 25,000 | 4.87% | 15,000 | 3.72% | 12,000 | |

| Hong Kong | 16.67% | 19,000 | 7.52% | 10,000 | 8.39% | 12,000 | |

| China | 15.49% | 11,000 | 8.54% | 7,000 | 6.74% | 6,000 | |

| Malaysia | 13.56% | 8,000 | 8.96% | 6,000 | 4.11% | 3,000 | |

| Other | 45.24% | 233,000 | 22.62% | 169,208 | 11.31% | 103,742 | |

| Subtotal | 1,471,000 | 960,208 | 855,742 | ||||

| TOTAL | 27.42% | 13,997,000 | 14.05% | 10,410,533 | 10.98% | 8,090,666 | |

Ogilvy Interactive Analytics department, based on CNGI '99 data

The above chart does not take into consideration the number of domain name holders who will effectively re-register their existing .com, .net or .org in a new TLD to protect their brands. This will increase the number of new registrations each year, although an exact figure cannot be calculated due to the unprecedented introduction of a new gTLD.

Technical Opportunity

In addition to the global demand for domain name registration in a new unrestricted TLD, Afilias believes that a substantial business opportunity exists from the enhanced registry functionality that Afilias' registry will offer, which surpasses the functionality of the incumbent gTLD registry. More specifically, unlike the incumbent gTLD registry, Afilias' registry model will provide a shared, near real-time Whois service, whereby registrants can search one database rather than searching every registrar's Whois database to determine whether a particular domain is already registered.

Furthermore, the new registry architecture will automate several functions that are currently performed manually. These include the ability to track, in real-time, status updates of customer registrars, custom reports for registrars, near real-time zone file updates, and over the medium term, real-time updates of the DNS zone files. By automating these processes, registrars can expect meaningful operational cost savings. As such, Afilias, through its technological solutions, will provide indirect business opportunities to its customer registrars through lower operational costs.

Competition

Afilias faces competition from several potential competitors as an operator of a new gTLD. Afilias' competitors may include:

Existing gTLDs and ccTLDsAfilias will compete against the operators of the existing gTLD and ccTLD strings that enjoy a first-mover advantage, and that in some cases, have substantial financial resources to launch a counter-marketing campaign against the new gTLD.Other Potential Bidders

A variety of other organizations may be submitting proposals to serve as a registry operator for a gTLD. These may include other domain name registrars who are not Member Registrars of Afilias, Internet access providers and Internet service providers.

Competitive Advantage

Afilias' strongest competitive advantage is its unique ownership structure that combines the collective expertise of its Member Registrars. Additionally, given that Afilias' owners also serve as Afilias' customers, they will continually look for ways to improve the functionality and services offered through the registry. Furthermore, Afilias' ownership structure provides a built-in distribution mechanism to market the new gTLD.

An additional competitive advantage includes the policies set by Afilias, which Afilias believes will enhance competition among registrars and eventually other TLD registries as other TLDs are released by ICANN. Afilias will provide incentives to non-member registrars in two ways to embrace the new gTLD. First, Afilias will provide qualified ICANN-accredited registrars the opportunity to take an equity position in Afilias. Second, Afilias will implement an annual rebate program open to any ICANN-accredited registrar that registers a domain name in the new gTLD.

Afilias' goal during the release of the new gTLD is to provide a very successful proof of concept for releasing new TLDs into the market. By marketing the gTLD successfully and by implementing a scalable yet reliable and high-quality registry, Afilias hopes to illustrate to ICANN the very strong demand for new TLDs overall. This, in turn, should prompt ICANN to release additional generic and restricted TLDs, thereby fostering enhanced competition among TLD registries.

| D13.2.4 Marketing plan. Advertising, publicity, promotion strategy, advertisement development strategy, relationship with advertising firm. Use of registrars and other marketing channels. |

Afilias has appointed OgilvyOne Worldwide and Hill and Knowlton Public Relations to develop a comprehensive global marketing plan. The agencies were chosen because of their expertise in launching and building brands on a worldwide scale through their respective networks. Both agencies are owned by the WPP Group, the world's largest agency network. As sister companies, the agencies will work together to create and execute a seamless marketing campaign. A confidential, detailed description of the Marketing Plan is provided in Appendix D.

The anticipated demand for domain name registrations in a new unrestricted TLD issued by ICANN (as defined by the number of new domain name registrations) is represented quantitatively in Table 1. These estimates consider several factors, including the following:

| Table 1. [CONFIDENTIAL] | ||||||

| Domain Name Registration Demand--New Domain Names Registered | ||||||

| Time Period

|

90% Confidence Level

Conservative Estimate

|

50% Confidence Level Moderate

Estimate

|

10% Confidence Level

Aggressive Estimate

|

|||

| Sunrise Period (Days 1-60)* | 300,000 | 700,000 | 1,000,000 | |||

| Start-Up Period (Days 91-180) | 1,250,000 | 1,875,000 | 2,500,000 | |||

| Remaining Year 1 (Days 181-365) | 1,293,680 | 2,015,069 | 2,790,125 | |||

| Year 2 | 2,969,909 | 4,948,655 | 7,322,928 | |||

| Year 3 | 3,135,132 | 5,541,415 | 8,695,925 | |||

| Year 4 | 3,135,132 | 5,883,217 | 9,798,777 | |||

| Year 5 | 3,135,132 | 6,246,093 | 11,041,513 | |||

*

Afilias will not accept registrations for 30 days after the Sunrise Period to

ensure that all properly submitted Sunrise Period registration requests are

properly processed.

Note: Figures presented in the financial model may vary

slightly depending on the proposed launch of the registry.

Significant assumptions underlying these projections at the 10%, 50% and 90% confidence levels include the following:

1) 1st Choice String Awarded

These projections assume that Afilias' top TLD string, .web, is awarded. Afilias' market research illustrates that .web is the most attractive string to consumers, therefore providing evidence for strong potential demand.

2) Domain Name Registration Base Rate - [CONFIDENTIAL]

Afilias believes that after the first six months of registry operations when trademark owners and early adopters have registered their domain names in the new TLD, demand will drop to a base level, from which incremental growth will occur. Afilias forecasts "base-rate" registrations for the first month of the Start-Up Period (as defined in Section E12 of the Description of TLD Policies) at the three confidence levels to be the following:

| 90% Confidence Level (Conservative) 50% Confidence Level (Moderate) 10% Confidence Level (Aggressive) |

200,000 registrations/month 300,000 registrations/month 400,000 registrations/month |

3) Registration Growth Rates - [CONFIDENTIAL]

Afilias believes that growth in demand for domain name registrations in the new TLD will slow with time. Furthermore, in constructing the demand forecasts for registrations, different growth rates have been utilized starting after the initial Start-Up Period, as depicted below:

90% Confidence Level (Conservative)Months 14-18 3% monthly growth

Months 19-30 1% monthly growth

Months 31-60 0% monthly growth50% Confidence Level (Moderate)

Months 14-18 4.5% monthly growth

Months 19-30 1.5% monthly growth

Months 31-60 0.5% monthly growth10% Confidence Level (Aggressive)

Months 14-18 6% monthly growth

Months 19-30 2% monthly growth

Months 31-60 1% monthly growth

Market Factors Impacting Demand

While it is virtually impossible to forecast with precision domain name registration demand, particularly beyond a three-year period, Afilias believes the following market conditions and internal capabilities will impact demand for its registry services.

Competition

VeriSign Global Registry Services, the registry operator division of Network Solutions, Inc., benefits from its dominant position as the exclusive registry for the .com, .net, and .org gTLDs. Beyond the introduction of repurposed ccTLDs (e.g., .tv, .cc, .to), Afilias represents the first wave of competition to the incumbent gTLD registry operator. After awarding Afilias approval to operate the registry for the new gTLD, ICANN may quickly authorize other gTLDs that may compete with Afilias' chosen gTLD. Increased competition from companies operating unrestricted TLDs may have a significant negative impact on the anticipated demand for Afilias' gTLD, saturating the market with gTLDs and, if introduced soon after Afilias' gTLD, reducing the initial adoption of Afilias' gTLD and its long-term growth potential.

Afilias may also face competition from more niche or restricted TLDs that provide domain names with more descriptive information than an unrestricted TLD could offer. For instance, if, following industry trends, more businesses than individuals register domain names (80% versus 20%, respectively, according to www.dotcom.com), newly-released business-related restricted TLDs may compete with Afilias' chosen gTLD, thereby siphoning away some of Afilias' expected demand. If these competitive market conditions prevail, Afilias can expect demand levels described at the 90% confidence level or below.

Conversely, if ICANN chooses not to issue additional TLDs in the near future, demand for Afilias' registry services should remain strong. In this scenario, Afilias can expect demand levels represented at the 50% or 10% confidence levels.

New Technologies

The emergence of new technologies may also have a significant impact on the demand for Afilias' registry services. In particular, new domain name directory technologies and software may be introduced that eliminate the need to register each domain name individually, significantly reducing the forecasted demand for domain name registrations. The imminent introduction of these new technologies may result in demand levels described at the 90% confidence levels.

Marketing Effectiveness

Another key component impacting the demand for the new gTLD is Afilias' effectiveness in marketing the new gTLD. Afilias' TLD is positioned to have global appeal, and as such, it must be marketed to the various growth regions effectively. Afilias must quickly create brand awareness among both existing registrants (to extend their existing brands to the new gTLD) and to potential registrants, who are yet to register a domain in either a ccTLD or a gTLD. Afilias believes that it will be able to cost-effectively encourage registrants to re-register their domain name in the new TLD through its built-in Member Registrar distribution mechanism. Effectively establishing and communicating Afilias' brand on a worldwide basis should build demand levels forecasted at the 50% or 10% confidence levels.

Pricing/Fees on Demand

Afilias intends to price the registration fees at a rate that is less than the current industry standard fee of $6 per registration for domain names on the .com, .net, and .org gTLDs. Afilias cannot guarantee that its customer registrars will pass this reduced price to their registrant customers, thus it is unlikely that pricing will have a significant effect on demand.

Anticipated Demand Phases

To manage demand for domain name registrations in the new gTLD most effectively, Afilias anticipates three distinct "demand" phases for registration, the first two of which are set by policies implemented by Afilias.

(1) Sunrise Period

As described in Section E15 of the Description of TLD Policies, Afilias will implement a Sunrise Period to permit owners of subsisting trademark or service mark registrations having national effect and that are issued prior to October 2, 2000 to be eligible to register their trademark or service mark as a domain name, using ASCII characters only. Registrants must certify to the registrar that they are eligible to register a domain name during this period. All domain name registrations obtained during the Sunrise Period will be for a minimum term of five years, to be payed by the registrant in advance.

Afilias anticipates that parties may dispute registrations that are granted during this period. Accordingly, Afilias will invoke a 90-day dispute period immediately following the end of the Sunrise Period to provide third parties with the opportunity to contest registrations obtained during the Sunrise Period.

Additionally, the evaluation period will provide Afilias with the opportunity to examine the operation of the registry and round robin systems and make any necessary modifications to the system prior to the opening of the TLD to the general Internet community. [THE FOLLOWING SENTENCE IS CONFIDENTIAL] Afilias estimates, with a 50% confidence level, that during the two-month period, a total of 700,000 trademarked domain names will be registered.

(2) Start-Up Period

Afilias anticipates a significant rush for domain name registrations during the Start-Up Period, which will commence immediately following the aforementioned examination period. During the Start-Up Period, anyone may apply for a domain name registration, and may seek an initial registration term of a minimum of two years and a maximum of ten years, in one-year increments. Afilias estimates that the Start-up Period will last three months. [THE FOLLOWING SENTENCE IS CONFIDENTIAL] Afilias forecasts, with a 50% confidence level, that over 1.875 million domains will be registered during the Start-Up Period.

(3) Steady-State Growth Period

After the first six months of registration, Afilias assumes that registration demand will drop to a base level, [REMAINDER OF THIS PARAGRAPH IS CONFIDENTIAL] from which, at the 50% confidence level, it will grow 4.5% on a monthly basis for the first six months of the steady-state growth period. Afilias anticipates with a 50% confidence level that the growth rate will slow to 1.5% starting the sixth month of the steady-state period, and will level off at a 1% growth rate 12 months thereafter. Afilias anticipates with a 50% confidence level the base-rate of registration to total 300,000 during the first month of the Steady-State Growth Period.

One of Afilias' greatest strengths is its ability to leverage its Registrar Members and partners to provide the necessary financial, human capital, and technical resources to meet the anticipated demand described at all three confidence levels. A review of these resources is provided below, and a time line describing the acquisition of major resources and other major events during the initial development of Afilias is provided in Figure 2. Table 3 provides estimates of the major resources required as well as the major costs associated with operating Afilias over a five year period at each confidence level.

Financial

[FIRST PARAGRAPH IS CONFIDENTIAL]

Afilias is currently self-funded and anticipates financing any immediate cash requirements through additional capital calls and, if necessary, through debt financing. Afilias anticipates requiring approximately $5,000,000 in additional capital in the 50% confidence level scenario. Afilias will secure the necessary capital to build Afilias upon ICANN approval through a variety of strategies. Afilias has already collected US$1.34 million in financing primarily from its Members. Upon commitment from ICANN to operate the new gTLD, Afilias will require its Member Registrars to contribute additional capital to Afilias to secure office space, hire its executive and administrative staff, and execute the initial phases of its marketing plan, which may total approximately $3.45 million. If necessary, Afilias will secure debt financing from a reputable commercial bank to cover the balance of any other additional capital required.

By the third year of operations, Afilias will consider transferring the registry operations from Tucows to its in-house technology staff. Afilias will rely on existing cash to finance the hiring of the additional staff required to manage and operate the registry and the leasing of required equipment to build the registry at the 50% and 10% demand forecast confidence levels. If demand for domain name registrations only reaches those registrations forecasted at the 90% level, Afilias will in all likelihood not bring the technical capabilities in-house, and instead will continue to outsource this function.

Technical

As stipulated in the Term Sheet between Tucows and Afilias, Tucows will provide the appropriate hardware, software, systems and technical staffing required to meet registration demand at the 10%, 50% and 90% confidence levels. During this period, Afilias' technical requirements will be limited to its five-person technical staff, described in more detail below.

During the second year of operations, Afilias may begin transitioning the registry operations from Tucows to its own facilities, and thus may require additional technical staffing resources. It may also require non-staff-related technical resources, including leasing the appropriate equipment required to operate the registry, such as database servers, front-end servers, switches, routers, software, processors, and storage devices. Additional technical resources required during the phase are described in more detail in Section D13.2.7.

Staffing

Staffing required to implement this business plan are described in the following categories.

Technical

Afilias will initially require a four-person technical staff, including an Operations and Engineering Manager, a Senior Systems Administrator, a Systems Administrator, and a Chief Technology Officer who will manage the technical staff. The technical staff will share one assistant.

To successfully integrate all technical capabilities in-house by the third-year of operations, Afilias will hire additional technical staff to design and build the infrastructure during the third quarter of the second year of operations. These staff requirements and their projected hire dates include the following, at the 50% confidence level:

| Staff Requirements | Hire Date |

| 1 Senior Architecture Designer | Month 16 |

| 2 Database Administrators/Developers | Month 18 |

| 3 Java Developers | Month 18 |

| 4 Senior Engineer Managers | Month 23 |

| 4 Registry Administration Engineers | Month 23 |

| 14 Technical Customer Support Staff (24/7) | Month 23 |

| 4 Senior System Administrators | Month 23 |

| 4 Senior Network Engineers | Month 23 |

To meet registration demand and the cumulative growth of new registrars, Afilias will hire an additional 10 technical support staff personnel in both the fourth and fifth years of operations, as necessary, at the 50% confidence level.

Marketing Staff

The Chief Marketing Officer will initially be responsible for a two-person marketing staff initially, including a Marketing Manager and a Public Relations Manager. The Chief Marketing Officer will share an assistant with both managers. Two Sales Managers may be hired, the first in year 1, the second in year 2, to provide regional marketing and sales assistance in the United States and Pacific Rim, respectively. Afilias does not intend to employ a significant marketing staff given its intention to employ outside consultants for marketing, advertising, and public relations services.

Billing Customer Support

In addition to the technical customer support staff discussed in more detail in the Technical Staff section, Afilias will also hire a billing customer support staff, which will include a Registrar Relations Manager, a Customer Service Manager, a Senior Customer Service Representative and three Customer Service Representatives to manage all billing-related customer support issues. Unlike the technical customer service staff, which will operate on a 24/7/365 basis, the billing customer support team will operate on a single 8-hour shift per day/5-days a week basis. In addition to customer support staff housed in the headquarters location, Afilias may, if circumstances warrant, locate additional customer support staff, namely a Customer Service Manager, in satellite offices in the United States and the Pacific Rim.

Registry Technical Infrastructure

As stipulated in the Term Sheet between Tucows and Afilias, Tucows will be responsible for acquiring the necessary systems and facilities required to operate the technical infrastructure of the registry for at least the first two years of operation. As discussed in previous sections, Afilias will consider building its own registry during the second half of the second year of operations, and thus, may need to acquire the necessary systems and facilities to (1) ensure a smooth transition between Tucows and Afilias and (2) meet the forecasted demand for registration services on an ongoing basis.

A brief outline of the necessary systems and facilities required to build and manage the registry on an ongoing basis include the following at the 50% confidence level.

Server Space

Equipment and Software

A more detailed description of the required systems and technical facilities required to successfully transition the registry operations from Tucows to Afilias can be found in the attached Technical Operating Plan.

Billing System

Afilias will develop a billing reporting system to be managed by Afilias' Accounts Receivable Manager to monitor all billings to customer registrars. Afilias' administrative customer support staff will be responsible for interfacing with customer registrars regarding any billing questions.

Office Space

Other facilities required by Afilias include office space and equipment for the executive and administrative staff. Afilias will secure an 8,000 square foot office space at its headquarters location. These headquarters will house its initial staff which will approximate 25 people, and will require office furniture, including desks, chairs, conference tables, a telephone system, computers, fax machines, copiers, and a corporate intranet system. Quantities and the costs associated with these items are provided in more detail in the "Costs" section of Appendix C.

| D13.2.8. Staff size/expansion capability. Plans for obtaining the necessary staff resources, capacity for expansion, hiring policy, employee training, space for additional staff, staffing levels needed for provision of expanded technical, support, escrow, and registry services. |

Afilias has been structured to operate without an initial significant human capital investment by partnering with Tucows to staff and manage the technical infrastructure required to operate the registry during the first two years of operations. Tucows will be responsible for providing additional technical staff necessary to meet increased demand for registrations. Afilias will expand its staff in other functions as necessary, but foresees little expansion required for non-technical functional areas. Staffing levels required to operate Afilias and manage the registry and meet customer demands in the Sunrise, and Start-Up Periods of operations are described in Section D13.2.6.

Office Expansion

In addition to the headquarters location, Afilias will consider opening a 1200 square-foot satellite office on the east coast of the United States that will house the Customer Service Manager, Marketing Manager, and an assistant, and provide additional office space for traveling officers of Afilias. Should Afilias choose to operate the registry on its own, it will significantly expand this office space to house the technical team required to operate the registry starting the third year of operations.

During the first half of the second year of operations, Afilias intends to open a second satellite office in the Pacific Rim to provide tailored customer service and sales support to Asian and Pacific Rim customers. This satellite office will consist of a 1200 square-foot facility that will house a Sales Manager, Customer Service Manager, and an assistant, and provide additional office space for traveling officers of Afilias.

Training Initiatives

Afilias will recruit executives with proven industry experience to fulfill its executive-level positions, thereby requiring little formal training initiatives for the executive team. Two staffing functions, however, where Afilias foresees the need for formal training are customer service and technical operations.

Customer Service

Selected members of the Board of Managers, in conjunction with the Chief Technology Officer, Vice President of Policy and Registrar Relations, and the Human Resources Administrator will develop a targeted customer service training program for Afilias' billing customer service team to ensure that consistently high levels of customer service are provided during all three projected demand phases for registry services. Furthermore, this training program will institutionalize proper protocols for managing all potential service requests from registrar customers.

Technical Staff

The Chief Technology officer, in conjunction with the Human Resources Administrator and a representative from Tucows will implement an annual week-long training program for Afilias' junior technical staff that will provide an introduction and updates to the major technical issues relating to the operations of Afilias Registry.

Hiring Policy

Afilias aims to select employees with the best job-related qualifications. Specific components of Afilias' hiring policy include the following:

Compliance

Employees will be selected without regard to race, color, religion, sex, national origin, marital status or handicap subject to job requirements and regulations. Furthermore, Afilias will comply with all applicable national and regional employment laws.

Sourcing and Recruitment

Afilias will retain an executive search firm to conduct a worldwide search for its senior management team members. Afilias will select a search firm with strong experience and industry contacts in the Internet industry and a strong international presence. To the extent possible, Afilias will also leverage the resources and industry relationships of its Member Registrars to identify potential candidates for the executive and administrative staff of Afilias.

For junior staff, and in particular, junior technical staff requirements which may arise beginning in the second half of the second year of operations, Afilias will place advertisements in classified pages of national newspapers and/or business magazines and on high-reach job sites on the Internet. The senior-level executives in each functional area will be responsible for drafting and releasing advertisements and managing the recruitment process for these junior-level positions.

Wherever possible, job openings will be filled through internal sourcing primarily through a job-posting system, which will provide employees with the information they need to nominate themselves for open positions. All eligible candidates will be given consideration, but the system will not guarantee an interview, selection or promotion.

Selection Process

Afilias will follow the direction provided by the executive search firm for the initial stages of the hiring process. Afilias expects a standard selection process to require approximately three months.

Afilias and the executive search firm will adhere to best practices regarding interview topic information. More specifically interviewers will be restricted from discuss the following information:

Retention

Afilias will provide its full-time employees with a comprehensive health and benefits package and will implement a performance-based bonus program for its employees to retain high-performing employees and provide incentives for them.

| D13.2.9. Availability of additional management personnel. How will management needs be filled? |

As discussed previously, Afilias has structured its operations to provide sufficient human capital investments at both the staff and executive levels, regardless of its anticipated growth. As such, Afilias anticipates little need for additional management personnel on an ongoing basis. To the extent necessary, Afilias will leverage its Member Registrars to identify additional management personnel and/or will retain an executive recruitment firm to supplement any unanticipated managerial candidates on an ongoing basis.

| D13.2.10. Term of registry agreement. State assumptions regarding the term of any registry agreement with ICANN or the sponsoring organization. Note that the .com/.net/.org registry agreement has a basic term of four years. |

Afilias proposes a registry operator term of eight years in duration, substantially longer than ICANN's contract terms with the current STLD registry operator. Reasons for negotiating a longer term include the following:

(1) As the operator for the first newly issued gTLD, Afilias bears significant risk in developing a company to operate the new gTLD registry. Afilias' overall projections have been conservatively stated as a "proof of concept" registry operator given the uncertainty relating the future release of additional TLDs. With these conservative projections, a meaningful return on investment to its constituent owners for this endeavor may only occur over an extended time horizon.

(2) As the operator for the new TLD, Afilias will expend significant resources to build and maintain the registry to develop effective customer acquisition and service systems, whose value increases with time, particularly in the face of additional competition. By building these systems and then facing the potential of losing the right to operate the registry, Afilias may be faced with significant sunk costs and a frustrated end-consumer base who are forced to adhere to policies of another registry operator. These customers, in turn, may be less likely to register for a domain name under any future new issued TLDs, impacting the entire market for domain name registration.

Afilias will establish performance and service level targets from which to evaluate its performance and report to ICANN on an annual basis. At the onset of the final year of its registry operator term, Afilias will evaluate its long-term performance as a registry operator and hopes to negotiate a renewal with ICANN.

| D13.2.11. Expected costs associated with the operation of the proposed registry. Please break down the total estimated operational costs by the sources of the costs for each estimated demand level. Be sure to consider the TLD's share of ICANN's cost recovery needs. (See http://www.icann.org/financials/budget-fy00-01-06jun00.htm#IIIB.) |

Table 2 and the detailed Profit and Loss statements provided in Appendix C identify the major costs associated with Afilias' operations for five years at the 90%, 50% and 10% confidence levels. What follows is a summary of these costs during the first year of operations at the 50% confidence level.

Operational Costs

Tucows Fees

[SECOND AND FOURTH SENTENCES ARE CONFIDENTIAL]

Costs associated with custom-building, managing, and operating the registry will initially be recognized as fees paid to the outsourced technology partner on a per registration basis. More specifically, for every domain name registered, Afilias will pay $2.95 to Tucows. These fees will be paid to Tucows on a monthly basis as new domain names are entered into the registry. Costs associated with the provision of fees to Tucows are expected to total U.S. $2,049,981 at the 50% confidence level of demand during the first year of operations.

Technical Operations

Initial technical operations costs include labor and equipment associated with developing, maintaining, and managing the registry systems. Afilias will initially hire a three-person Systems Development and Support Staff that will be managed by the Chief Technology Officer. [FOLLOWING SENTENCE IS CONFIDENTIAL] Costs associated with Systems Development and Support will total $565,833 at the 50% confidence level of demand in the first year of operations.

Billing Customer Service

These costs include labor associated with providing billing-related customer service to registrar customers. Labor associated with this function include a Customer Service Manager, a Senior Customer Service Representative, three Customer Service Representatives, and an Administrative Assistant in the headquarters location and an additional Customer Service Manager in the United States Satellite office. This staff will be managed by the Vice President of Policy and Registrar Relations. [FOLLOWING SENTENCE IS CONFIDENTIAL] Customer Services costs will total $459,813 at the 50% confidence level of demand in the first year of operations.

Marketing and Sales

Costs associated with Afilias' marketing and sales efforts will include labor costs associated with hiring a Chief Marketing Officer, a Marketing Manager, a Public Relations Manager and a group Administrative Assistant in the headquarters location and an additional Sales Manager in the United States Satellite office. Afilias will launch a worldwide integrated marketing and public relations campaign managed by Afilias' retained advertising and public relations consultancies. [THE REMAINING PORTION OF THIS PARAGRAPH IS CONFIDENTIAL]. Afilias' marketing and public relations costs are anticipated to reach $22,936,771 at the 50% confidence level of demand during the first year of operations. This advertising budget includes $6 million that is allocated for a co-operative advertising campaign with Afilias' Member Registrars, whereby the Member Registrars could contribute $2 for every $1 contributed by Afilias. Therefore, in this co-operative advertising program, Afilias expects Member Registrars to contribute a maximum of $12 million in additional advertising funds.

Research and Development

Afilias will be actively involved in the development of new registry service offerings that facilitate the growth of domain name registrations. Afilias will capitalize on the industry expertise of its Technical Review Committee and the ongoing efforts of its technology development staff to continuously improve the functionality of the registry operator. [THE FOLLOWING TWO SENTENCES ARE CONFIDENTIAL] Costs associated with research and development of these offerings will total $39,955 during the first year of operation. These costs, however, are anticipated to expand substantially in the second year of operations to $660,814, at the 50% confidence level of demand.

General and Administrative

General and Administrative ("G&A") costs comprise all the overhead costs associated with the operations of Afilias. G&A labor costs include salaries and benefits for the CEO, Executive Assistant to the CEO, the CFO and accounting staff, the Office Manager/Human Resources Manager and Assistant, and the General Counsel and Assistant. Other non-labor G&A cost categories include rent, telecommunications, office supplies, staff travel and entertainment, seminars and conferences, corporate insurance, facility maintenance, outside legal counsel, financial and accounting services, executive search services, trademark review, and Web site hosting and connectivity. [THE FOLLOWING SENTENCE IS CONFIDENTIAL] G&A costs will total US$3,555,366 at the 50% confidence level of demand during the first year of operations, assuming a 50% confidence level of demand.

ICANN Cost-Recovery Fees

[THIS PARAGRAPH IS CONFIDENTIAL]

In addition to registration and renewal fees for each domain name registered or renewed, Afilias will charge its registrars an additional US$0.20 service fee that will be distributed directly to ICANN to serve as cost-recovery for ICANN in overseeing registrar and registry activities. As with the registration and renewal fees, the cost recovery fee will apply for each year of registration or renewal. ICANN cost-recovery fees are anticipated to total $515,000 in the first year of operation and $1.53 million in the second year of operations assuming a 50% confidence level of demand.

| D13.2.12. Expected revenue associated with the operation of the proposed registry. Please show how expected revenue is computed at each estimated demand level. |

Revenues associated with the various services provided by the Company are illustrated in more detail in the Detailed Profit and Loss Statement provided in Appendix C, which shows revenue at the 10%, 50% and 90% demand levels. Notes provided with these forecasts provide additional information regarding the calculation of these revenues. Please refer to Table 3 for overall revenue estimates at all three confidence levels over a five-year period.

Domain Name Registrations

[THE FIRST SENTENCE IS CONFIDENTIAL] Afilias expects revenues stemming from domain name registrations to total $3,917,188 on an accrual basis during the first year of operations at the 50% confidence level, which assumes that registration services do not commence until the seventh month of operations. Revenue represents the product of Afilias' annual registration fee, term of registration, and the number of registrations anticipated during a given period.

Domain Name Registration Renewals

Beginning in the third year of operations, Afilias expects to begin collecting domain name registration renewal revenues. Renewals will be priced the same as initial registrations and will be offered in 1 to 10 year terms in annual increments. Renewal revenues are calculated as the product of (1) the number of registered domain names under Afilias' registry; (2) the percentage of existing domain names renewed at a given period, (3) the renewal fee charged by Afilias, and (4) the term of the renewal. [THE FOLLOWING SENTENCE IS CONFIDENTIAL] Revenues associated with renewals are expected to total $1,150,000 during the third year of operations on an accrual basis, at the 50% confidence level.

Domain Name Transfers

When registrants request to transfer a registration to another registrar, Afilias will charge the receiving registrar a one-year registration fee. [THE FOLLOWING SENTENCE IS CONFIDENTIAL] Afilias estimates that 2% of new registrations in any given period will include transfers between registrars, accounting for an additional US$78,344 in revenue during the first year of operations at the 50% confidence level.

| D13.2.13. Capital requirements. Quantify capital requirements in amount and timing and describe how the capital will be obtained. Specify in detail all sources of capital and the cost of that capital (interest, etc.). Evidence of firm commitment of projected capital needs will substantially increase the credibility of the registry operator's proposal. |

[SECOND AND THIRD SENTENCES ARE CONFIDENTIAL] Afilias has structured its operations to enable Afilias to fund its capital needs through a series of capital calls to its Member Registrars, and if necessary, debt financing. Afilias' Member Registrars have already committed a total of approximately $1.34 million to Afilias, which is being used to finance the initial start-up of Afilias. As stated in the Operating Agreement, upon being awarded the bid by ICANN to operate the TLD registry, Afilias Member Registrars, in the aggregate, will be called upon to commit an additional $3.45 million in funding to Afilias. In addition to this second capital call, Afilias will secure, if necessary, a loan from a commercial lending bank chosen upon approval from ICANN to operate the registry.

Afilias believes that no additional investment capital necessarily will be required to operate Afilias beyond these initial capital calls and debt financing. However, Afilias has reserved Class B Units for other, non-member registrars and other potential strategic investors to take equity positions in Afilias. Afilias will request additional capital calls among its Member Registrars and possibly, other strategic outside investors, who would obtain ownership in Class B Units, if required.

Afilias anticipates that it will finance the integration of any technical infrastructure during the second and third years of operations through available cash collected in registry fees during the first two years of operation. Afilias anticipates no liquidity event (e.g., sale or IPO) for Afilias in the foreseeable future.

| D13.2.14. Business risks and opportunities. Describe upside and downside contingencies you have considered and discuss your plans for addressing them. |

Opportunities

By marketing and operating a new gTLD, Afilias has the opportunity to play an integral role in creating a new market space within the Internet that is no longer defined by the .com. By offering the Web extension and by marketing it effectively, individuals and businesses on a worldwide basis will have a new opportunity to create a valuable presence on the Internet. Because of this opportunity, the demand for the extension may exceed those projections described in this business plan. Afilias is building a flexible organizational structure that will scale to meet demand exceeding forecasts provided at the 10% confidence level. Afilias is dedicated to providing the highest level of quality customer service and staffing required to meet registration demand at forecasts at all confidence levels, and will dedicate additional staff as required to meet any demand that exceeds the 10% confidence level.